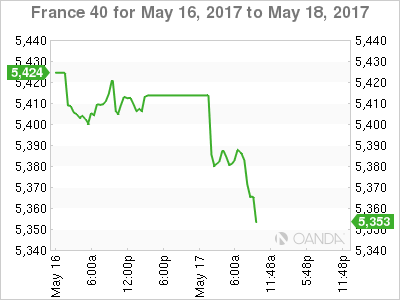

It’s been an uneventful week for the CAC, which has inched lower in the Wednesday session. Currently, the CAC is trading at 5370.80, down 0.65 percent. On the release front, the spotlight remains on key consumer indicators. Eurozone Final CPI climbed 1.9%, matching the forecast. Final Core CPI improved to 1.2%, also matching the estimate. On Thursday, the president of the ECB, Mario Draghi, will speak at an event at the University of Tel Aviv.

European stock markets are lower due to the political uncertainty which continues to rock the United States. The American media is having a field day, as the Trump administration tries to douse the political firestorms that have engulfed Washington. On Tuesday, reports surfaced that President Trump asked former FBI director James Comey to end an investigation into ties between Russia and Trump’s former security adviser, Michael Flynn. Another brewing controversy is Trump’s passing of classified intelligence to the Russian foreign minister earlier this week. Trump initially denied the claim, but has since backtracked, admitting that he did share intel with the Russians, but that he had acted within his rights. With the Trump administration preoccupied with damage control, investors are growing increasingly nervous that the president’s agenda for a stimulus package and tax reform will stall, and the euro has taken advantage, gaining 1.5% against the greenback.

The markets were right on target in forecasting euro-area inflation data. Eurozone Final CPI matched the forecast with a strong gain of 1.9% in April, considerably higher than last month’s gain of 1.5%. Eurozone inflation is closing in on the ECB’s target of 2.0%, which could increase pressure on the ECB to consider tapering its ultra-loose monetary policy. Germany, for one, is finding that ultra-low interest rates is hampering growth, and wants Brussels to adopt a tighter monetary policy. On Tuesday, Eurozone Flash GDP was unrevised from the April forecast, posting a gain of 0.5% in the first quarter. The eurozone continues to show improved numbers in 2017, boosted in no small part by the German economy, which expanded 0.6% in the first quarter.

The French economy has been struggling, and all eyes are on new president Emmanuel Macron to make substantive changes that will kick-start the weak French economy. Inflation slipped to 0.1% in April, after an unexpectedly strong showing in March, which showed a gain of 0.6%. Meanwhile, the spotlight remains on the French political front, with President Emmanuel Macron choosing Edouard Philippe, a conservative lawmaker, as his new prime minister. Macron has pledged to dismantle the left-right divide which has characterized French politics for decades, and his choice of Macron, who has support on both sides of the aisle, is an important first step in his goal of unifying the country.

Economic Calendar

Wednesday (May 17)

- 5:00 Eurozone Final CPI. Estimate 1.9%. Actual 1.9%

- 5:00 Eurozone Final Core CPI. Estimate 1.2%. Actual 1.2%

Thursday (May 18)

- 13:00 ECB President Mario Draghi Speaks

*All release times are EDT

*Key events are in bold

CAC, Wednesday, May 17 at 8:40 EDT

Open: 5374.88 High: 5395.50 Low: 5364.30 Close: 5370.80