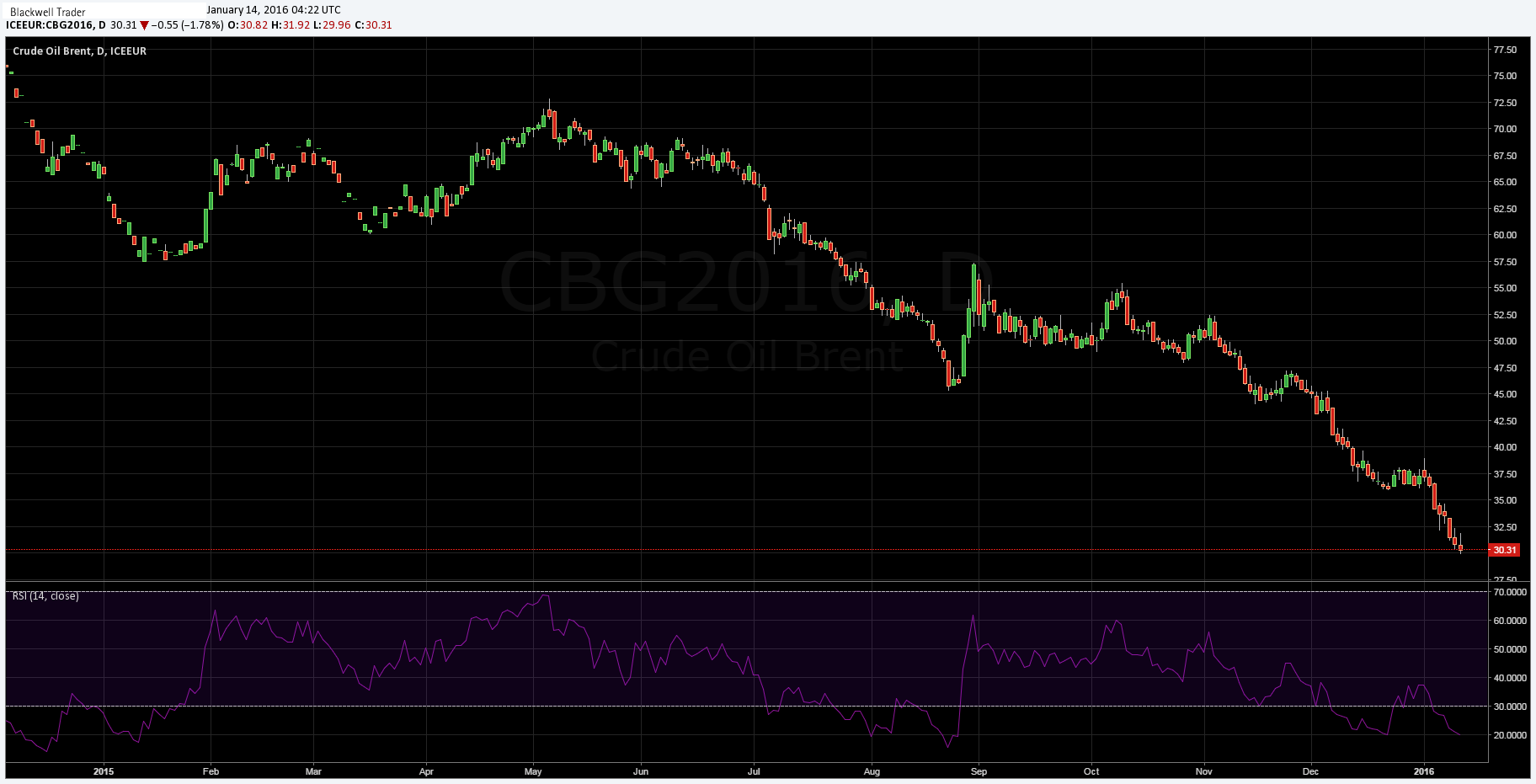

The looming spectre of Iranian oil shipments has spooked world oil markets as the price of Brent crude has declined below $30 a barrel for the first time since 2004. Speculation is mounting that world oil markets could be in for a rough year as global demand continues to sag.

Despite US domestic concerns over the viability of an Iranian nuclear deal, it appears that an agreement is close to being achieved. Such a monumental step would allow Iranian crude oil to flow freely following the lifting of sanctions. Subsequently a nuclear deal could have a significant impact on world crude markets as Iranian exports could further depress a sector already mired in over-supply.

Subsequently, as the parties appear close to reaching a resolution, the increasing risks of the additional supply are being priced into global oil prices. In fact, crude oil prices in London have slumped over 1.8 percent whilst WTI desperately clings to the $30.00 handle. The widening gulf between Brent and WTI prices continues largely due to the risk that the additional seaborne supply poses to Brent.

The return of Iran to the oil exporting fold has the potential to significantly impact global oil prices. The beleaguered state is likely to exacerbate the current global oversupply by an additional 500,000 barrels per day. This level of supply could potentially rise to 1 million barrels a day, within 6 months, following the lifting of sanctions.

Subsequently, Brent crude oil prices are likely to remain under pressure until some certainty is obtained regarding the lifting of sanctions. Currently, London crude oil is trading around the $29.92 a barrel mark but the additional Iranian supply could very well see prices around the $24.00 range. As a result, traders are keenly watching the outcome of the nuclear negotiations for a hint at Brent’s future trend direction.

In addition, poor US consumption and inventory data further complicates the markets view of future demand. As the world’s largest consumer of oil products markets typically look towards the US data for signs of strength. However, gasoline stockpiles continue to grow and are currently at over 240 million barrels, the highest since February of 2015. Subsequently, concerns continue to mount over a US-led slowdown in demand that could have a long lasting impact in crude markets.

Given the current lack of demand, coupled with the continuing oversupply of crude, the coming quarter looks bleak for Brent and WTI prices. Crude oil markets are in a perilous position and as the essential rebalancing occurs we could very well see a significant change to the market structure and power of Middle Eastern participants in the coming year.