The Brazilian economy finally seems to have turned the corner. This BRIC major and the biggest economy in South America recently got a boost from the Fed’s ‘taper hold’ decision along with several other emerging markets.

Double pressure from slower growth and heightened inflation was crippling the country’s core. To add to its woes, Brazil witnessed weakness in its currency – real – that depreciated more than 17% against the US dollar earlier this year.

However, a deluge of initiatives and somewhat favorable economic data again brought this beaten but promising region into the light in September. Primarily, Fed’s ‘taper hold’ decision did the trick. With this decision, investors again began pouring in cheap dollar in faster growing emerging markets thus providing some respite at the current level.

Of late, some solid China data also helped Brazil to score better on some economic parameters as China is Brazil’s largest trading partner.

Short-Term Ease on Current Account Deficit

Fears over swelling current account deficit in the region appear to have dispersed somewhat for the time being. Current account deficit narrowed to $5.505 billion in August from $9.018 billion in July. Market is abuzz with the anticipation of Brazil entering again into the bond markets with renewed hopes for higher-yielding emerging-market bonds following ’taper hold’. This coupled with the improvement in balance of trade gave a short-term cushion to Brazil’s current accounts.

The Real Gaining Strength

On August 22, Brazilian central bank intervened in the currency market to provide $60 billion worth of cash and insurance by the year end to spark the real’s prospect and augment liquidity. The measure is intended to serve triple targets of taming inflation, arresting the slide in real and setting growth in motion. This currency intervention is likely to widen Brazil’s $45 billion strategy adopted earlier in 2013. We believe the strategy has shown its true colors as real gained the most in two years in September. Temporary fix in debt-ceiling in the US should also provide some scope for improvement for the real in the near term.

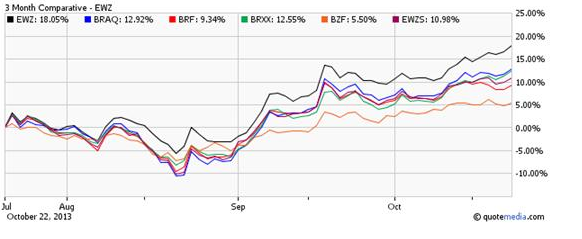

The positive trend can further be validated with the WisdomTree Brazilian Real Fund (BZF) – the only fund that looks to deliver returns to the money market rates in Brazil and appreciation of the Brazilian real relative to USD – adding 5.5% in the last three months (as of October 22, 2013).

Moderating Inflation

Inflation, although quite high on a nominal basis, began to calm down since August on a year-over-year basis. In September, the inflation was 5.86%, down 23 basis points from the year-ago period.

As per Reuters, Brazilian inflation is expected to touch the year’s low in mid October. The government targets 4.5% for this year, plus or minus 2 percentage points. Actually, a set of interest hikes to tame inflation seems to help the country’s inflation scenario.

ETF Impact

All these above-mentioned factors prepared the Brazilian ETFs for a decent run in the recent times. The ultra popular fund in this segment, the iShares MSCI Brazil Capped ETF (EWZ), gained 18.05% in the last three-month period (as of October 22, 2013) (read: Will Brazil ETFs Rebound in 2013?).

Some other names in the space which emerged from their lows and returned positively in the last three months include Market Vectors Brazil Small-Cap ETF (BRF), iShares MSCI Brazil Small Cap Index Fund (EWZS), Global X Brazil Consumer ETF (BRAQ) and EGShares Brazil Infrastructure (BRXX). Notably, two small-cap funds BRF and EWZS returned 9.34% and 10.98% while BRAQ and BRXX added 12.92% and 12.55%, respectively.

Can This Upturn Sustain?

It’s just the beginning of a long journey. A lot still needs to be done to find long-term solutions for all the economic issues. Especially, on the inflation front the condition is still not convincing as the recent Reuters poll suspects inflation to flare up again in the months ahead. Inflation is expected to finish 2013 at 5.83%, as per a survey by Brazilian economists. The rate is also expected to stay stubborn at 5.94% in 2014.

At present, Brazil's benchmark interest rate is pegged at 9.50%, staying at the peak among the world's largest economies, after five successive raises since April. Finding no other way to contain the potential rise in inflation, analysts expect monetary policy committee to go for another 50 bps hike in their November meeting which is really not a healthy sign for the country’s growth.

Despite being part of emerging economies, Brazil’s growth rate is much slower than many of its counterparts. In fact, with growth projections falling below 3% for 2013 GDP, the country is also lagging many usually slow growing developed nations. (read: Short Brazil with These Inverse ETFs).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Brazil ETFs Set To Take Off?

Published 11/05/2013, 12:22 AM

Updated 07/09/2023, 06:31 AM

Are Brazil ETFs Set To Take Off?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.