Just when I thought there wasn’t room for another book on options for the beginning to intermediate retail trader/investor, along came a text to prove me wrong--Erik Kobayashi-Solomon’s The Intelligent Option Investor: Applying Value Investing to the World of Options (McGraw-Hill, 2015). It’s not just that the author sets out to blend clashing cultures but that he looks at options from a fresh, albeit sometimes controversial perspective.

Value investors are known to be patient, to hold onto their positions for long stretches of time as price catches up to value—or so they hope. Options traders, by contrast, always have to keep one eye on the calendar, perhaps even on the clock. Value investors who decide to include options in their portfolios eschew short-dated options; they tend to look a couple of years out. And they embrace directionality—no iron condors for them. As the author contends, “flexibility without directionality is a sucker’s game. … Winning this sort of bet is no better than going to Atlantic City and betting that the marble on the roulette wheel will land on red—completely random and with only about a 50 percent chance of success.” (p. 28) At this point short-term probability traders would most likely throw the book across the room (or stop reading this post). But that would be rash; even they can find useful information in this book.

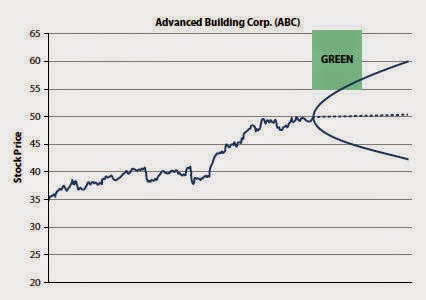

The author’s theoretical probability cones, creatable with a few plug-in numbers on his

subscription website, extend indefinitely into the future. The value investor can then overlay his rational valuation range for a particular stock on its Black-Scholes-Merton probability cone and look for discrepancies.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.

Kobayashi-Solomon uses probability cones to describe basic option positions as well as to explain how input variables to the Black-Scholes model affect the prospect of profits on options trades. For instance, a trader who buys short-dated calls at 55 on a $50 stock has “a little corner of the call option’s range of exposure within the BSM cone, but not much.” (p. 68)

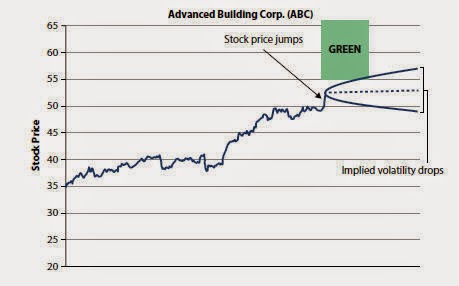

In the above diagram implied volatility is assumed to be 35%. If it falls to 15%, here’s what happens. “The stock price moves up rapidly, but … the BSM cone shrinks as the market reassesses the uncertainty of the stock’s price range in the short term. The tightening of the BSM cone is so drastic that it more than offsets the rapid price change of the underlying stock, so now the option is actually worth less!” (p. 69)

Options, of course, provide the investor with leverage, but this leverage is not the same as the leverage you get when you buy a stock on margin. Let’s say you have a $50 stock that you believe is worth $85. Call options at the 65 strike are $1.50. You can either buy the stock on margin or buy options. If you decide to buy options, the $1.50 per contract is essentially an interest payment because it is all time value; it is made up front and is a sunk cost. This “prepaid interest can be offset partially or fully by profit realized on the position, but it can never be recaptured.” (p. 170) On the other hand, “payment on the principal amount of $65 in this case is conditional and completely discretionary.” (p. 168) No matter how the stock performs, you’ll never receive a margin call. By contrast, repayment of a conventional loan from your broker is mandatory, so if the stock drops heavily, you’ll get a margin call from your broker.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.

Two simple measures for measuring option investment leverage are lambda and notional exposure. The author discusses these measures but then explains why they are insufficient to help an investor manage a portfolio containing option positions. The challenge for the intelligent option investor is to “find as large an asymmetry” between valuation and market price “as possible and courageously invest in that company. If you can also tailor your leverage such that your payout is asymmetrical in your favor as well, this only adds potential for outsized returns.” (p. 184) The author considers a -1.8/2.6 leverage ratio especially attractive; it is similar to that of Berkshire Hathaway’s portfolio. A recent AQR Capital paper, "

Buffett's Alpha," found that “a significant proportion of Buffett’s legendary returns can be attributed to finding firms that have low valuation risk and investing in them using a leverage ratio of roughly 1.8. The leverage comes from the float from his insurance companies.” (p. 185)

Although The Intelligent Option Investor is not the first book an aspiring option investor should turn to, it is a worthy complement to some of the classic options texts.