CAD/JPY is yet another example of a currency pair producing impressive long-term gains. The rate surged from a pandemic low of 73.81 in March, 2020, to as much as 110.53 in September, 2022. That 49.7% gain in two and a half years compares favorably even to the returns of many individual stocks over the same period.

Alas, what the market giveth, the market taketh away. Despite a 670-pip recovery since mid-March, CADJPY is still down by nearly 1000 pips from its September 2022 peak. So the question is, can the recent rally continue or is it just a correction within a bigger downtrend? Let’s try and find out with the help of the Elliott Wave chart below.

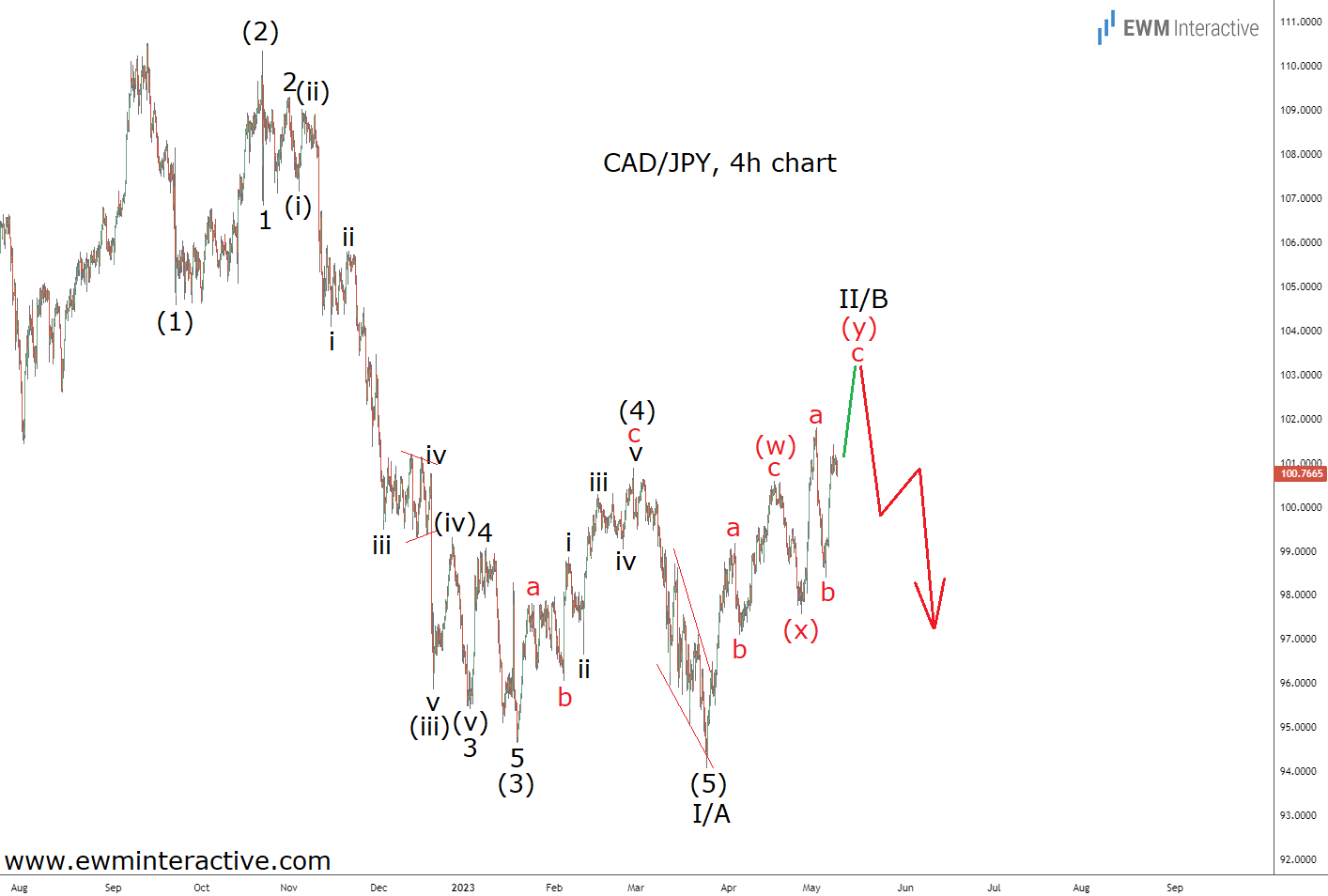

The 4-hour chart of CAD/JPY reveals that the drop from 110.53 to 94.07 is a five-wave impulse pattern. We’ve labeled it (1)-(2)-(3)-(4)-(5) in wave I/A, where three lower degrees of the trend are also visible within the structure of wave (3). Wave (5) is an ending diagonal. If this count is correct, the current recovery must be part of a three-wave correction in wave II/B.

Judging from its structure so far, it seems to be shaping up as a (w)-(x)-(y) double zigzag. Wave ‘c’ of (y) can lift the pair to a new swing high near 103.00-105.00. Once there, however, the 5-3 Elliott Wave cycle would be complete and it would be time for the bears to return in wave III/C. Targets below 94.00 can be expected once the downtrend resumes.