Last week, the Bank of Canada raised interest rates. What does it mean for the US dollar and gold?

On Wednesday, one week ago, the Bank of Canada increased its target for the overnight rate from 0.50 percent to 0.75 percent. The bank rate and the deposit rate, which create the operating band, were raised to 1 percent and 0.5 percent, correspondingly. As one can see in the chart below, it was the first hike in seven years. Still, the key policy interest rates remain at a very low level.

Chart 1: BOC’s benchmark for the overnight interest rate over the last 10 years.

Although the upward move was generally expected, the BOC took a surprisingly hawkish tone, as it considered recent softness in inflation temporary. The official reason behind the hike was that “recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy”. However, the BOC could be also worried about the housing market or it did want to stay behind the hawkish Fed.

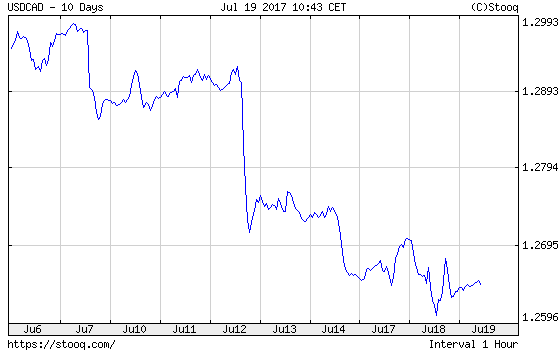

The hike is bullish for the Canadian dollar. Indeed, as the chart below shows, the loonie soared 1.3 percent the day the BOC moved. The appreciation of the Canadian currency may continue for a while, especially that the BOC will likely not stop at one hike.

Chart 2: USD/CAD exchange rate over the ten last days.

The appreciation of the loonie would add some downward pressure on the US dollar, which should be positive for the gold market (however, the link between the yellow metal and the greenback has weakened recently).

Given significant housing imbalances in Canada, too aggressive a tightening of monetary policy could trigger a correction in the housing market, which would spur some safe-haven demand for gold. On the other hand, a hawkish turn among major central banks in the world seems to be bearish for gold. But a lot depends on the relative performance of the Fed. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.