- UK CPI unchanged, core CPI ticks lower

- US retail sales hotter than expected

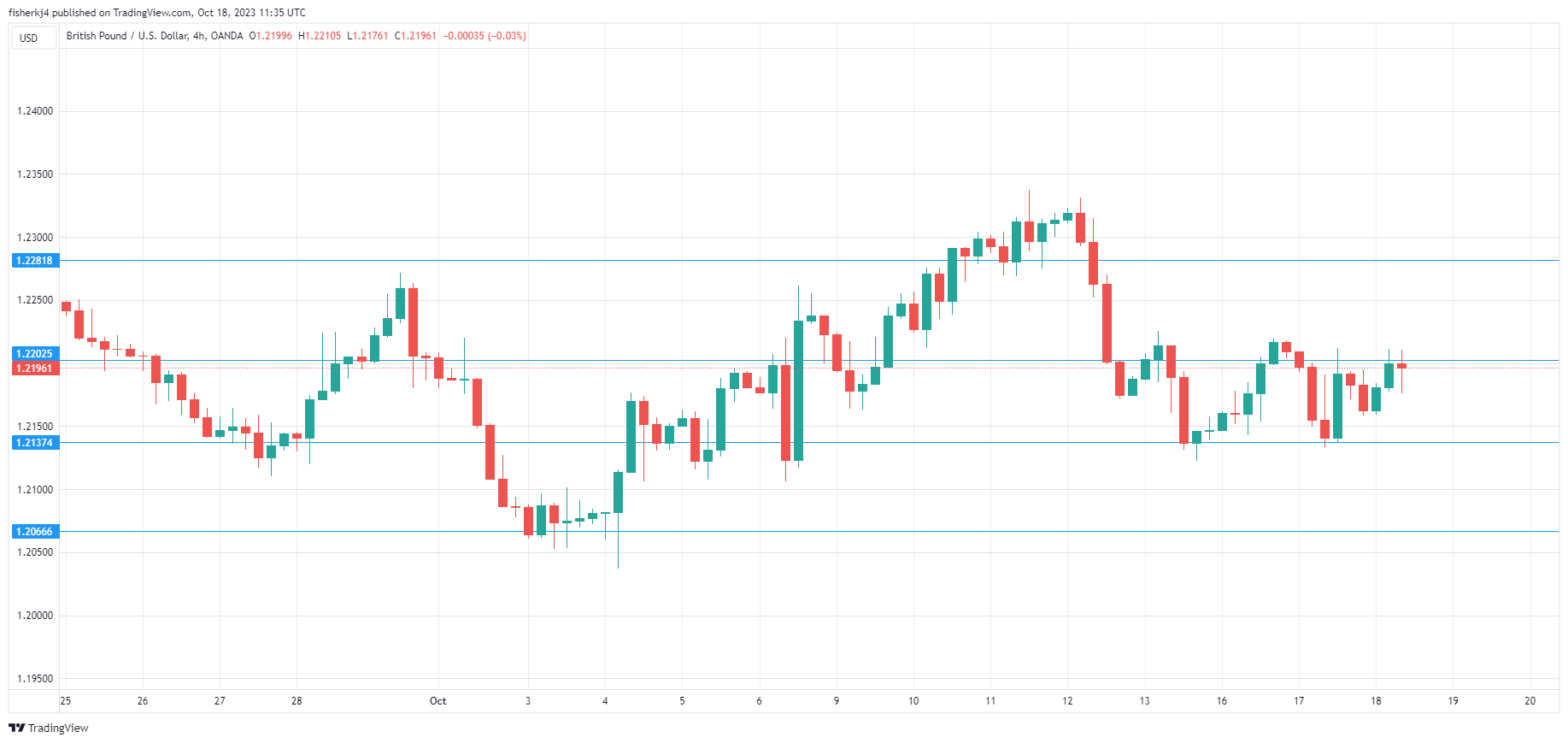

- GBP/USD is testing resistance at 1.2202. Next, there is resistance at 1.2281

- There is support at 1.2137 and 1.2066

The British pound is showing limited movement on Wednesday. In the European session, GBP/USD is trading at 1.2194, down 0.09%.

UK CPI Unchanged, Core CPI Ticks Lower

Today’s UK inflation report showed little change from a month ago, a reminder that the battle to curb inflation will be a long one. Headline CPI was unchanged in September at 6.7%, remaining at its lowest level in 18 months, but above the market estimate of 6.6%. Month-to-month, headline CPI rose 0.5%, up from 0.3% in August. A sharp rise in gasoline prices was the main driver of September inflation, which was partially offset by a decline in food prices.

Core CPI, which is closely watched by the Bank of England, dropped in September from 6.2% y/y to 6.1%. However, the core rate jumped to 0.5% m/m, up sharply from 0.1% in August, matching the market estimate. The upswing points to core inflation remaining sticky, but the future markets are widely expecting the BoE to pause for a second straight month, after 14 consecutive rate hikes. Today’s inflation report is unlikely to shed much light on what the BoE will do at the November 2nd meeting, and Governor Bailey said on Monday that like the September meeting, upcoming rate decisions would be close calls.

US Retail Sales Jump in September

US retail sales in September were hotter than expected, a sign that consumer spending remains robust despite the challenging economic picture. Retail sales are not adjusted for inflation, which means that consumers have managed to keep up with price increases. Consumer spending has been strong in the third quarter, which should translate into a solid GDP reading next week. It also provides support for the Fed to keep interest rates at elevated levels – Fed rate odds for a December hike have risen to 34%, up from 30% prior to the release.