Yen crosses fell heavily after BoJ decided no to go with more stimulus for now. The drops were direct and that means - VERY strong, without any retracement. Nikkei was slaughtered too. BoJ appeared quite hawkish last night even more than the FED(!). The market was surprised by The Bank of Japan holding off on expanding monetary stimulus, investors were expecting more Abenomics which Kuroda failed to deliver.

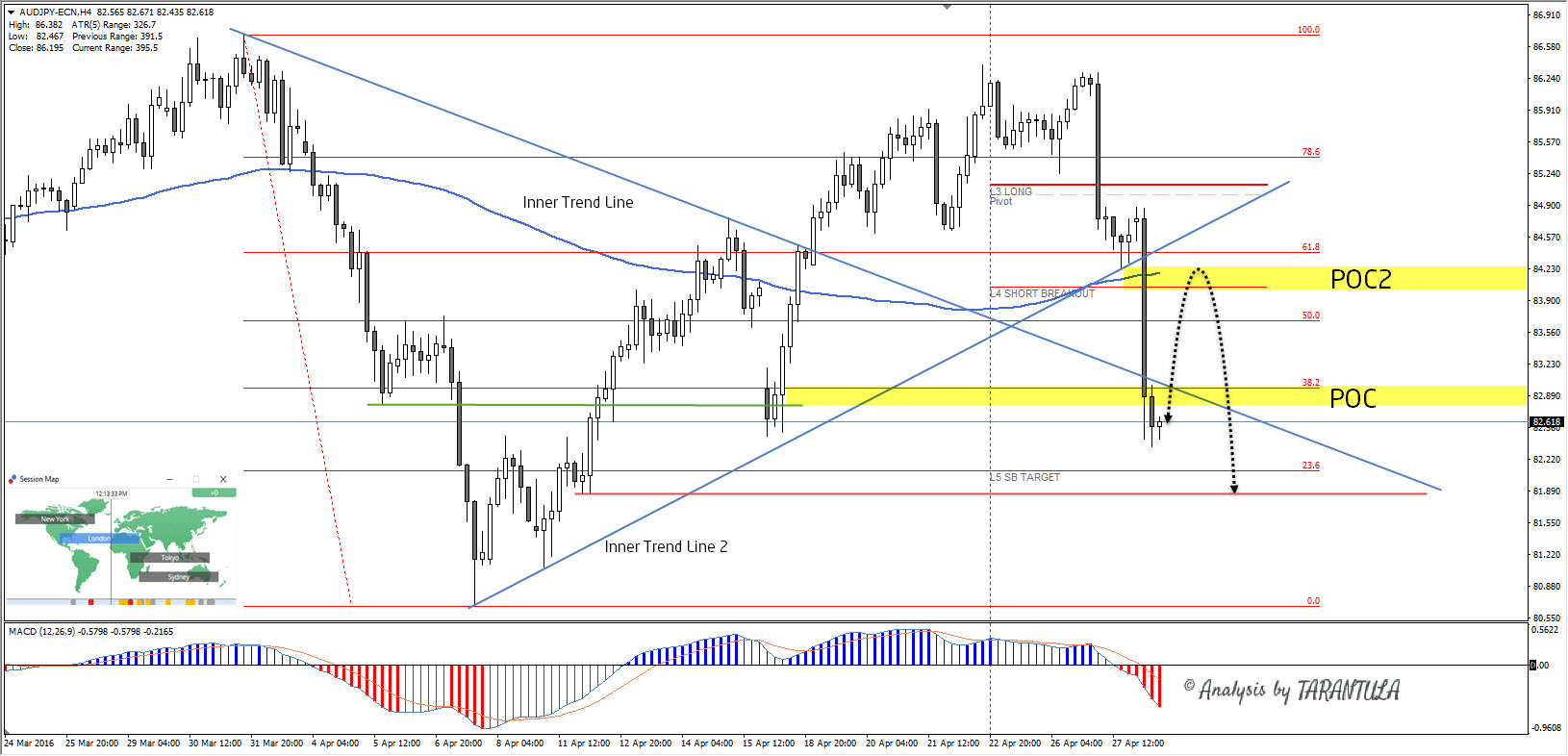

Technically 82.80-83.00 is POC1 (38.2, historical sellers, inner trend line) and the price should reject after a potential first touch of the zone. However the drop was huge and more substantial retracement is favored. POC2 (EMA89, L4, inner trend line 2) 84.05-20 is another potential bearish rejection zone and if the price retraces in the zone we might also start looking for short opportunities.

So focus is on POC1 and POC2 as the price should reject off these zones. Targets are 82.09 and 81.66.

*Your capital is at risk