· AUDUSD faces strong battle near 200-day SMA

· MACD and RSI suggest bullish bias

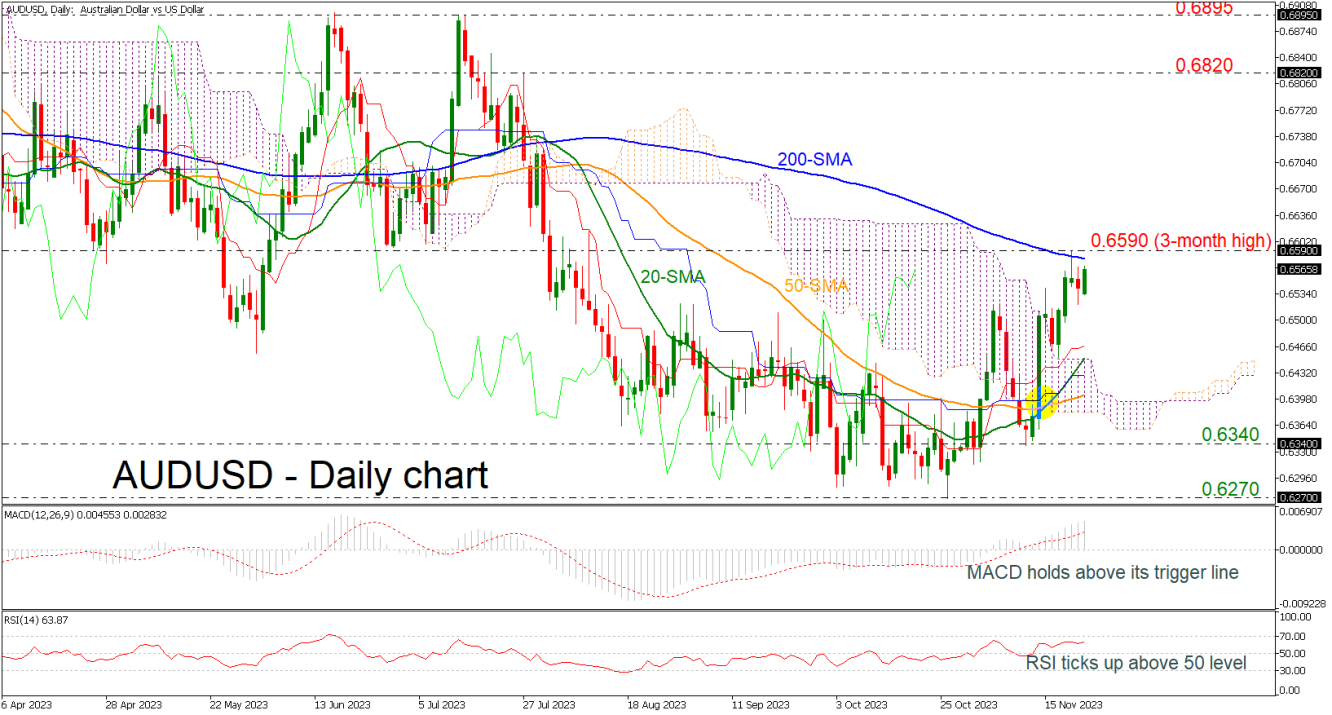

AUDUSD could not find enough buyers to expand Tuesday’s bull run above the three-month high of 0.6590, closing with some losses on Wednesday.

Technically, the short-term risk is leaning to the upside. The price is developing well above the Ichimoku cloud, while the MACD oscillator is strengthening its positive momentum above its trigger and zero lines. Also, the RSI is pointing north and is moving towards the 70 level.

Given the current positive momentum, the question now is whether the pair will move above the 200-day simple moving average (SMA). A clear step above it and beyond the three-month high of 0.6590 would drive the market towards the next psychological marks, such as 0.6600, 0.6700 and 0.6800 before challenging the 0.6820 resistance level, registered on July 27.

However, if the market fails to climb above the recent peak, traders will turn to the downside again meeting the Ichimoku cloud and the 20- and the 50-day SMAs at 0.6450 and 0.6400 respectively. More losses would put the bearish outlook back into play, resting near 0.6340 and 0.6270.

To sum up, the latest spike in AUDUSD has not excited traders yet. An extension above the 200-day SMA and the 0.6590 barricade is still required to make the upturn look more credible. Note that the bullish cross between the 20- and 50-day SMAs is still intact.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUDUSD challenges the recent 3-month peak

ByXM Group

AuthorTrading Point

Published 11/23/2023, 05:06 AM

Updated 05/01/2024, 03:15 AM

AUDUSD challenges the recent 3-month peak

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.