AUD/NZD climbed as high as 1.1332 in March, but thing did not go very well for the bulls, who lost control and allowed the bears to sink the pair to 1.0408 as of June 9th, 2016. Just as it was all looking bullish three months ago, it is all looking bearish now. And that is why we would not rely solely on the current trend. Instead, we are going to use the Elliott Wave Principle in order to prepare for a probable change in the direction of the trend. The weekly chart of AUD/NZD below shows why a bullish reversal should be expected very soon.

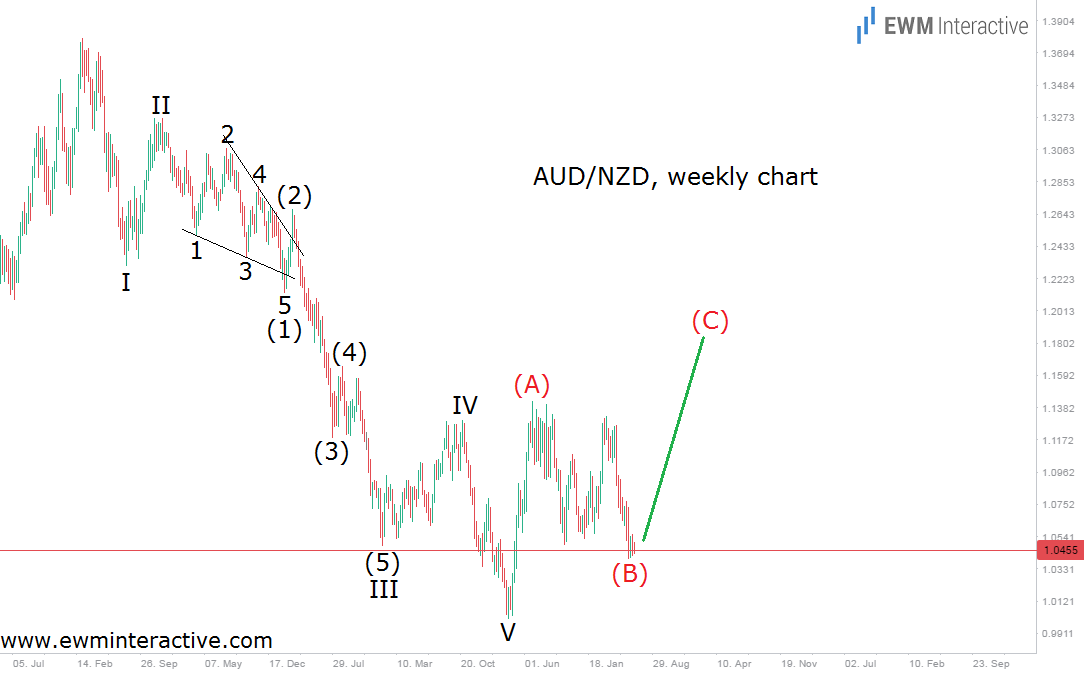

Looking at the weekly chart, we see that AUD/NZD crashed from 1.3790 to 1.0019 between March 2011 and April 2015. What is even more important is that this sell-off is a textbook five-wave impulse, where wave III is extended. According to the Wave principle, every impulse is followed by a three-wave correction in the opposite direction. That is what we believe has been in progress since the bottom at 1.0019. The problem is that the retracement does not have the necessary three waves yet. So far, it looks like an (A)-(B)-(C) zig-zag, where wave (C) to the north is missing. But let’s go deeper into the details, in order to confirm the bullish outlook.

The daily chart of AUD/NZD visualizes the sub-structure of waves (A) and (B) of the correction. Wave (A) is clearly impulsive. The sub-waves of wave (5) are also clearly visible. Once wave (A) was over at 1.1429, wave (B) to the south began. It appears to be a W-X-Y double zig-zag, developing between the parallel lines of a corrective channel. The theory states that once a correction is over, the larger trend, indicated by the five-wave sequence, resumes. On the daily time-frame, the larger trend is the (A)-(B)-(C), so we should expect its resumption in the face of wave (C) to the upside. If this is the correct count, as long as the invalidation level at 1.0019 holds, AUD/NZD is likely to head north towards a new multi-month high above 1.1430. Bears, beware.