- Markets are bracing for a busy week ahead of the next FOMC meeting, major earnings reports, and Q2 GDP

- Bitcoin and Ethereum trended down early Monday and look poised for volatility

- The top two crypto assets are currently sitting on vital support.

Uncertainty is mounting around Bitcoin and Ethereum ahead of this week’s Federal Open Market Committee meeting. Furthermore, upcoming earnings reports from America’s five biggest tech companies and other reports could impact crypto prices over the next few days.

Bitcoin and Ethereum Brace for Volatility

Volatility has struck the cryptocurrency market as speculation mounts around a series of highly anticipated meetings this week.

Of particular significance to crypto market participants is the next Federal Open Market Committee, which is scheduled to take place on Wednesday, July 27. The Fed is widely expected to implement another 75 basis points interest rate hike in a bid to curb U.S. inflation, which last month hit a 40-year high of 9.1%. A rate hike could incentivize some crypto investors to sell of their holdings and take profits as high interest environments tend to negatively impact risk-on assets.

The U.S. gross domestic product for the second quarter of the year is also due to print this Thursday, which could spark further fears around the possibility of a U.S. recession. The economy shrank by 1.6% in the first quarter, and it’s expected that this week’s reading will show a growth of 0.5% in the second quarter. However, if the growth is slower than expected or another retraction is printed, it could be viewed as another sign that the U.S. has entered a recession.

Additionally, earnings reports from Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META) could give an indication of the health of the U.S. economy, potentially leading to volatility in global and crypto markets.

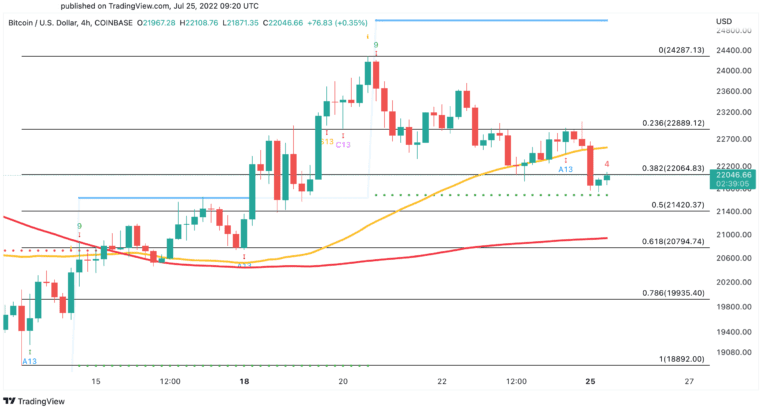

Ahead of one of the busiest weeks of the summer for crypto, Bitcoin dropped 3.7% early Monday. The leading cryptocurrency declined from a high of $22,580, hitting a low of $21,750. Although it has rebounded in the last few hours to hit $22,050 at press time, its next move remains unclear.

On the four-hour chart, Bitcoin’s recent activity is pointing to a crucial price point. The Tom DeMark (TD) Sequential indicator’s support trendline at $21,700 needs to hold to avoid further losses. If Bitcoin fails to hold this level, it could suffer a downswing toward the 200-hour moving average at around $20,800.

Bitcoin would likely have to slice through the 50-hour moving average at $22,700 to have a chance of printing higher highs. Overcoming this significant resistance level can give it the strength to retest its July 20 high at $24,290.

Ethereum has also kicked off the week in the red, losing over 100 points in market value. The sudden downswing pushed ETH to the lower boundary of a parallel channel at $1,500, where prices have been consolidating for the past week. This crucial support area must hold to avoid triggering a retracement to $1,360.

Based on the recent price action, Ethereum looks like it will need to print a four-hour candlestick close above $1,670 to advance further. If it succeeds, it would have better chance of a breakout toward $1,850.