Back in the summer, life was good for the aluminum market.

Prices were increasing, and the market looked healthy… Futures spreads were narrowing… Midwest premiums were rising…

Still, I sent out a word of caution imploring readers to look past the commodity’s sunny disposition.

Namely because the combination of rising global aluminum inventories – along with slowing growth worldwide and the strengthening of the U.S. dollar – indicated that the high prices were unsustainable at the time.

Now, buried under a heavy winter, prices have indeed turned sluggish.

And as a world superpower reawakens after a national holiday, prices will become even more unpredictable.

Mountains of Metal Create a Price Rollercoaster

Part of the reason for the drop in price is the piles of aluminum inventories around the world. You can see in the chart below how the price of aluminum has trended over the last couple of years.

In fact, at Vlissingen – a large port in the Netherlands notorious for storing large quantities of light metal – aluminum is stuffed into every available space. Ingots are omnipresent, in outdoor sheds, in boats, on the docks, and just sitting outside! Plus, there are another 685,000 tonnes in Rotterdam.

With those storage facilities, the LME currently has a whopping 1.7 million tonnes of aluminum sitting in their registered warehouses throughout the world.

But that’s not all of the aluminum that exists…

There’s still more stored in non-registered warehouses, including in forms like processed and scrap metal.

In addition, China has stepped up exports of semi-manufactured products, which attract tax rebates and could also douse Asian premiums next year.

But high and rising aluminum inventories aren’t a new phenomenon. In fact, they’ve been the stigma pressuring aluminum markets for years.

New Data… Same Old Story

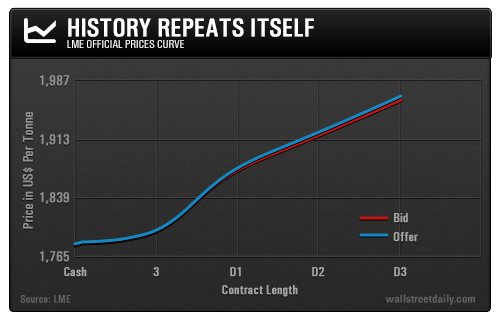

Anyone who follows the metals markets knows that large banks and financial institutions are holding metal as a financing vehicle and profiting from the yield, which is well over current interest rates due to aluminum’s steeper yield curve.

You see, over time… the stores of aluminum built up, while the queues to get it out grew longer due to warehouse rules dictating the amount that could be released.

In many cases, the warehouses setting those rules are owned by the fanatical institutions holding the metal. These limitations resulted in rising Midwest premiums, even as outright futures prices dropped.

As controversy arose around these deals, regulatory authorities slowly stepped up to the plate.

But while regulation has helped to reduce warehouse queues, the Dodd-Frank and Volcker rule has encouraged banks to wind down prop desks. Unfortunately, this also reduces liquidity in the marketplace.

Today, though, we can see a different image forming.

A New Reflection

Yes, aluminum prices are still drifting lower, but so is the Midwest premium, which has lost 10% of its value just over the past few weeks as delivery queues have shorted.

The spot premium, measured in cents per pound, peaked at $0.24 in early February, partly due the U.S. auto revival. But the premium dropped to $0.22 this week, according to Platts.

What this likely means is that reality is setting in… We have a colossal amount of aluminum inventories and a surplus of producers. And this trend isn’t likely to change course any time soon, as forward deals have been booked for under $0.20 per pound.

Ultimately, spreads are likely to ease further once the short rolls are finished, as those holding warrants will need to be compensated for holding on to metal through the delivery queue.

And the final kicker is how much it costs to produce the common metal. The highest input cost of producing aluminum is energy, which is getting cheaper by the day. And as input costs decrease, there is a greater incentive to produce.

Thus we have a serious disconnect between the two.

A pure-play is to short aluminum futures, bearing in mind that when China returns from its New Year’s holiday, the markets will be sensitive to any economic data released next week.

BY Shelley Goldberg