Both the Bank of Japan and the Federal Reserve are set to meet and decide this week. The last Central Bank to meet, the ECB, caused the financial markets to swell and swirl. The markets remain on edge with Bonds moving like Stocks and volatility across the board waking up after its summer doldrums. The recent market sell-off and weak economic data have reduced the odds of a U.S. rate hike this week. But, Japan will act first and anything can happen on the waters of Tokyo Bay. Possibly adding to any major market moves is the close proximity of so many major assets to the 200-day moving averages: the U.S. 10-year yield, the U.S. Dollar Index, as well as Crude Oil. Any break in these major assets into another trend could cause significant rebalancing by macro investors which could add to the volatility of a Central Bank move. So strap in and be ready for Wednesday’s news and market reaction.

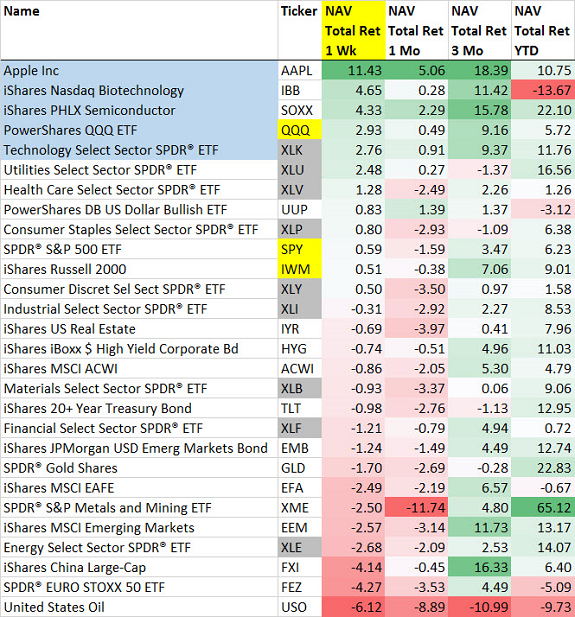

Apple (NASDAQ:AAPL), Tech, Biotech and the NASDAQ led the markets bounce last week…

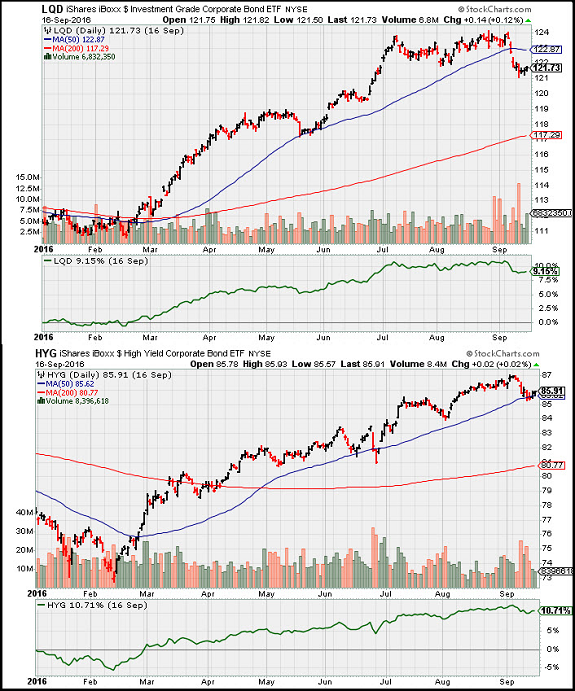

We want to continue to closely monitor the trading in credit…

The uptick in financial market volatility, combined with a big September issuance period for new corporate debt, has led to a pickup in selling across the Credit ETFs. High grade looks a bit more uncertain than low grade, but keep an eye on both for a further break, which will give you a good read on investor risk appetites.

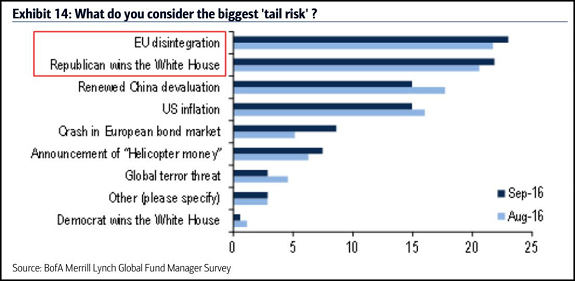

Tail risks look all political now…

One of the more looked at charts last week was the monthly BofA Merrill Lynch manager study, which increased the weight of a tail risk to the falling apart of the EU and/or a Trump victory. This helps to explain why an improvement in the Trump polling has put pressure on Global Equities.

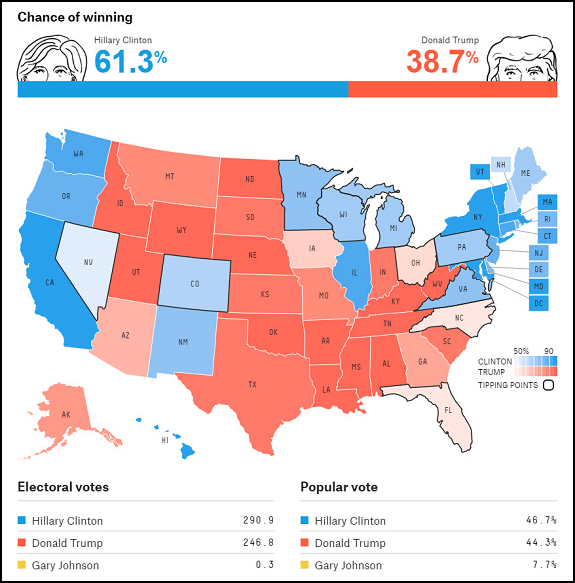

Looking at 538’s detailed poll analysis still has Team Hillary > Team Donald but the numbers have been narrowing…

Missing from the top reasons for a tail risk was the possibility of a recession…

“No US equity bear mkt of last 25 yrs. begun without a recession starting within 12 mo following market top” – UBS

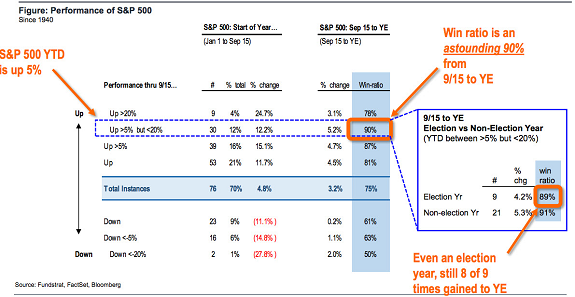

Thomas Lee will point out the seasonality factor combined with YTD performance as a reason to buy any September dip…

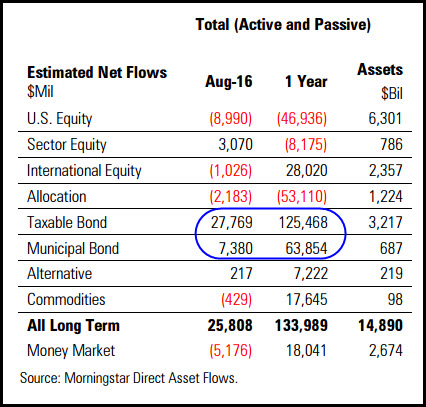

Looking at the recent Fund flow data shows investors still plowing into Bonds at an amazing rate…

It will be interesting to see how those same bond-buying investors react if bonds no longer diversify risk from equities…

The last real estate down cycle had Stockton as its poster child. This time it may be Greenwich…

“You can’t give away a house in Greenwich,” Sternlicht said Tuesday at the CNBC Institutional Investor Delivering Alpha Conference in New York.

The town—about 30 miles (48 kilometers) northeast of midtown Manhattan and home to some of the country’s largest hedge funds—is seeing a pile-up of houses on the market and prices that are faltering as properties linger. Home sales in the second quarter fell 18 percent from a year earlier to 169 deals, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

At the same time, new listings surged 27 percent. The absorption period, or the time it would take to sell all the homes on the market at the current pace, was 12 months, compared with 7.7 months a year earlier, Miller Samuel and Douglas Elliman said.

Canada’s broken real estate poster child will be easier to locate…

Nine students with no apparent source of income bought $57-million worth of single-family homes in Vancouver’s tony Point Grey neighbourhood over the past two years, according to records compiled by British Columbia’s Opposition New Democrats.

The NDP said the purchases are more evidence that authorities have let the region’s housing market overheat beyond the reach of most locals.

The properties include a $31-million mansion that Canaccord Genuity founder Peter Brown sold earlier this year to a buyer whose occupation was listed on the title document as “student.”

Four of the sales to student buyers were covered by mortgages from three major banks – a fact that underscores how Canada’s banks are inflating the region’s housing market, said NDP housing critic David Eby, who provided data from his provincial riding.

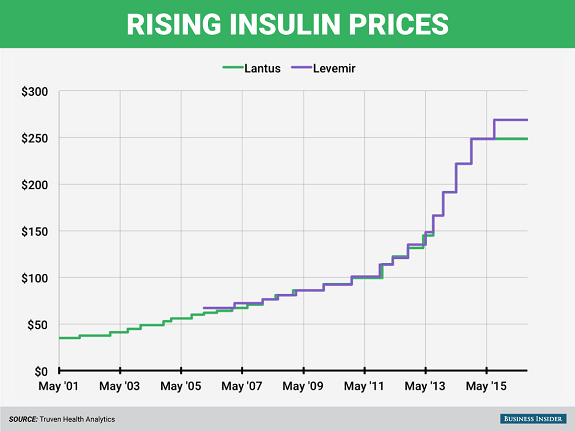

And if you are looking for the next Epi-Pen, the insulin pricing practices of Sanofi (PA:SASY) and Novo Nordisk (CO:NOVOb) might have some explaining to do so…

Finally, a good pen by the co-founder of Lyft. So many investment implications as car ownership evaporates in the next 10 years…

As a country, we’ve long celebrated cars as symbols of freedom and identity. But for many people — especially millennials — this doesn’t ring true. We see car ownership as a burden that is costing the average American $9,000 every year. The car has actually become more like a $9,000 ball and chain that gets dragged through our daily life. Owning a car means monthly car payments, searching for parking, buying fuel, and dealing with repairs.

Ride sharing has already begun to empower many people to live without owning a car. The age of young people with driver’s licenses has been steadily decreasing ever since right around when I was born. In 1983, 92% of 20 to 24-year-olds had driver’s licenses. In 2014 it was just 77%. In 1983, 46% of 16-year-olds had licenses. Today it’s just 24%. All told, a millennial today is 30% less likely to buy a car than someone from the previous generation.

Every year, more and more people are concluding that it is simpler and more affordable to live without a car. And when networked, autonomous vehicles come onto the scene, below the cost of car ownership, most city-dwellers will stop using a personal car altogether.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.