The striking development among speculators in the futures market is the reversal of the record gross (and net) short Treasury note position two months ago. The net position has now swung to the long side, and by the most in nine years.

The bulls added 119.9k Treasury note contracts to raise the gross long position to 826.5k contracts. Many bears capitulated and covered 136.1k previously sold short contracts. The gross short position stands at 611.8k contracts. The net speculative position is long 214.6k contracts, a dramatic swing from being net short 41.3k the previous week, and net short position of 410k at the end of February.

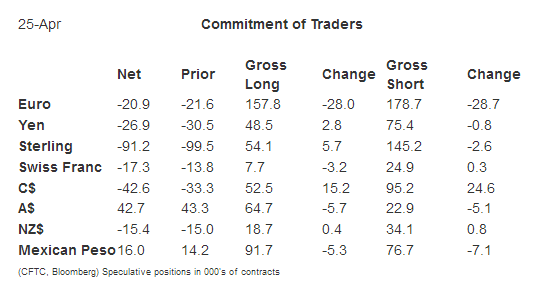

Speculative adjustment in the currency futures was considerably more modest. Only the euro and Canadian dollar futures saw gross position adjustment of more than 10k contracts.

Bulls and bears moved to the euro's sideline ahead of the ECB meeting. The bulls liquidated 28k contracts, leaving a gross long position of 157.8k contracts, a record level the previous week. The bears covered 28.7k short contracts, reducing the gross short position to 178.7k contracts. The net short position was little changed at 20.9k contracts (vs. 21.6k contracts the previous week).

Speculators did the opposite in the Canadian dollar futures. The bulls and bears took on more exposure. The gross long position increased by 15.2k contracts to 52.5k. The gross short position increased by 24.6k contracts to 95.2k. The net short position of 42.6k contracts is the largest in a year.

Despite the movement in the spot market, speculative position adjustments in the yen and sterling were minor. In both cases, the gross longs edged higher and the gross shorts were shaved. Speculators remain net long Mexican pesos, but gross longs and shorts were reduced. The same story holds for the Australian dollar, where speculators moved to the sidelines, but have a net long position.

The falling price of oil saw the bulls cut and run, while the bears pressed. The gross long position was slimmed by 19.1k contracts, leaving 618.8k. The gross short position rose by 13.0k contracts to 206.9k. There adjustment s resulted in a 32.1k contract reduction in the net long position to 411.8k contracts. It peaked in late February near 560k contracts.