I hope you had an enjoyable Memorial Day holiday. It’s now (unofficially) summer!

If you’re like me, you spent some time grilling with friends and family this weekend. Indeed, all across the country, people were chowing down on burgers, sausages, and chicken (maybe even a few vegetables).

And since barbecue season is now upon us, it’s worth asking: Are the companies providing our summer fare a “Buy” right now?

Purveyors of Fine Food and Drink

The food and beverage industries offer a number of dividend-paying stocks, including the six below, which are some of the biggest names in the business.

First is Tyson Foods (NYSE:TSN), the world’s second-largest processor and marketer of chicken, beef, and pork. Its brands include Tyson (of course), as well as Hillshire Farm, Jimmy Dean, Ball Park, and Sara Lee.

Next is Hormel Foods (NYSE:HRL), famous for introducing Spam. Hormel owns its namesake brand in addition to Black Label, Lloyd’s, Saag’s, and Wholly Guacamole. It also owns a few other popular but less barbecue-related brands like Skippy and Chi-Chi’s.

Kraft Foods Group (NASDAQ:KRFT) – which recently merged with Heinz – is virtually inescapable at any barbecue. Among its brands, Kraft counts A1 steak sauce, Country Time Lemonade, Cracker Barrel cheese, Kraft Mayo, JET-PUFFED Marshmallows, Kool-Aid, Oscar Mayer meats, and Heinz condiments.

Now, in my opinion, a good barbecue isn’t complete without a few beers. And when it comes to beer, there’s no company quite like Anheuser-Busch Inbev (NYSE:BUD). This massive conglomerate owns everything from Budweiser to Stella Artois to Corona. It also owns Beck’s, Leffe, and Hoegaarden. And it even owns craft breweries like Goose Island and Elysian.

SABMiller (LONDON:SAB) is the world’s second-largest beer company, though its $58-billion market cap is just one-third of Anheuser-Busch’s. SAB owns Miller, Coors, Blue Moon, Grolsch, Foster’s, Keystone, and Leinenkugel’s, among many, many others.

Finally, there’s Heineken (AMS:HEIN), the Dutch brewery that also owns Amstel, Sol, Murphy’s, and many other brands across the globe. With a $46-billion market cap, Heineken is the world’s third-largest beer company.

Big Valuations, Small Dividends

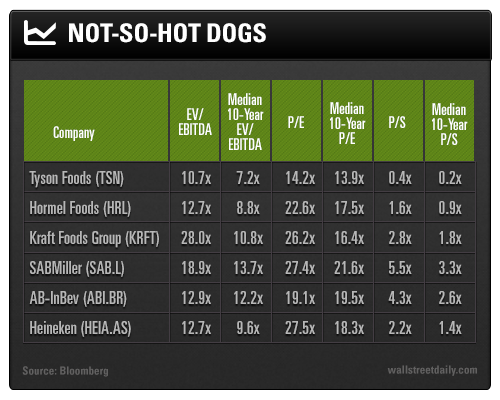

Let’s start by looking at the current valuation of these companies compared to their 10-year median:

As a group, these stocks are trading at a significant premium right now. In fact, only Tyson and AB-InBev are trading at even somewhat justifiable valuations. The rest are prohibitively expensive. Thus, we’ll narrow our focus to hot dogs, sausages, and beer.

Next, let’s take a look at the dividends paid by Tyson and ABI. The latter yields a pretty respectable 2.7% and, with a dividend payout ratio of 68.5%, it’s well below our 80% threshold. Unfortunately, Tyson’s indicated yield is a meager 0.9% – better than nothing, but not what we’re looking for as income investors.

That leaves us with just one out of six companies, Anheuser-Busch. And it does have a lot going for it. Total revenue has grown for six consecutive years, including by more than 8% in 2014. It has a decent yield, and the dividend has grown substantially since 2009, when it was cut by 90%.

However, the company is still expensive relative to its 10-year median – and perhaps most importantly, the U.S. market is facing increasing pressure from craft beer sales.

Consider this: By the end of 2014, craft beer sales were responsible for 11% of the total market in the United States. That’s up from just 2.6% in 1998, an incredible rise.

The trend isn’t slowing, either. Last year, craft beer dollar sales grew 22%, faster than in any previous year. Once a niche market, craft beer is now a $20-billion-a-year industry. So, while ABI does pay a decent dividend, it’s on the wrong end of a growing market trend. Plus, the stock isn’t exactly cheap right now.

Bottom line: Go ahead and enjoy some sausages, hot dogs, and beer this summer – but don’t bother with these major food and beverage stocks.