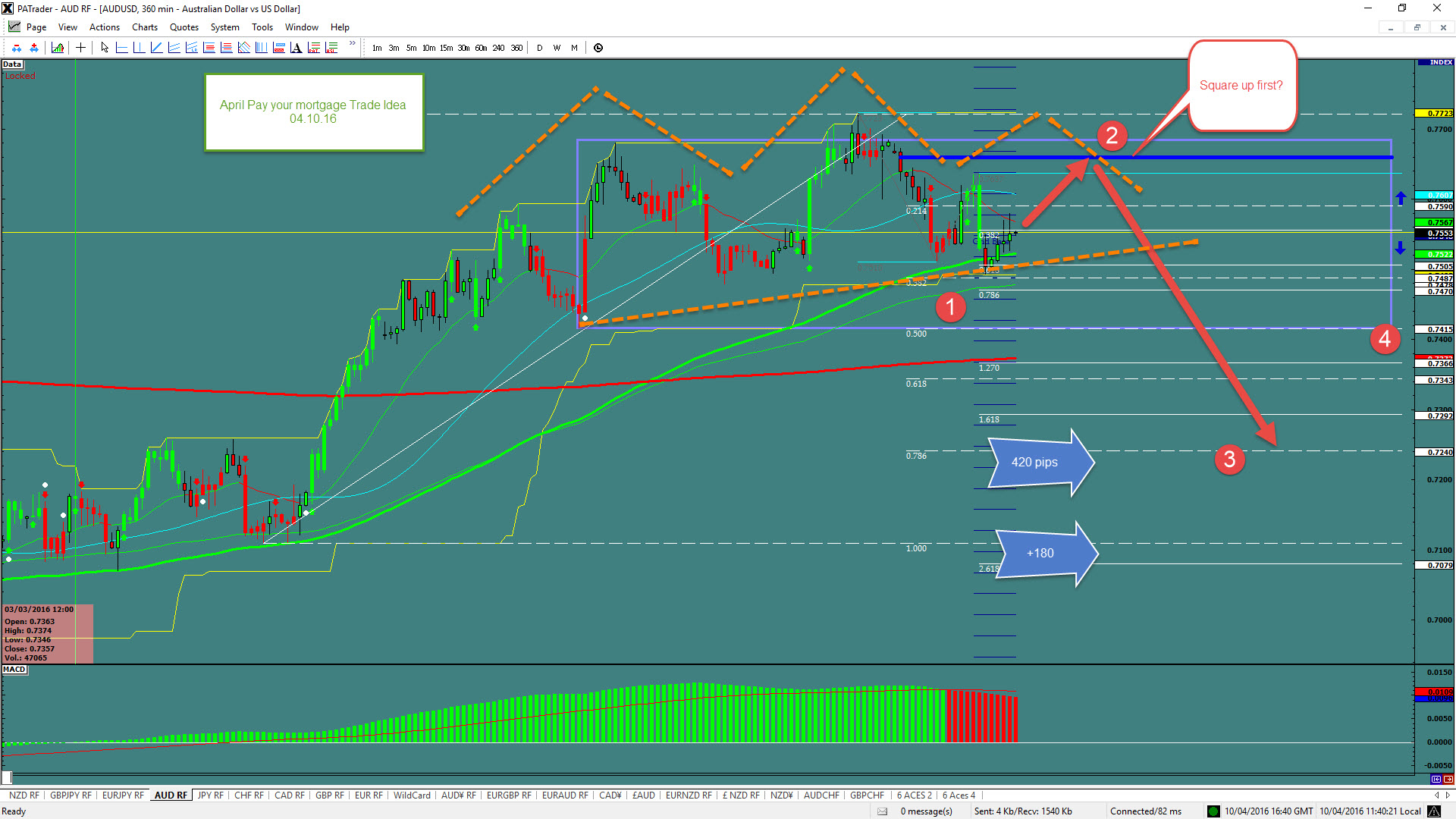

This month's pay your mortgage trade setup is found in the AUD/USD pair. When looking at this pair on a 240 min chart you'll notice a head and shoulders pattern being printed. The “trend is your friend until it bends” and it is bending. The result should be 5 waves to the downside. The nice thing about this setup is that even if it still ranges there is 210 pips potential to the downside if it does not break out and trend. There are three sell entry points: The square up @ around 0.7650, the break of the neckline around 0.7505 and the break of the range @ 0.7400. Depending on the entry execution we are looking for 2210-600 pips!

Keep in mind the chart scale as you prepare for a trade like this. It took 2 weeks to complete the big up wave. Wave 1 and 2 typically happen pretty quickly leaving the 3rd and strongest wave to make our trade. The pair’s ATR (Average True Range) is currently 87 pips a day (14-day average) so a 210-600 pip trade could take a while. Both Elkana and I agree that this is a great opportunity, we just are not sure of the Head and shoulder yet. What is it? The market will confirm that as we go along.

Our trading methodology is based on proprietary technical indicators. We pay attention to what the big banks are doing in the markets (the Big Boys) and specifically look for opportunities that have a high opportunity and low risk. We always identify our target before entering a trade, and we focus on the risk of the trade instead of the reward. We have (and follow) rules, and we press our winning trades without exception.

Remember that we recommend that you always trade with stops. And if you don't trust yourself or think you'll get cold feet in a long trade like this, then place the trade and walk away. Better to get taken out by a stop or target than to second guess an active trade and take yourself out. Do your research before you place the trade. Trust your research.