Gold has had quite a run higher. After a more than 2 year downtrend the shiny yellow rock found a bottom at 1050 in December and started higher. Since then it has had an almost parabolic rise topping out so far around 1275. A $225 run, up 21%. Pretty good for less that 3 months.

After a move like that and a pause in the price action though it is time to reflect on what the next move may be. There are several signs in the chart that suggest it may be a retracement of some or all of the gain. Let’s take a look.

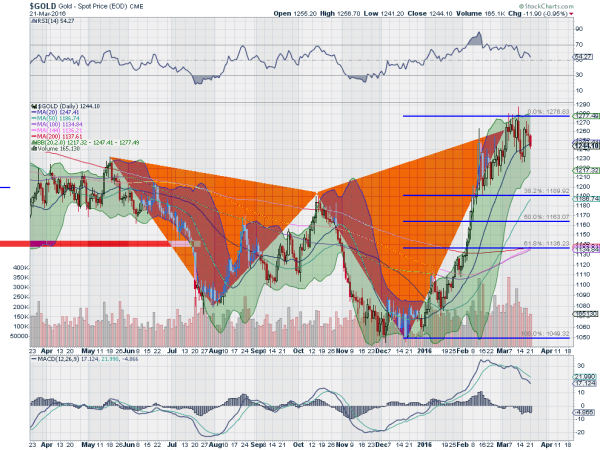

The chart above tells only facts. And it does not tell the future but there are clues to where it may turn. The first is the loss of momentum. The RSI and MACD are both falling. The RSI is near a cross down through the mid line. These support the downside. The next is that the Bollinger Bands® which had been rising in a steep channel have turned sideways. This does not point to a downturn but a possible sideways action.

Next you can see the two triangles of a bearish Shark harmonic pattern. This pattern looks for a 38.2% retracement of the up move as a first target, or to about 1190. Should that not hold the second target is at 1136, a 61.8% retracement of the pattern.

Gold is traded from emotion probably more than anything else, so it will do what ever it does. But the signs in the chart are starting to align for a move lower in the near term. Time to protect gains or take some profits.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.