In my previous post, I questioned whether we could expect a change to a more dovish tone from the FOMC and Jay Powell regarding interest rate hikes would support last week’s strong market close. It did, and then it didn’t, with equities rising strongly on the release of the statement, which accompanied the expected 75 basis point increase in rates (already priced in by the market). All seemed to be going well for the bulls until the press conference.

This part of the FOMC is when financial journalists have the opportunity to question Fed Chair Powell in detail, hoping to elicit current Fed thinking on rates, the pace and direction of future rises, the Labor market, inflation plus whether the much trailed ‘pivot’ would be mentioned. There was indeed a ‘pivot’ but not the ‘dovish’ one the market was expecting. Instead, there was an aggressively hawkish one. Powell’s words were clear: “It’s very premature to think about or talk about pausing our rate hikes.” which was the cue for stocks to sell off into the close.

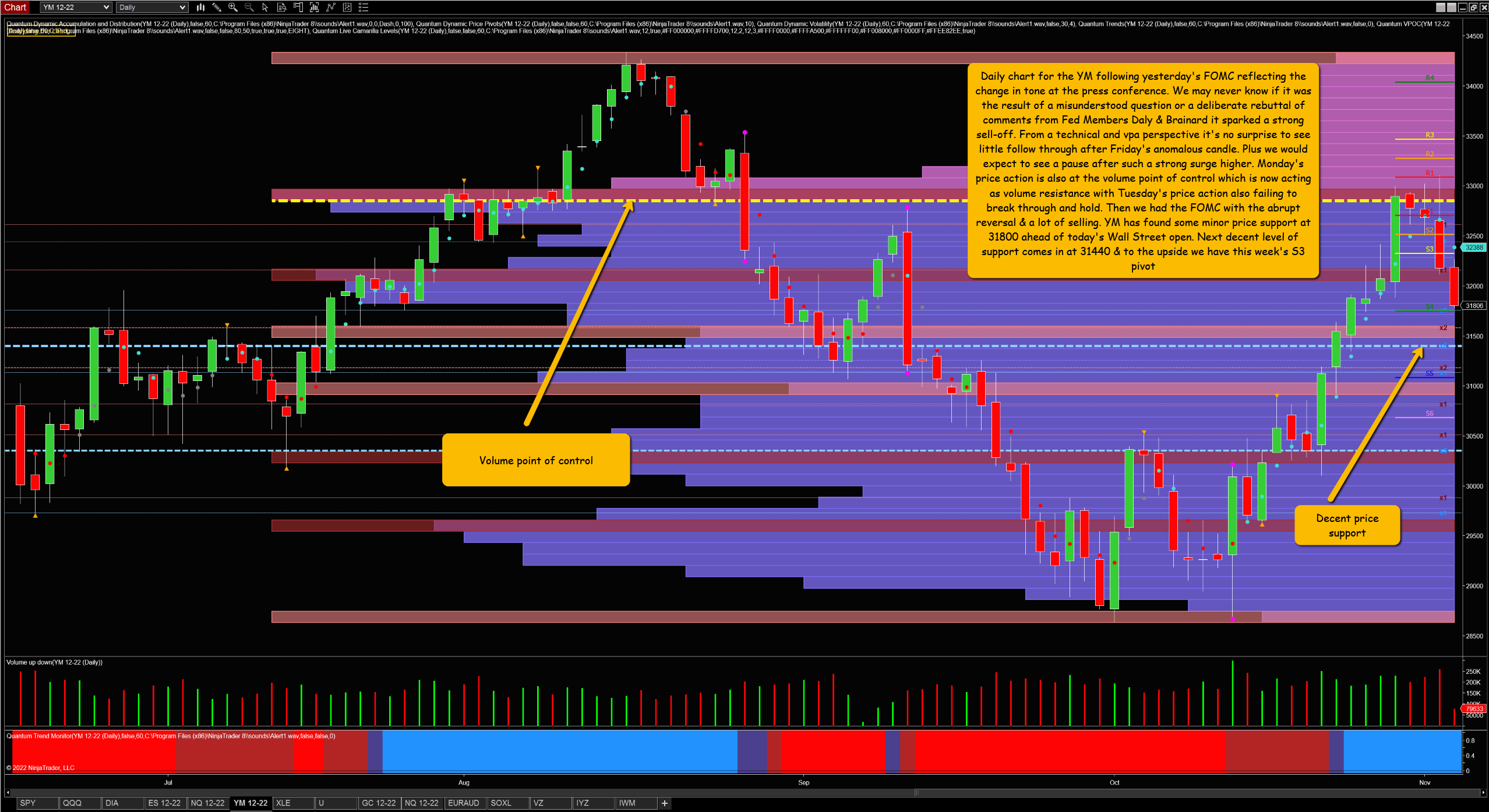

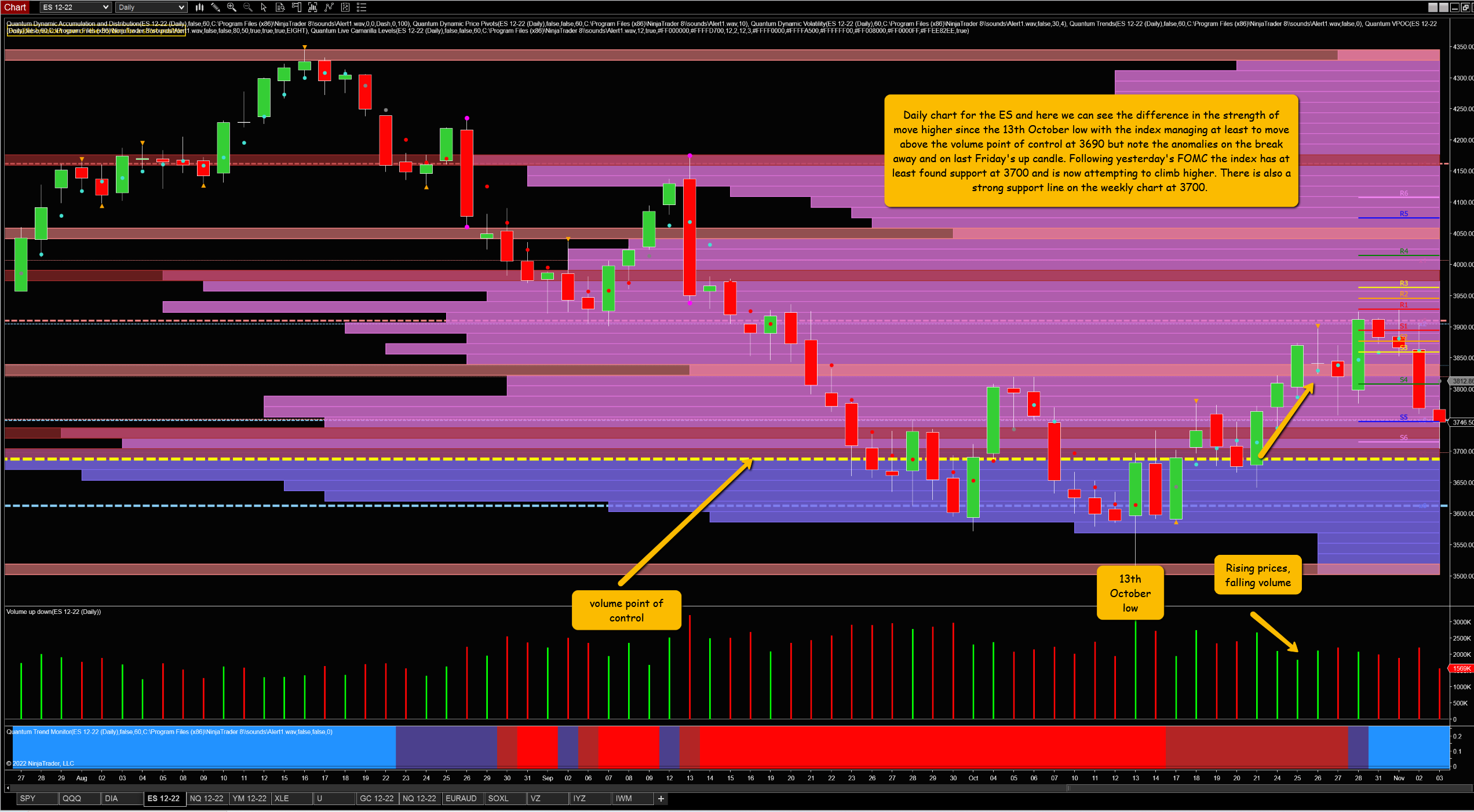

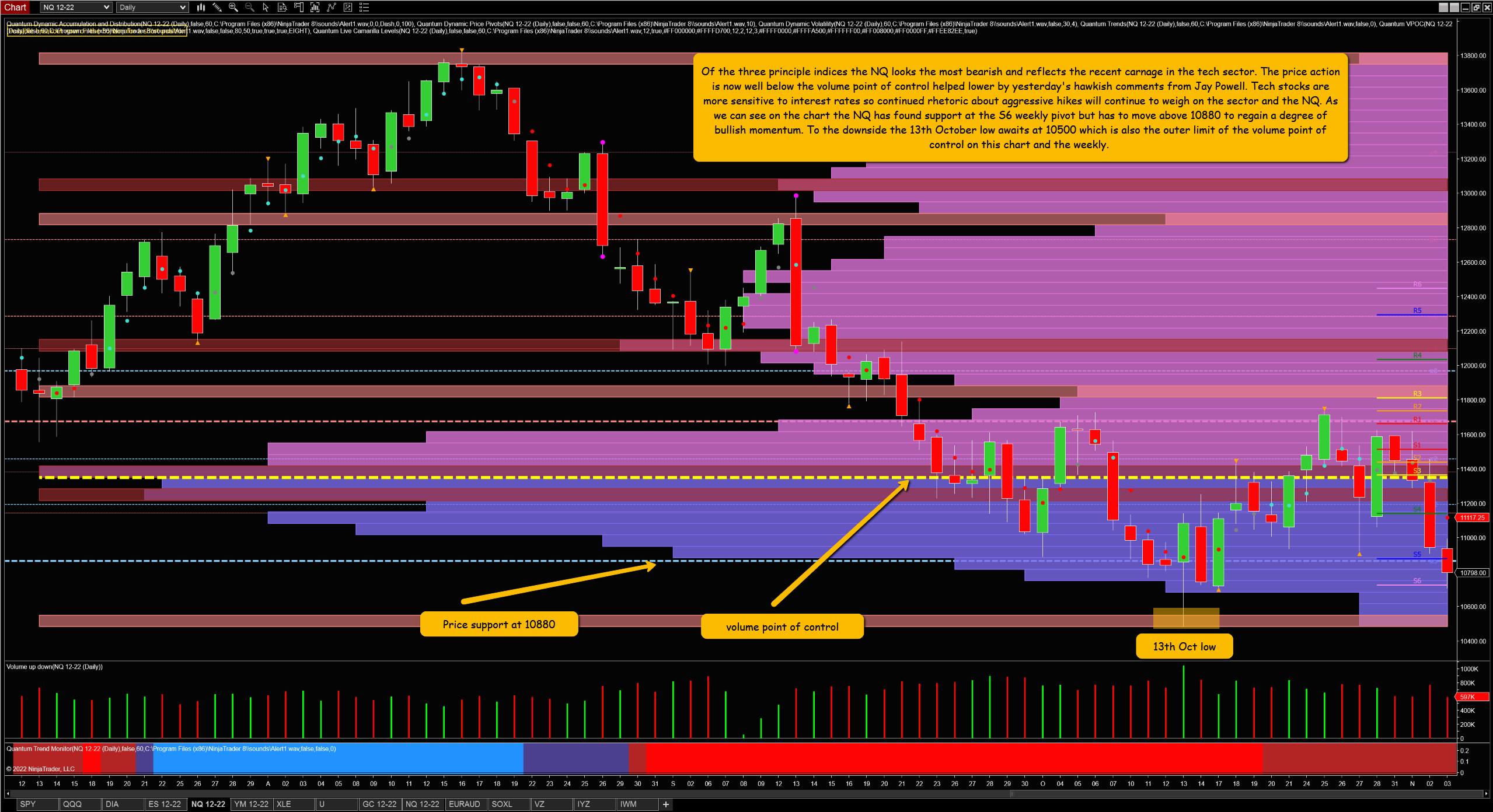

To see this action, I’ve taken the daily charts for the Dow, S&P and Nasdaq futures where we can see yesterday’s price action across all three is identical. However, what is interesting is the difference in the overall chart structure for these indices, with the Dow outperforming the other two since the key October 13 low.

What is also striking is the position of the volume point of control with only the S&P trading above this important support and resistance metric.

Of the three indices, the Nasdaq looks the most vulnerable to a re-test of the October low as the index has been driven lower by a struggling tech sector. Technology stocks are also sensitive to interest rates, so Powell’s firm assertion that the ‘ultimate level of interest rates will be higher than previously expected’ would not have done them any favours.

Of course, hovering over the US is the spectre of recession, and whilst the economy appears to be holding up well in comparison to other jurisdictions any data suggesting otherwise is when there would be a complete re-think about interest rates. This is when we can expect the ‘dovish’ pivot.

Today we have the Nonfarm Payrolls (NFP) where the forecast is for another good number, albeit lower than last month. What is interesting about the NFP data is that since May, the monthly figures all come in much better than expected, which in an inflationary environment does not bode well for interest rates. In other words, a strong labour market and one where job openings outstrip the supply of available workers feed into inflation as workers can set higher wages which they also need to cope with rising inflation.

It is a vicious circle made more depressing when in answer to a question Jay Powell admitted that the Fed had no control over energy or food costs, the two items which are driving inflation higher. This makes one wonder whether the interest rate tool the Fed and other banks use to fight inflation is actually fit for purpose in the current environment.