- Liquidity is contracting

- Economy is vulnerable

- Hesitation near recent highs

Fed Minutes Speak To Ongoing Taper

Liquidity is a politically correct term for Fed money printing. All things being equal, stocks tend to perform better during periods of stable or expanding liquidity. Conversely, stocks tend to face headwinds during periods of liquidity contraction. Wednesday’s Fed minutes continued to hint at ongoing liquidity contraction. From Bloomberg:

“Participants agreed that, with the unemployment rate approaching 6.5 percent, it would soon be appropriate for the Committee to change its forward guidance in order to provide information about its decisions regarding the federal funds rate after that threshold was crossed,” according to the record of the meeting, the final one led by Ben S. Bernanke before the end of his term as central bank chairman. “Several” Fed policy makers also said that in “the absence of an appreciable change in the economic outlook, there should be a clear presumption in favor of continuing to reduce the pace” of the Fed’s bond purchases $10 billion at each meeting.

Housing Continues Weak Economic Trend

The Fed was hoping the economy was strong enough to step up as they stepped back on the stimulus front. Thus far, the economy is not holding up its end of the bargain. Wednesday brought another disappointing report on the state of the U.S. housing market. From Reuters:

U.S. housing starts recorded their biggest drop in almost three years in January as harsh weather disrupted activity, but the third month of declines in permits hinted at some weakness in the housing market. Wednesday’s data was the latest suggestion that a brutally cold winter was putting a big dent in the economy. But severe weather cannot be blamed for all the slowdown in growth as the economy appears to have ended 2013 with less momentum.

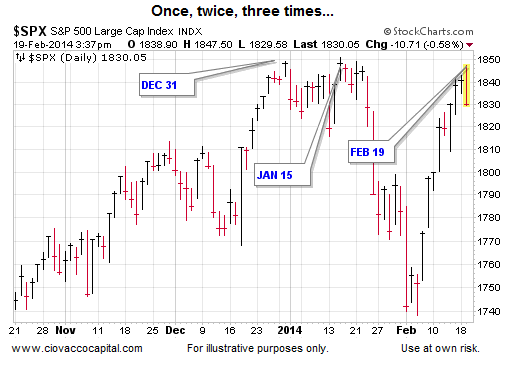

Third Time Was Not A Charm

If you know your market history, you know hesitation near all-time highs needs to be watched carefully. As shown in the daily chart of the S&P 500 below, Wednesday marked the third push toward 1,850 on the S&P 500. The January attempt to hold above the December high was unsuccessful. Over the past three trading sessions, the market has thus far failed to move convincingly to a new high, which indicates a lack of conviction regarding future economic outcomes.

Investment Implications

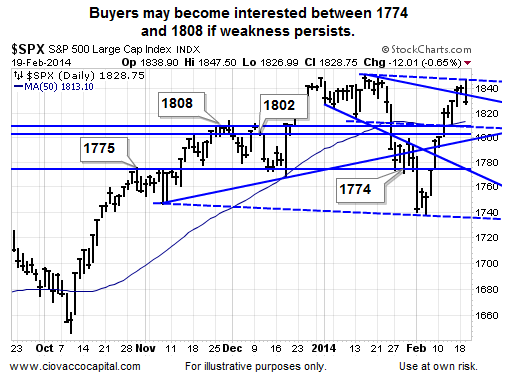

It is far from time to run for the exits from a technical or economic perspective, but it is prudent to remain open to the possibility of further weakness in stocks. We made no changes Wednesday. We continue to hold core positions in U.S. stocks (SPY) and technology (QQQ), coupled with some cash and bonds (TLT). The chart below shows some levels we will be watching over the next week or so.

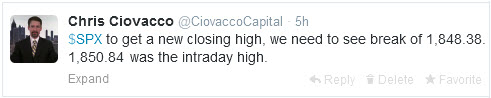

What would negate some of our concerns short-term? The tweet below provides the answer ($SPX = S&P 500).

The bulls need some good economic news. Thursday brings reports on inflation, employment, and manufacturing. Friday’s economic calendar features an update on existing home sales.