The Australian dollar has posted gains on Wednesday, following limited movement in the Tuesday session. The pair is trading just shy of the 0.75 line. On the release front, Australian MI Leading Index posted a small gain of 0.2%.

In economic news, the US will release Existing Homes, with the markets expecting the indicator to improve to 5.53 million. As well, Federal Reserve chair Janet Yellen will testify before the House Financial Services Committee regarding the Fed’s Monetary Policy Report. On Thursday, the US will release Unemployment Claims.

Janet Yellen appeared before a Senate finance committee on Tuesday, and her testimony was cautious and tentative. Yellen acknowledged that the US economy could be stronger, saying that “[c]onsiderable uncertainty about the economic outlook remains”.

As expected, Yellen provided no hints with regard to the timing of a rate hike, leaving the markets doubtful that we’ll see a rate hike in July. Yellen said she does not expect the US economy to enter a recession, but if such a scenario did occur, the US would not follow Japan and Europe and adopt negative interest rates.

On a more positive note, Yellen said that weak oil prices, low interest rates and stronger wage growth should support consumer spending.

The RBA minutes from its June policy meeting were upbeat in tone on Tuesday, and the Aussie responded with gains before it retracted. In the minutes, policymakers said that stronger economic data and a weaker Australian dollar had allowed the RBA to stay on the sidelines and maintain the benchmark rate at 1.75%.

Will the RBA lower rates in the next few months? Australia’s economy has shown signs of improvement recently, as GDP grew an impressive 3.1% in Q1 year-on-year, its strongest gain in three years.

There was more positive news on Friday, as Employment Change improved to 17.9 thousand, beating the estimate of 14.9 thousand. The RBA had strongly hinted that it was planning to lower rates, but the stronger economy has given it some room to hold current rate levels. The RBA will hold a policy meeting on July 5, but is unlikely to take any action, as the meeting takes place just days after the national election.

With just one day left until the Brexit referendum vote in the UK, the campaign between the “In” and “Out” camps is going down to the wire. Polls continue to predict a very close vote, but market sentiment is leading towards the UK staying within the EU. This sentiment has boosted the British pound in recent days against the dollar and the euro.

Prime Minister David Cameron and other prominent British personalities have warned that a vote to leave the EU would damage the UK economy, while the “Leave” vote has tapped in to voter dissatisfaction with Brussels, particularly concerning immigration

The “Leave” camp also claims that EU over-regulation has stifled British businesses, and point to countries such as Switzerland that have close economic relations with the EU but are not part of the bloc. Still, leaving the comfort zone of the EU would be a journey into the unknown, and analysts predict that if the UK exits the EU, the pound could dive by as much as 10 percent.

Tuesday (June 21)

- 20:30 Australian MI Leading Index. Actual 0.2%

Wednesday (June 22)

- 14:00 Federal Reserve Chair Janet Yellen Testifies

- 14:00 US Existing Home Sales. Estimate 5.53M

- 14:30 US Crude Oil Inventories. Estimate -1.3M

Upcoming Key Events

Thursday (June 23)

- 12:30 US Unemployment Claims. Estimate 271K

*Key releases are highlighted in bold

*All release times are EDT

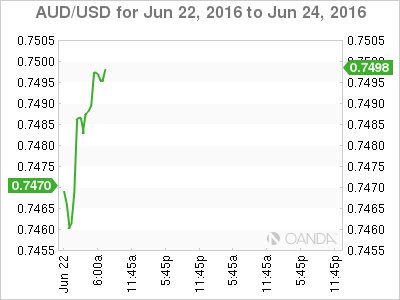

AUD/USD for Wednesday, June 22, 2016

AUD/USD June 22 at 6:50 EDT

Open: 0.7451 Low: 0.7440 High: 0.7502 Close: 0.7496

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7251 | 0.7339 | 0.7472 | 0.7612 | 0.7739 | 0.7835 |

- AUD/USD has posted gains in the Asian and European sessions

- 0.7472 is a weak support line. It could see action in the Wednesday session

- There is resistance at 0.7612

- Current range: 0.7472 to 0.7612

Further levels in both directions:

- Below: 0.7472, 0.7339, 0.7251 and 0.7160

- Above: 0.7612, 0.7739 and 0.7835

OANDA’s Open Positions Ratio

AUD/USD ratio is showing gains by short positions on Wednesday. Long positions command a majority (58%), indicative of trader bias towards AUD/USD continuing to move towards higher ground.