The short at $0.7790 as of last article netted more than 500 pips, as the position was exited last week before the dismayed NFP was released. $0.7100 level indeed was defended as we forecasted, when sellers exited the market around $0.7150 in anticipation of the NFP last Friday to book profits for the month.

One aspect retail traders have to understand about trading is that institution are more interested in stable long term positive performance than a short term aggressive and choppy performance. We could not afford to make 30% return for three straight months and lose 10% on the fourth and fifth months while hoping to recover those losses. Depending upon the portfolio objectives and expected return, compatible investment and trading strategies have to be deployed to meet investors’ expectation.

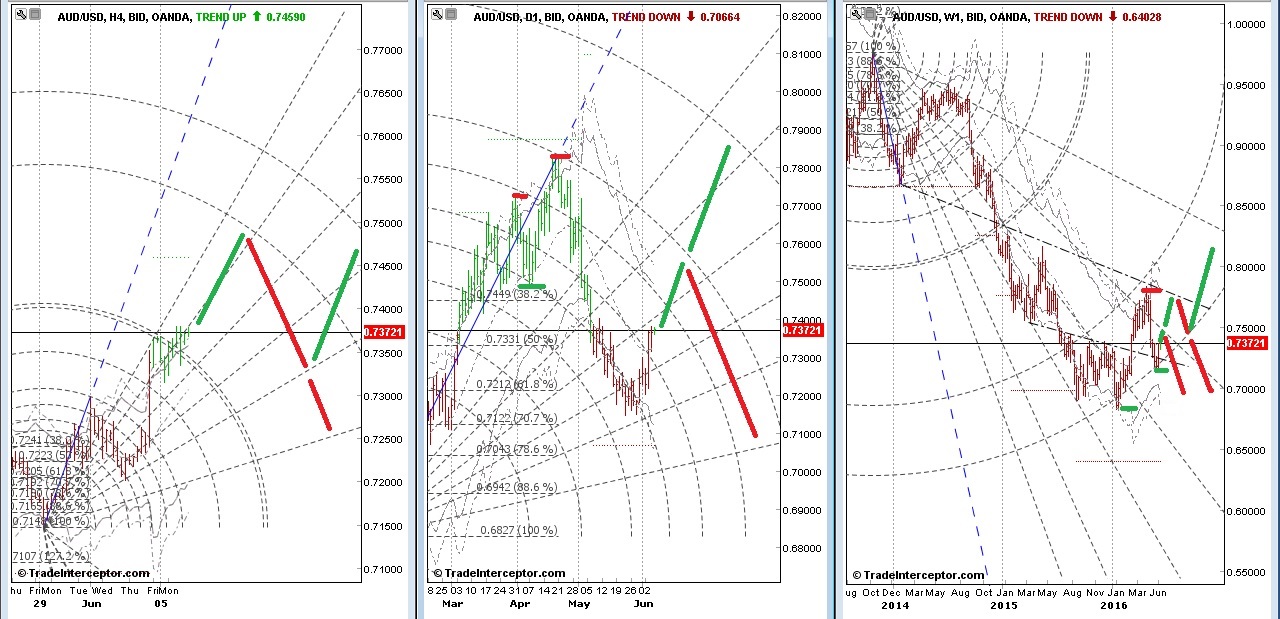

Aussie closed last week with bullish engulfing candle and 80% of the time this signify a buyers market, though we believe the rise is temporary before sellers set back in to sell at a better price in anticipation of RBA rate cut in August. So depending upon your strategies and trading style, you could be a short term buyer or long term sellers. We must also say that the size of your fund could also affect your style as we know it is a lot easier to liquidate smaller positions than a significantly large one. When everybody is selling, it is not easy to find a buyer who would bid at your asking price, and subsequently you are forced to close at any price. This in essence is how market crash happen.

The Australian economy was not all that bad or as bad as market had expected, when the GDP data was released last week. Indeed market consensus was proven wrong when Q1 2016 economic growth was reported at 1.1%, almost doubled the market expectation at 0.6%, and previous report was also revised higher, from 0.6% to 0.7%. Prior to that, unemployment was also reported stable at 5.7% compared to market expectation of 5.8%. For this very reason, we expect the RBA to hold rates in June meeting, though we expect another rate cut later especially if wages and inflation remain weak.

We must agree that the rise in Aussie was also strengthen by the weaker greenback, as market responded to the shockingly low NFP number released by the US Bureau of Labor Statistics. World largest economy only added 38,000 non-farm jobs last month, although the private report from Automatic Data Processing lodged 173,000 additions. Interestingly, US unemployment fell by 0.3% to 4.7% from 5.0% previously as less workers claim for unemployment benefits. This definitely strain the Feds intention to raise funding rate as early as next week’s FOMC meeting.

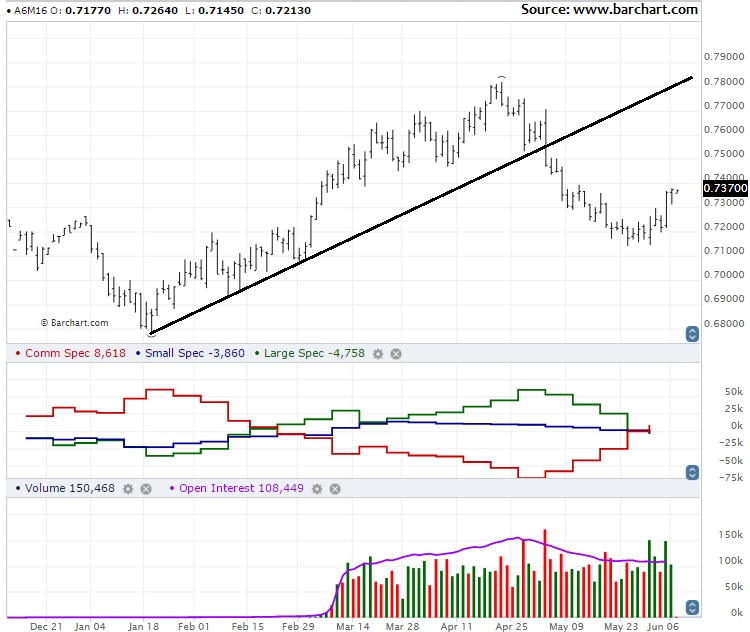

Looking at the recent CoT report, Aussie flipped from net long to net short as large and small speculators shorted the commodity currency with 4,758 and 3,860 contracts respectively. It was also reported that market participants were net short in all currencies against the dollar, except for yen, kiwi and loonie. On the institutional side, Morgan Stanley (NYSE:MS) has reinstated another short targeting $0.6800

Halal Traders decided to stay flat for now, looking for a better entry to reinstate another short.

Please read our risk warning disclaimer.