- CB’s cut growth and inflation forecasts

- ECB’s Nowotny: ‘meeting nothing to get excited about’

- BoE Hawks find the fold

- Poloz has market doing all the work

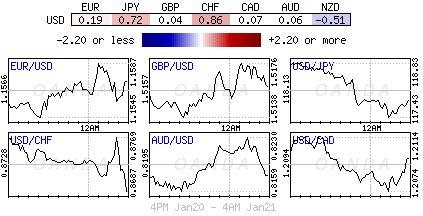

Despite Japan’s Governor Kuroda, Canada’s Governor Poloz and the BoE’s MPC votes taking the lead in in the first-half of this week, Capital Markets are firmly focused on the European Central Bank, and in particular Draghi’s post press conference tomorrow, where the possible introduction of QE tops their agenda.

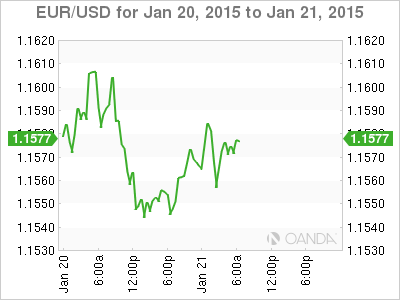

The market has been pricing in an ECB sovereign buying outcome. The consensus is for Euro interest rates to remain unchanged, while extending its program of asset purchases to include sovereign as well as corporate bonds. What percentage mix, how many, and from whom is yet to be divulged. The issue is how the program is designed and whether it is seen as credible and sufficient? Nevertheless, investors cannot nor should take anything for granted. Last week’s surprise Swiss decision to do away with the franc “cap” just shows that investors cannot afford to be complacent with rate decision and policy-making any more.

What to Expect from the ECB?

The announcement is not expected be an open ended QE. Expect to see Draghi use the post-meeting press conference to talk about the size and whether it’s fixed – he will be required to talk up an open-ended solution. The market expects the EUR to see large “swings” in the weeks ahead. The point of interest of the ECB’s meeting is not only the initial size of the stimulus program but also the explicit balance sheet target. Market participants are now using the early 2012 levels, €2.6 to €3.1 trillion, as a reference. If the target falls to the upper end, the EUR/USD (€1.1575) may plunge to fresh lows. Nevertheless, if the ECB disappoints, it could trigger a massive short covering rally as the market is greatly tilted on the short side. The first line of strong resistance is expected near €1.1745.

No matter what, everyone should be expecting plenty of market volatility, with the risk that the market having “brought the rumor will now want to sell the fact.”

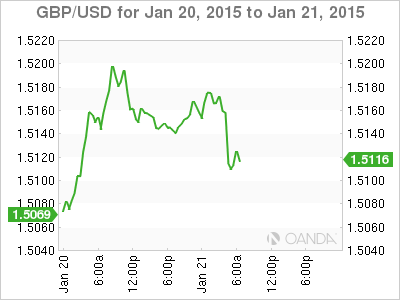

BoE members come in from the cold

This morning’s Bank of England’s MPC minutes saw members Weale and McCafferty welcomed back into the majority fold on keeping rates unchanged (9-0 vote count). From their perspective they believed that there was risk that a rate rise would prolong period of “low” inflation. It was only six-months ago that the pair jointly were voting for a tighter monetary policy. Collectively, all members are alert to the risk that low inflation might become entrenched and even see the possibility of an annual fall in U.K prices during H1 2015. It seems that that the BoE considers that medium term inflation risks may have shifted.

“Crossing the floor”

The surprise vote encouraged volatile sterling price action. The GBP/USD managed to print session lows of below the psychological £1.5100 handle after the BoE dissenters moved back into the majority believing now any rate hike would risk persistent “low” inflation. So far the pound has been unable to hit fresh 17-month lows despite the dove’s actions. Perhaps GBP requires help stateside to take on its lows?

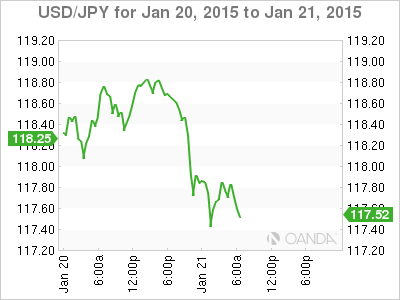

No BoJ surprises

The BoJ kept closely to their monetary policy script overnight, but cut its core consumer inflation projections issued only a matter of months ago. Again, plummeting crude prices were to blame.

As expected, the BOJ pledged to increase the monetary base at an annual pace of ¥80t ($676 billion) through purchases of government bonds and risky assets. It also extended the March deadline of two-loan programs, both aimed at lending rather than hoarding cash, by one year. It increased the size of one of the programs by ¥3t to ¥10t.

BoJ’s Post Press Conference

Governor Kuroda went to great pains to reiterate that Japan’s positive economic (virtuous) cycle remained intact, with no changes in the underlying trend in CPI. Japanese policy makers are expected to remain proactive and assess risks and adjust policy as needed. Kuroda repeated that CPI is likely to reach the +2% target in mid FY15/16 (some members were cautious about the time frame). Falling oil prices should support global growth but limit CPI gains in short-term. Policy makers are “not” considering cutting interest rates paid to excess reserves parked at the BoJ.

The yen (¥117.74) strengthened outright as the BoJ kept asset purchases steady. Expect investors to curtail their trading ahead of the ECB announcement. Hopes of ECB action tomorrow have been dampened this morning by ECB’s Nowotny comments. He indicated, “Meeting will be an interesting one, but nothing to get overexcited about.” He reiterated that he did not expect deflation in Eurozone and that it was harder to fight deflation than inflation.

Market doing the BoC’s work

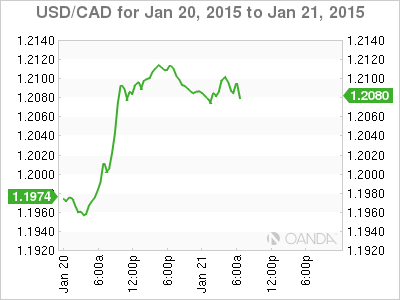

A small percentage of the market expects the Bank of Canada to slightly open the door to rate cuts in its policy decision later this morning. It must be noted that Governor Poloz has moved away from forward guidance, the CAD has weakened sharply since the last policy meeting and that 5-year Canada paper’s yields continue to fall. This scenario begs the question why cut rates? Poloz must be happy that the market is naturally doing the bulk of his work. If anything, Poloz and company may be hinting at pushing back the first potential rate hike. The swap market is pricing in less than a 30% probability of a rate cut by year-end. Three-weeks ago there was a small rate hike bias – the fixed income market is looking at Q3, 2016 for the first possible hike.

The “loonie” trades atop of its six-year low $1.2100. It’s ongoing weakness fueled by lower oil prices and a softer than expected report yesterday on Canada’s monthly manufacturing sales for November (-1.4% to $51.53). At today’s first policy statement and quarterly report for the new-year, the BoC is widely expected to cut growth and inflation projections.