Bitcoin Trading Alert originally sent to subscribers on October 8, 2015, 1:06 PM.

In short: short speculative positions, target at $153, stop-loss at $273.

Cryptocurrency payments may be suited for an emerging niche of the payments system, given that changes are made to how transactions are confirmed, we read on CoinDesk:

(…) there may be no older and bigger 'buried treasure' use case for bitcoin than its ability to serve as a protocol for micropayments. Compared to credit cards and PayPal Holdings Inc (NASDAQ:PYPL), the latter of which defines a micropayment as less than roughly $5, bitcoin is divisible into 100 million smaller units called Satoshis, valued at $0.000002 at today's price levels.

(...)

However, despite this promise, the network today can't send satoshis at an affordable price.

(...)

Still, Dryja [a Bitcoin developer] is one of the developers seeking to bring about a future where bitcoin's technology can fulfill its promise. As the co-creator of the Bitcoin Lightning Network, first proposed in February, Dryja and Joseph Poon kickstarted a conversation about how bitcoin's technology could be upgraded with payment channels.

This is an interesting initiative – if it turns out to be operational, Bitcoin-based systems could be used to transfer very small amounts of money. Even though the amounts of every single transaction would be small, the overall market for micropayments could actually be very large. The article cites it could be as big as $925 billion by 2025. Pure SF, it would seem, but so would the possibility of the transfer of funds without a third party over the Internet a couple of years ago.

It is argued that micropayments could replace adds as a form of payment for various kinds of digital content. If a content provider is paid every time an ad is seen on their page, it might be possible to substitute this with a system whereby the visitor makes micropayments to access the content. A lot would have to be worked out here, such as how the payments would be confirmed and so on, but the potential seems to be there. We’ll wait for more news about Bitcoin micropayments.

For now, let’s focus on the charts.

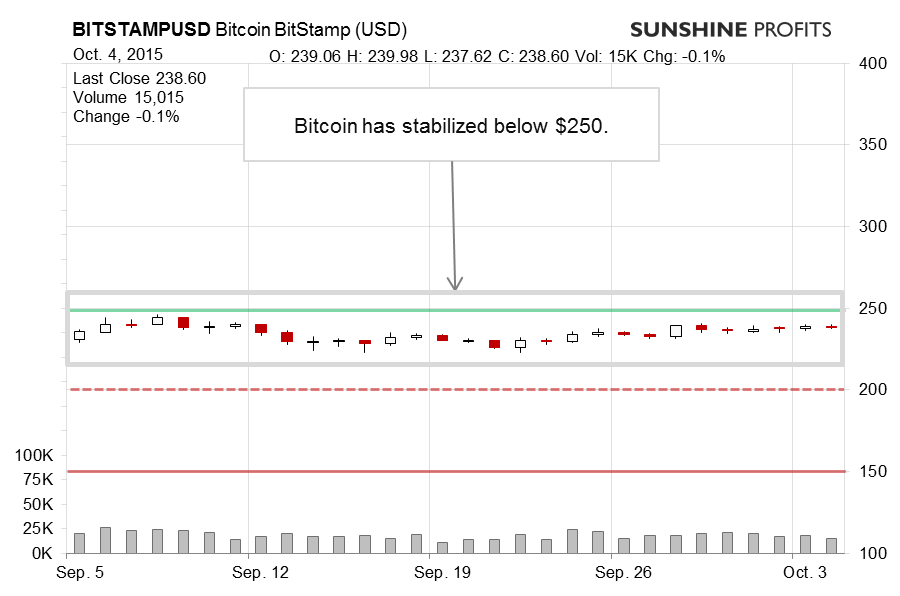

On BitStamp, we see that Bitcoin is now close to $250 (green line in the chart). Does this change anything? Our take is that it doesn’t, at least not yet. If you recall our recent comments:

(…) Today has been slightly different as Bitcoin has been up (…). The main question remains: “Is this a meaningful signal?”

Our take is that it’s not, at least not at the moment. Yes, Bitcoin is above a possible trend line (not visible in the chart), but it’s still below $250 (green line in the chart) and the move today has been far from extremely volatile. The situation, as it is, is not really bullish at the moment. We would have to see more appreciation/volatility for the outlook to shift.

Now that Bitcoin has come close to $250, the situation is getting tenser but the situation actually is less bullish than it might seem at first sight. Actually, it is still bearish, not bullish and it most likely will remain bearish unless Bitcoin moves visibly above $270.

On the long-term BTC-e, the situation looks like it “in-your-face bullish.” “Looks” is the key word here as our recent comments remain up to date:

Yes, Bitcoin is above the line drawn through the July and September tops but if we zoom out and look at an even longer time frame, the currency is still below a possible declining trend line based on the 2013 top and the September 2015 top. At present, our take is that Bitcoin would have to at least move up above this line, above $260-270, to suggest a more meaningful turnaround. This is not the case at the moment. Actually, even though the situation is more bullish on the surface, not much has actually changed and the outlook remains bearish.

Now, $270 is the level to observe. It might be tempting to think of Bitcoin as rallying from $250 but we would actually wait until $270 to even think about changing the positioning (if nothing major happens, that is). Actually, our take is still that Bitcoin is possibly in the position to decline more significantly in the next couple of weeks. Yes, we could see some more strength now, but our view is that it would be followed by a more pronounced decline.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $147, stop-loss at $273.