Summary

ACC Ltd (NSE:ACC) believes it is a leading provider of inpatient substance abuse treatment services for individuals with drug and alcohol addiction.

The full IPO calendar is available at IPOpremium.

Based in Brentwood, TN, ACC Holdings scheduled a $65 million IPO on the NYSE with a market capitalization of $269 million at a price range midpoint of $13 for Thursday, October 2, 2014. SEC filings

Manager, Joint-managers: William Blair/ Raymond James

Co-managers: Avondale Partners

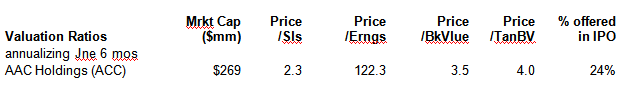

Valuation

Glossary

Conclusion: Neutral plus

Difficult to grow, very competitive market

P/E ratio of 122

Price-to-sales of 2.3

May be a roll-up acquisition vehicle in a fragmented market

To put the conclusions and observations in context, the following is reorganized, edited and summarized from the full S-1 referenced above.

Business

ACC believes it is a leading provider of inpatient substance abuse treatment services for individuals with drug and alcohol addiction.

As of August 31, 2014, ACC operated six substance abuse treatment facilities located throughout the United States, focused on delivering effective clinical care and treatment solutions across our 467 beds, which included 338 licensed detoxification beds.

ACC is currently developing three facilities and have an additional property under contract that we plan to develop into a new facility.

The majority of approximately 750 employees are highly trained clinical staff who deploy research-based treatment programs with structured curricula for detoxification, residential treatment, partial hospitalization and intensive outpatient care.

By applying a tailored treatment program based on the individual needs of each client, many of whom require treatment for a co-occurring mental health disorder, such as depression, bipolar disorder and schizophrenia, ACC believes its offers the level of quality care and service necessary for clients to achieve and maintain sobriety.

Market

The market for mental health and substance abuse treatment facilities is highly fragmented with approximately 16,700 different facilities providing services to the adult and adolescent population, of which only 33% are operated by for-profit organizations.

Corporate Relocation

In 2012, ACC moved corporate offices to Brentwood, Tennessee from Temecula, California.

In 2012, ACC also opened a centralized call center; staffed a marketing department to transition outsourced marketing activities in-house; expanded accounting and finance department to accommodate the financial reporting needs of a more mature, seasoned company; and added human resource, IT and operations personnel to meet the demands of rapid growth

Competition

ACC believes it is one of the largest for-profit companies focused on substance abuse treatment in the United States.

According to IBISWorld, approximately 77% of all substance abuse treatment clinics in the United States have a single location, and approximately 44% of all substance abuse treatment facilities have fewer than 20 employees.

Many of the largest for-profit addiction treatment providers operate in the broader behavioral healthcare sector without focusing primarily on substance abuse.

ACC believes its size and core focus on substance abuse treatment provides ACC with an advantage over competitors in terms of building our brand and marketing our platform to potential clients.

5% shareholders pre-IPO

Michael T. Cartwright, 38%

Jerrod N. Menz, 35%

Lucius E. Burch, III, 6.3%

Dividends

No dividends planned

Use of proceeds

ACC expects to net $56 million from its IPO. Proceeds are allocated to repay approximately $14.6 million of outstanding indebtedness, consisting of the outstanding balance of approximately $13.1 million on the revolving line of credit and an outstanding balance of approximately $1.5 million on a term loan assumed and refinanced in connection with the BHR Acquisition.

ACC also intends to use $7.3 million of the net proceeds from this offering to pay the amount owed in connection with the settlement of certain litigation.

Disclaimer: This ACC IPO report is based on a reading and analysis of ACC’s S-1 filing, which can be found here, and a separate, independent analysis by IPOdesktop.com. There are no unattributed direct quotes in this article.