Bitcoin is "total insanity" according to Berkshire Hathaway's Charlie Munger. It produces no earnings, and it cannot be valued. This article details why Bitcoin is "fool's gold," and then reviews two of our Top 10 Big-Yield Investments for 2018.

Bitcoin Is Fool's Gold

Here is a performance chart for Bitcoin Investment Trust (OTC:GBTC), and despite the volatility, you can see how a lot of people have already made a lot of money just by owning it.

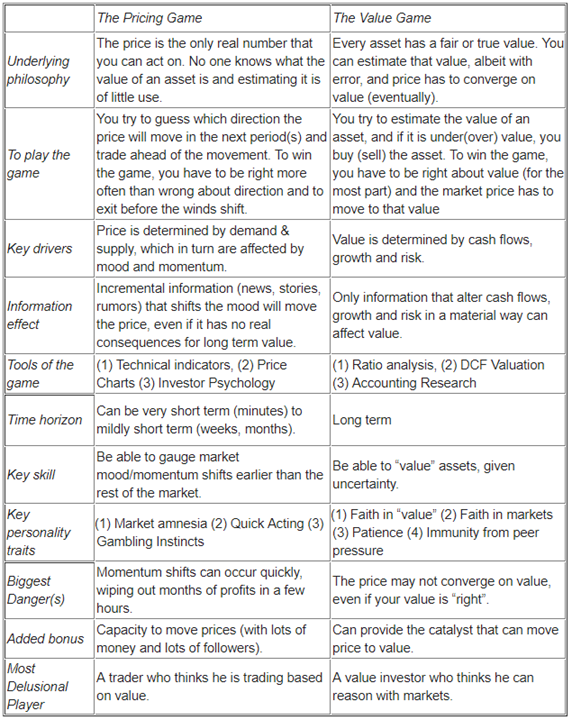

However, Bitcoin is not an "investable" asset. Specifically, NYU Stern Professor, A. Damodaran, does an excellent job explaining how Bitcoin is not an income-generating asset that can be valued, but rather Bitcoin has characteristics of a currency that can only be priced.

As the above table explains, the most delusional player in the Bitcoin space is the trader who thinks he is trading based on value. And for more perspective, when Charlie Munger was recently asked about Bitcoin (and cryptocurrencies, in general), he said:

"I think it is perfectly asinine to even pause to think about them… It's bad people, crazy bubble, bad idea, luring people into the concept of easy wealth without much insight or work. That's the last thing on Earth you should think about… There's just a whole lot of things that aren't going to work for you. Figure out what they are and avoid them like the plague. And one of them is bitcoin. … It is total insanity."

And because we strongly agree with Munger's attitude about Bitcoin, here is what he had to say about Bitcoin compared to gold:

"You know it is one thing to think gold has some marvelous store of value because man has no way of inventing more gold or getting it very easily, so it has the advantage of rarity. Believe me, man is capable of somehow creating more bitcoin. … They tell you there are rules and they can't do it. Don't believe them. When there is enough incentive, bad things will happen."

There was a time when the US dollar was backed by the gold standard (i.e. you could exchange your US dollars for an equal amount of gold). However, most nations abandoned the gold standard in the early 20th century as confidence and trust grew in the value of government-issued currencies (even though a lot of governments still hold a substantial amount of gold reserves). Bitcoin isn't backed by the gold standard and it isn't issued by a trustworthy government. Granted, gold has some attractive qualities (as Munger described above), but we're still much more comfortable keeping our nest egg in income-producing assets/investments that can be valued, not gold. And Bitcoin isn't even remotely as stable or trustworthy as gold. Bitcoin is fool's gold (i.e. it's not nearly as attractive as some people believe).

Attractive Big-Yield Investments Worth Considering

If you are looking for actual, income-producing, investments offering big-yields (instead of highly-speculative trading opportunities, like Bitcoin), we have highlighted a few ideas below.

New Residential (NYSE:NRZ), Yield: 11.2%

New Residential focuses on investments related to residential real estate, and the company has been doing an exceptional job in recent years to evolve with the evolving residential mortgage market. Specifically, the company was an innovator in the Excess Mortgage Servicing Rights industry following the housing crisis whereby NRZ picked up some of the risky business "Big Banks" were forced to shed. However, NRZ managed the Excess MSR business in a way that allowed it to avoid some of the industry pitfalls (such as legacy lawsuits) while generating strong profits (and huge dividends) for investors.

The more recent problem for NRZ is that opportunities to grow the Excess MSR business have diminished as NRZ has already captured a huge portion of this market, and also the growth opportunities for the Excess MSR business are diminished because the distress of the financial crisis is falling further into the rearview mirror. Further, NRZ's inability to actually service mortgages in-house limited the deals they were able to make (NRZ owned the servicing rights, but they didn't actually service the mortgages - this was outsourced). Excess MSRs have been a fantastic business over the last few years, but as the industry moves forward, NRZ needs to keep evolving, and that's exactly what the company has been doing. Specifically, NRZ is acquiring mortgage servicer, Shellpoint Partners.

It was announced earlier this month that NRZ is acquiring Shellpoint Partners, and this is a smart move in multiple ways because it will allow NRZ to continue evolving with the evolving industry. Specifically, NRZ is gaining a mortgage servicer and originator. This is huge for NRZ because it allows the business to keep growing. For example, the acquisition will not only give NRZ access to more deals (because they'll soon be able to actually service in-house), but it will also allow NRZ to grow new business opportunities with its origination capabilities.

The other big advantage of this deal is that it reduces the risk associated with a couple of distressed mortgage servicers upon which NRZ has been highly dependent (Ocwen (and Ditech) as described in detail in our previous NRZ article.

Also importantly, the new Shellpoint deal will help ensure NRZ is able to keep covering and growing its big dividend. For perspective, the following chart shows that NRZ has been covering its dividend with a healthy margin of safety.

Overall, we believe NRZ's dividend is well-covered and its business continues to have growth opportunities thanks to management's consistent smart decisions to evolve with the evolving industry.

AmeriGas (NYSE:APU), Yield: 8.2%

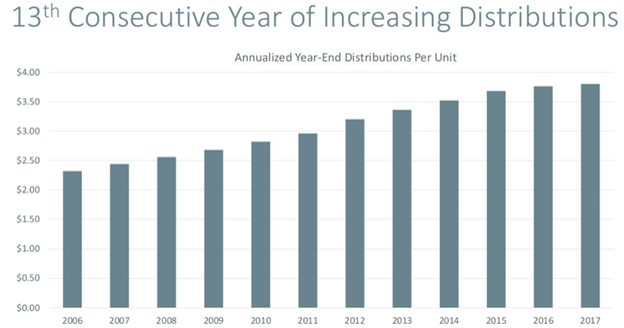

AmeriGas is the largest propane distributor across the US, with operations in all 50 states. It's organized as an MLP and it offers a big growing distribution yield, currently 8.2%.

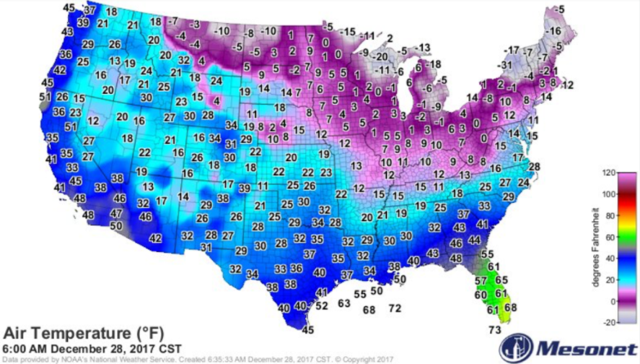

And the good news for AmeriGas is that we're finally having some cold weather across the US and this will help the company's bottom line.

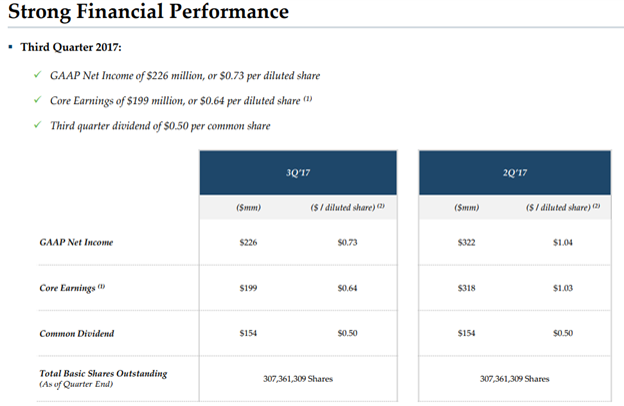

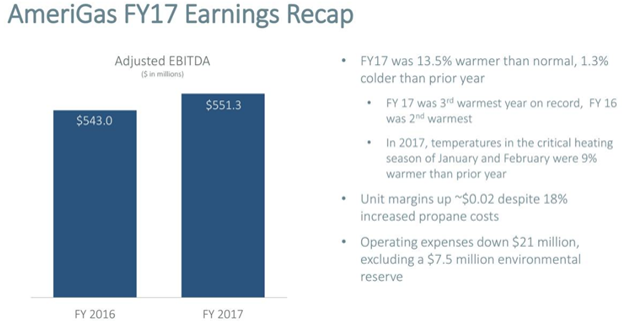

Specifically, the company has been challenged by warmer than normal winters across the US in recent years, which puts pressure on the company's revenues. However, despite the warmer winters, AmeriGas recently reported its fiscal year 2017 results (in November) and it grew its full-year adjusted EBITDA versus 2016, as shown in the following graphic.

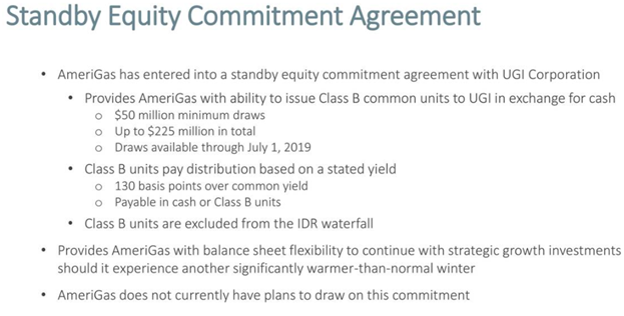

Worth noting, the company has a standby equity commitment on hand if it needs extra cash to support its business (and the big distribution payments to investors). However, the company explains it is not currently needed, and the relatively colder winter we've been having so far (versus the last two years) helps ensure the company will have plenty of cash flow generated by operations.

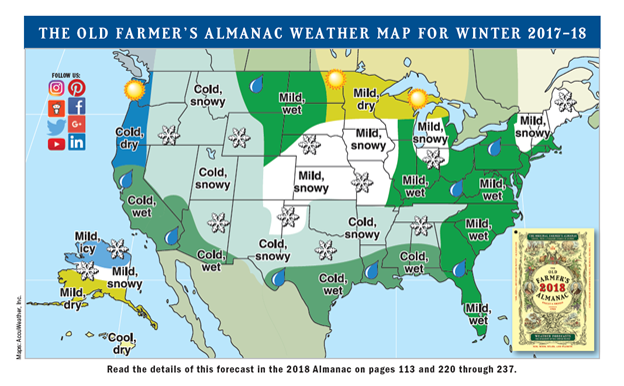

We're certainly not claiming to have a working crystal ball, but according to the Old Farmer's Almanac "the long-range winter forecast for the rest of 2017-2018 shows generally colder temperatures than last winter for the U.S. and Canada" which is a good thing for AmeriGas.

We've owned units of AmeriGas since mid-March of this year. And while we've experienced some price appreciation, healthy distributions payments, and one distribution increase, we believe this company has more upside ahead, especially considering winter weather is likely to revert toward the averages in the upcoming years, which will be a great improvement for the company. Also worth mentioning, AmeriGas has an extremely low beta (around 0.3) which is good for volatility reducing diversification benefits within a larger income-focused investment portfolio. Investors should be aware of the tax implications of investing in an MLP (e.g. K-1 statements at year-end), but if you are an income-focused investor, AmeriGas' 8.2% yield is worth considering.

Conclusion:

In our view, there is no way to value Bitcoin. It generates no income, and it pays no dividends. It's also not backed by the gold standard, nor does it receive the "full faith and credit" of the US government (or any reputable government, for that matter). Rather than rolling the dice and hoping to "get rich quick" with Bitcoin, we prefer attractively-valued and high-income-producing investments. For more attractive investment opportunities, consider our recent ranking of Top 10 Big-Yield Investments for 2018.