At the beginning of the week, Brent crude oil prices were likely to start growing due to the temporary weak US dollar; however, on Tuesday, a sharp fall followed. The price went lower than $49 per barrel affected by the concerns over the further reduction in the Chinese demand and the statements made by OPEC.

In particular, on Tuesday, OPEC announced that the oil and petroleum production grew to the maximum of the last three years; and, amid the sharp over-demand, it only worsens the situation.

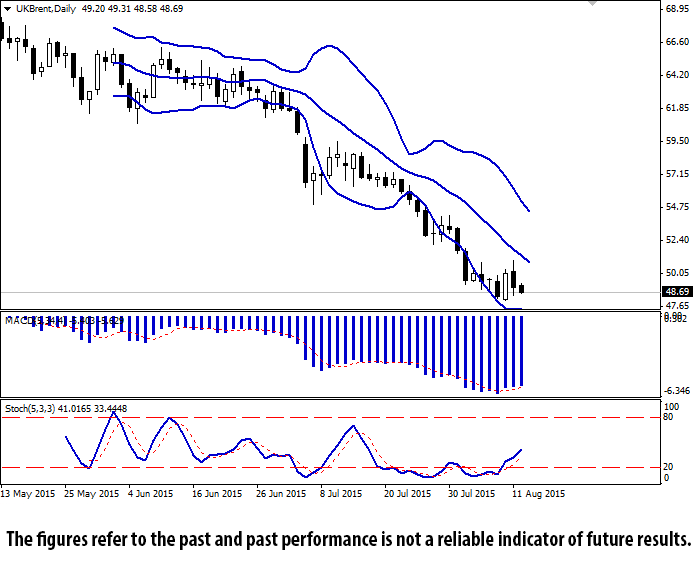

Bollinger Bands® on the daily chart is moving down steadily, keeping a strong “bearish” impetus in the medium and long run. At the same time, as the price range is narrowing, a flat dynamics is appearing and the pair may turn to sideways.

MACD is growing, keeping a weakening buy signal (the histogram is above the signal line). Currently, it is better not to open new long positions; however, the pair still may grow.

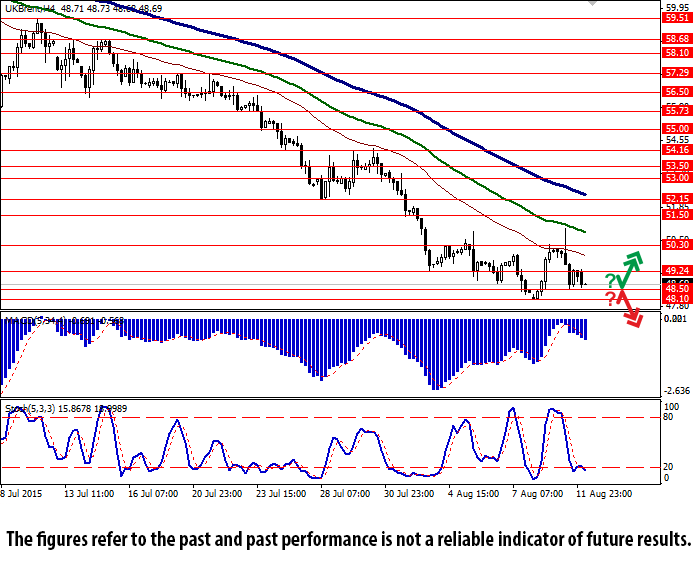

Stochastic is in the middle of its working area. The indicator recommends to keep opened positions, but do not hurry with placing new orders.

Support levels: 48.50 (the nearest mark) 48.10 (current record 10 August low).

Resistance levels: 49.24, 50.30 (near the upper border of the flat channel), 51.50, 52.15, 53.00, 53.50, 54.16 (near 29 July local high), 55.00.