By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- 5 Reasons for a Euro Short Squeeze

- Dollar: A Patient Fed = Profit Taking

- AUD Soars on Chinese Data

- CAD: Lifted by 3% Rise in Oil

- NZD: Stronger than Expected Trade Data

- GBP/USD Breaks 1.55

5 Reasons for a Euro Short Squeeze

The euro traded higher against the U.S. dollar Wednesday and we believe that further strength in the currency pair is likely for a number of reasons:

- Grexit No Longer an Immediate Risk

- ECB President Draghi Sees First Signs of Confidence in Real Economy

- Yellen in No Rush to Raise Rates

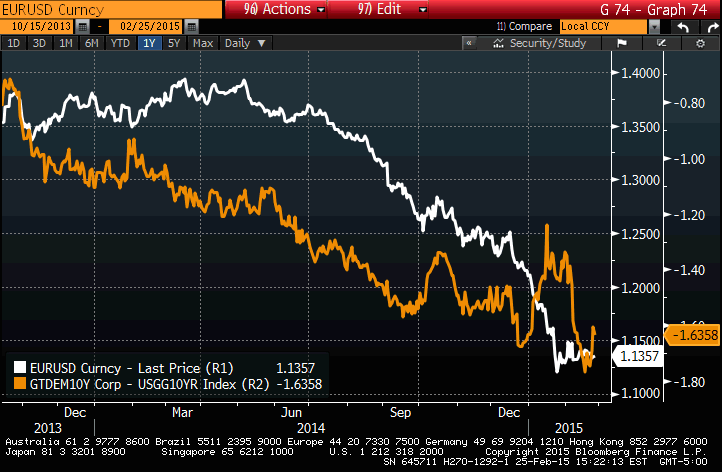

- German – U.S. 10-year yield Spread Moves Higher (see chart below)

- Extreme Short Positions

First and foremost, speculators continue to hold a significant amount of short EUR/USD positions and as the downside risks for Europe recedes, the motivation to cover those positions increases. One of the main reasons why investors sold euros aggressively in January was because of the fear that Greece could leave the Eurozone. This week that fear and concern was eliminated (for the time being) when Greece received a 4-month bailout extension. Weakness in the Eurozone economy also weighed heavily on the currency because it pushed the European Central Bank to increase stimulus. However on Wednesday afternoon, ECB President Draghi said he saw the first signs of confidence in the economy as stimulus starts to have a positive impact on growth. We have not heard any optimism from the ECB head in some time and this view suggests that the central bank may no longer be looking to increase stimulus again in the near term. Across the Atlantic, the Fed’s patience could lead to further profit taking in the dollar. At bare minimum, it has driven Treasury yields lower, causing the 10-year German and U.S. yield spread to increase in the EUR/USD’s favor as indicated by the chart below. With Greek headline risk gone for the time being, we expect the euro to quietly drift higher as speculators take profit on their short positions.

Dollar: A Patient Fed = Profit Taking

Janet Yellen provided no fresh insight on U.S. monetary policy in day 2 of her testimony on Capitol Hill. As a result, the U.S. dollar continued to trade lower against all of the major currencies. A smaller decline in new home sales did not help the dollar although it is notable that the greenback has held up well against the Japanese yen compared to other major currencies. The biggest loses were seen against the commodity currencies, which benefitted from higher oil prices and stronger data from China. The dollar could see further losses Thursday with the release of consumer prices, durable goods and jobless claims. Gas prices continued to fall in January and there was a broad-based decline in consumer prices. While we are long-term bullish dollars, we also believe there’s scope for a deeper pullback that could drive USD/JPY to 118 and the EUR/USD toward 1.15. In the past 2 days, the Federal Reserve has made it clear that it's in no rush to raise interest rates. Forex traders were sorely disappointed but equity and Treasury traders continued to cheer the news by sending stocks to fresh records and Treasury prices higher. Yellen opted for flexibility over clarity but she also made it clear that rates could rise at any time. The recent pullback in the dollar indicates that investors had hoped for more from Yellen -- but a June rate hike was never realistic. The central bank doesn’t want to raise interest rates too quickly because it fears that a premature increase would undermine the recovery and hamper job healing. Instead we expect forward guidance to be changed in June, followed by a rate hike in September. Market expectations had gotten ahead of themselves in recent weeks so a pullback is natural but the most important thing to remember is that the Fed will still raise interest rates in 2015.

AUD Soars on Chinese Data

All three of the commodity currencies traded higher Wednesday but the strongest gains were seen in the Australian dollar. As reported by our colleague Boris Schlossberg, AUD/USD “ran all the way to 7900 figure on the back of better HSBC Flash PMI readings out of China. The PMI popped back above the 50 boom/bust line printing at 50.1 versus 49.6 eyed. This was the first expansionary reading in four months suggesting that the manufacturing sector may have stabilized. Chinese growth has slowed to a 14-year low as the country tries to pivot from a manufacturing giant to a more consumption-based society. Still, Wednesday’s news was a welcome note of relief for investors who were becoming concerned that the manufacturing sector could slip into a recession. The Aussie was the biggest beneficiary of the news as a pick up in Chinese manufacturing indicates that demand for Australia’s raw materials may remain steady.” The Canadian dollar also extended its gains as oil prices rose back above $50 a barrel. The New Zealand dollar joined in as well thanks in part to Fonterra’s decision to hold their milk payout forecast steady as dairy prices stabilize and also due to better-than-expected trade numbers.

GBP/USD Breaks 1.55

We have been looking for sterling to outperform for some time and are finally beginning to see some nice upside in the pair. The British pound broke through its 1.55 resistance against the dollar, rising to its strongest level in nearly 2 months. Hotter-than-expected housing-market data contributed to the move but recent comments from Bank of England officials also supported the currency. According to the latest data from the British Bankers Association, mortgage approvals rose 36.4k, compared to a forecast of 36k. While this is well off last year’s run rate, it suggests a potential bottom. At the same time, U.K. policymakers have been talking about raising rates. On Tuesday, we heard from BoE Governor Carney and Fed Chair Yellen. In contrast to Yellen who is in no rush to raise interest rates, U.K. officials are growing more concerned about wage growth. Tuesday we heard from Carney, Weale and Forbes, all of whom seem to see the need for tightening. Carney did not talk about monetary policy specifically but he is one of the more hawkish members of the central bank. Forbes on the other hand said wage growth is picking up and there is limited slack in the economy. She felt that rates will have to rise at some point and that a gradual increase should support the economy. Weale agreed that recent data confirms that pay pressures are building and monetary policy should be based on expected -- not current -- inflation. As a result, he felt that rates could rise sooner than the markets expected. Clearly, the majority of U.K. policymakers are leaning toward higher rates and we think this will drive sterling even higher.