The Australian dollar continued to gain ground. AUD/USD has risen 0.31% on the day and was slightly below the 0.72 line. US markets were closed for a holiday, and with Australian data limited to tier-2 releases, the Australian dollar was to have a relatively quiet day.

It was another strong week for the Australian dollar, which rose 1.62%. A strong Australian retail sales report on Friday helped the Aussie end the week with strong gains.

April retail sales rose 0.4%, marking a fourth successive month of sales gains. This points to solid consumer spending despite rising inflation. Still, there is a concern that businesses will have to pass on higher costs to their customers, which will crimp consumer spending if inflation doesn’t peak soon.

For RBA policy makers, curbing inflation expectations is no less important than curbing inflation. If inflationary pressures are broad-based, there is the danger that inflation expectations will continue to accelerate and boost actual inflation.

Consumer spending, PCE price index weigh on US dollar

The week ended with solid consumer data out of the US, which has boosted risk sentiment and pushed the US dollar lower. Personal Spending rose 0.9% in April, above the forecast of 0.7%.

The Core Personal Consumption Expenditures for April was unchanged with a gain of 4.9%. These readings indicate that consumer spending remains steady despite high inflation.

Investors also seized on the Core PCE Price Index for April, considered the Fed’s favorite inflation indicator. The index came in at 4.9%, down from 5.2% (4.9% exp.).

This is the index’s first decline in 17 months. Although one reading does not make a trend, other inflation indicators also have dropped – April CPI and core CPI were both lower than in March, for example.

It’s too early to tell if we have hit that long-sought-after inflation peak, but the markets have nonetheless lowered their expectations of Fed hikes, which has weakened the US dollar.

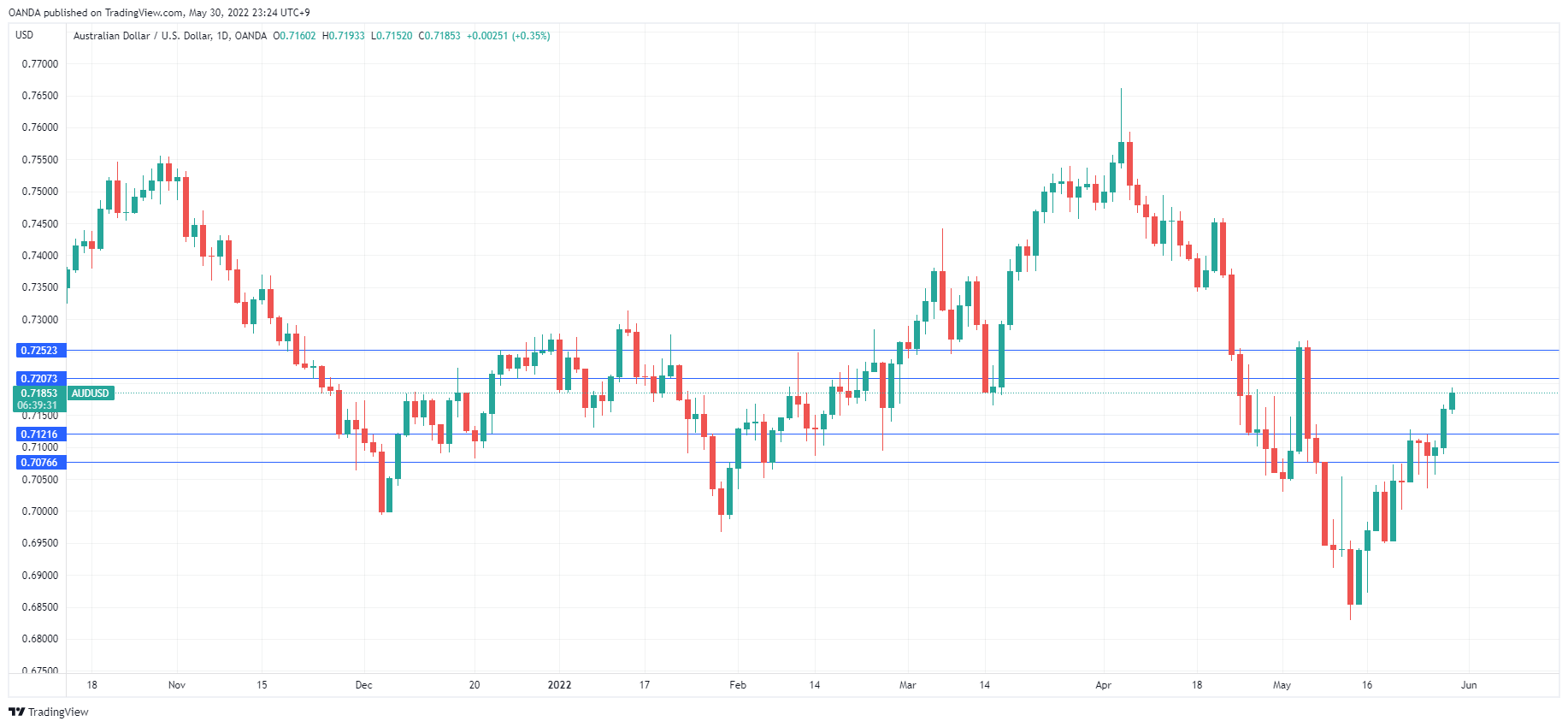

AUD/USD Technical

- 0.7207 is under pressure in resistance. Above, there is resistance at 0.7252

- There is support at 0.7121 and 0.7076