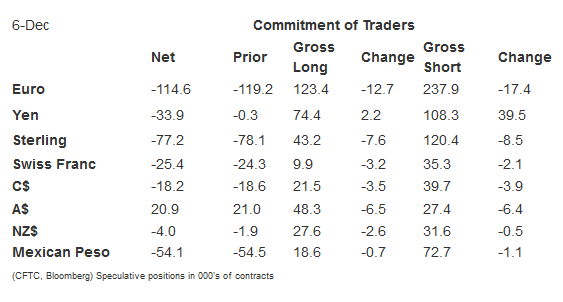

Speculators appeared mostly interested in reducing exposure in the run-up to the US jobs data and the Italian referendum. They liquidated gross longs in the currency futures market and covered shorts. Of the eight currencies we track there was a single exception, the Japanese yen.

Despite the yen's decline in the spot market, the bulls were not shaken. They added 2.2k contracts to lift the gross long position to 74.4k contracts. That makes it the second largest gross short speculative position in the currency futures behind the euro. However, the bears dominated. They extended their gross short position by 39.5k contracts to 108.3k. This is the largest gross short position in a year. This drove the slide in the net position from short less than 300 contracts to being net short 33.9k.

The bears also hugged the US 10-year note futures market. They added 95.7k contracts to their gross short position, raising it to 711.1k contracts, which appears to be a new record. The bulls retreated, selling 36.6k contracts, leaving them with 482.5k. The net short position swelled to 228.6k contracts from 96.3k. Recall that in late November the net speculative position was long 172.6k contracts

The euro was the only currency futures besides the yen in which speculators made a significant (10k contracts or more) adjustment. The bulls liquidated 12.7k contracts (leaving 123.4k) and the bears covered 17.4k contracts (leaving 237.9k contracts). This produced a little slippage in the short position. At 114.6k contracts, the net short position was the smallest in seven weeks.

We share two other observations about the speculative positioning in the currency futures. First, the net short Swiss franc position of 25.4k contracts is the largest in a year. Since 2012, it has bottomed between 25k and 30k several times. Of the currency futures we track, speculators were only net long one, the Australian dollar.

For the record, we include the speculative positioning in the light sweet crude oil futures market. The gross long position rose by 38.1k contracts to stand at 589.8k contracts. The gross short position was cut by 51.7k contracts to 212.2k. This translates into an almost 90k-contract increase in the net long position to 377.6k contracts.