This is the latest performance update on my long-short account based on my Trend Model signals (see An intriguing Trend Model interim report card). The Trend Model account had another excellent month as it returned 7.8% for December; the one-year return was 40.9%; and the return from inception of September 30, 2013 was 44.0%.

I reiterate my disclaimer that I have nothing to sell anyone right now. I am not currently in a position to manage anyone`s money based on the investment strategy that I am describing.

Trend Model description

For readers who are unfamiliar with my Trend Model, it is a market timing, or asset allocation, model which uses trend following techniques as applied to commodity and global stock market prices to generates a composite Risk-On/Risk-Off signal (risk-on, risk-off or neutral). I have begun updating readers on the Trend Model signals on a weekly basis (for the last weekly comment, see The adults are back at their desks. Sell?) and via Twitter (@humblestudent) as new developments occur.

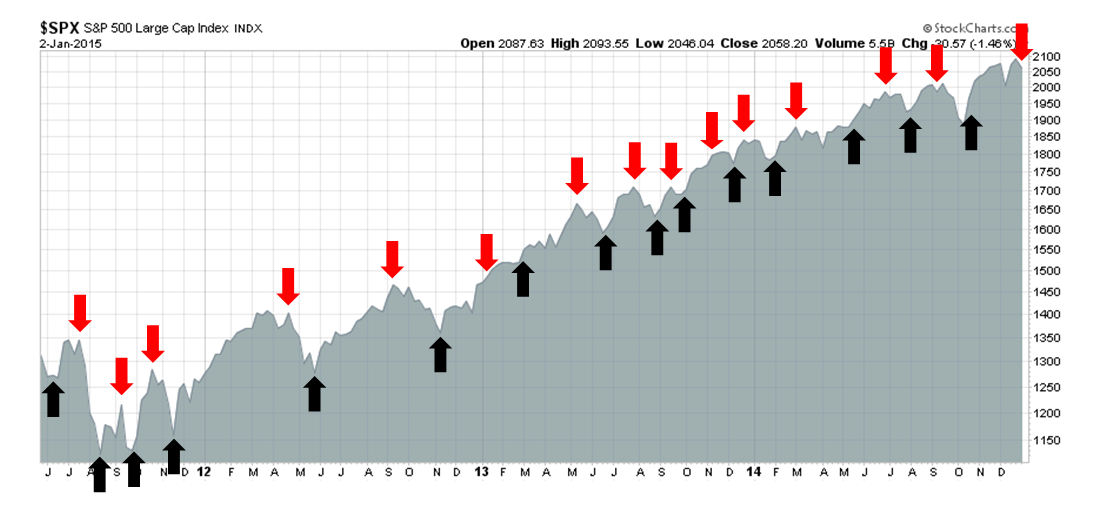

The chart below shows the actual (not back-tested) changes in the direction of the signal, which are indicated by the arrows, overlaid on top of a chart of the SP 500. You can think of the blue up arrows, which occurred when the trend signal changed from negative to positive, as buy signals and the red down arrows, which occurred when the trend signal changed from positive to negative, as sell signals.

Trend Model Signal History

A proof of concept

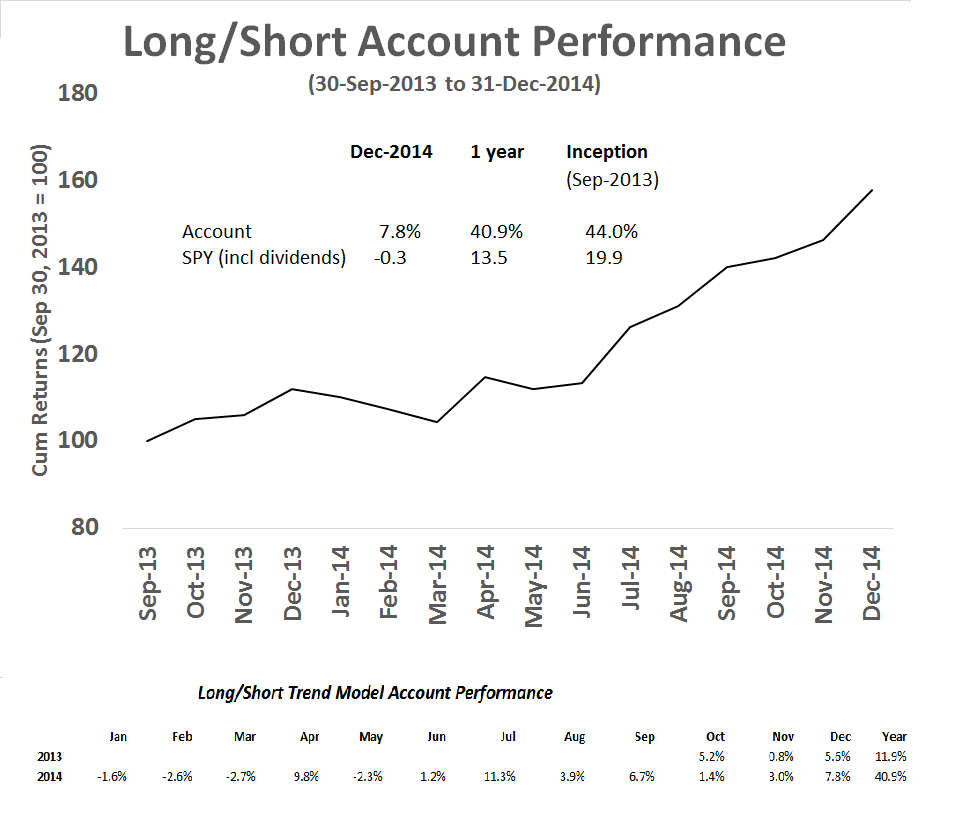

While the results from the above chart representing paper trading is always interesting, there is no substitute for actual performance. As a proof of concept, I started to manage a small account that traded long, inverse and leveraged ETFs on the major US market averages and, on occasion, sector and industry ETFs. Trading decisions were based on Trend Model signals combined with some short-term sentiment indicators. The inception date of the account was September 30, 2013 and the chart below represents an interim report card of that account.

When evaluating the performance of this trading account, keep in mind that this is intended to be an absolute return vehicle. While I do show the SPDR S&P 500 (ARCA:SPY) total return, which includes re-invested dividends, for illustrative purposes, the S&P 500 is not an appropriate benchmark for measuring the performance of this modeling technique

A good December

The account was up 7.8% in December, 40.9% for one year and 44.0% from inception (September 2013). However, I would also like to point out that turnover averaged about 200% per month, so this strategy is not for everyone.

In line with the results for the second half of 2014, this strategy continue to be promising:

- Returns are strong and the Trend Model is performing better than expected.

- Returns are highly diversifying compared to major asset classes. They are uncorrelated with equities (correlation of -0.24 with SPY) and bonds (-0.30 with AGG).

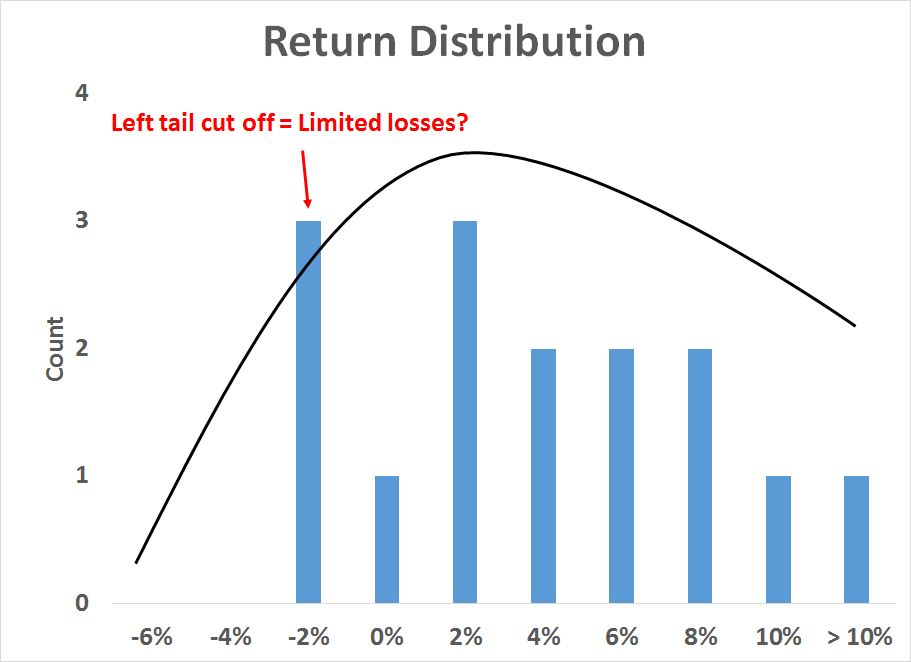

The chart below shows the distribution of month returns and these results are also encouraging at a number of different levels:

- Returns are consistently positive, with 73% batting average.

- The strategy seems to be cutting losses and letting winners run. Though the data sample is still small, the chart below seems to display a bell-shaped return pattern with the left tail cut off, indicating that losses are limited.

Ponzi scheme like returns?

These results seem too good to be true. An article in FINalternatives entitled "5 signs your surefire hedge fund investment is a Ponzi Scheme" indicates that this Trend Model trading strategy fits many of the criteria:

- It sounds too good to be true.

- Overly consistent returns.

- The investment is only offered because of your religion, or membership in a group, club or family.

- Secrecy is required in connection with the investment.

- Roadblocks are put up when you try to withdraw the money.

In my own defense, I would point out that I am not offering anything to anyone without the proper disclosure under the appropriate securities regulations. If that day were to come, the actual track record would be fully disclosed and verifiable.

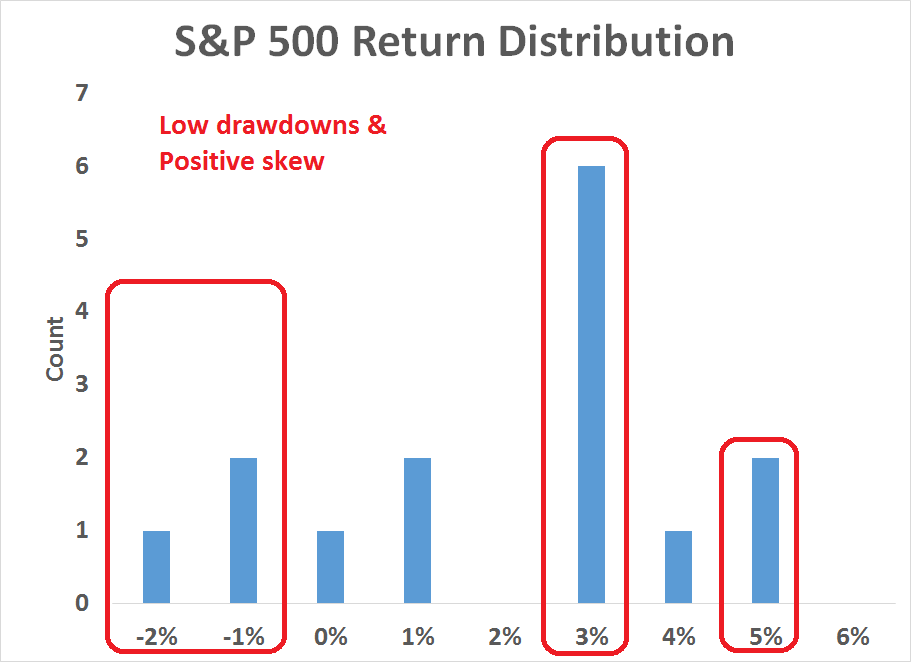

Nevertheless, points 1 and 2 do raise some red flags about the current investment environment. 2014 was an extraordinary year for stock prices as the SPX more or less went up in a straight line and drawdowns were very low by historical standards. This kind of environment tends to be very kind to trend following models like the one that I am employing.

As a demonstration of the unusually stable condition of stock prices, the Sharpe ratio for a simple investment in SPY over the same period was an astounding 2.2! By way of comparison, the long term Sharpe ratio realized by investment legends like Warren Buffett, George Soros and Julian Robertson ranged from 0.8 to 1.0 (see The hedge fund shakeout continues).

For a slightly different perspective, the chart below shows the monthly return distributions for SPY over the same period. Note that the scales are different from the chart above of the Trend Model account return distributions and the correlation of returns between the two series is -0.24. Nevertheless, the analysis provided by this chart does show the extraordinarily stable and positive returns exhibited by equities over the time in question.

2015 could be an acid test year

I believe that the market environment is likely to turn less friendly for both stocks and the Trend Model trading strategy in 2015. In a recent market review, I postulated a positive year for US stock prices but with a much higher (see 2015: Bullish skies with scattered periods of volatility). Trend following models do not perform well in choppy markets. We saw a recent example of this in October 2014, when the account eked out a return of 1.4% after seeing a MTD return oscillate from a low of -6% and high of 10%.

The stock market does see increased volatility as I had forecasted, then the choppiness will indeed be an acid test for this trend following strategy. Positive returns during these volatile periods will lean more on the short-term sentiment models that I use to better assist the main trend following model to calibrate both entry and exits as well as the magnitude of position commitment.

To summarize, results continue to be promising for this model. Readers who want to monitor the signals of the Trend Model can also check out my blog posts here, which include Trend Model updates, or follow me via Twitter @humblestudent.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.