’Tis the season for us contrarian income investors to “bottom fish” the bargain bin for dividend deals. Let’s grab these discounted generous payouts while we can—these are the best weeks of the year to secure 7%+ payouts in 2022 and beyond.

For the next week or two, unloved 7%+ paying closed-end funds (CEFs) will be sold in the spirit of “tax loss” season. Wealthy investors and money managers are looking for 2021 losers to book against recent gains.

And thanks to the epic sector rotation we’re seeing now, the dogs of ’21 are likely to become the darlings of ’22. Fortunately we can buy them cheap—and we can identify these values using a “one-click” CEF valuation tool.

This indicator is called the discount to net asset value (NAV). It’s a quirk of CEFs that lets their shares trade for below the fair market value of the investments in their portfolios.

We’ve talked about these discounts, which you can easily spot on CEF screeners, plenty of times in the past. But there’s a big mistake many people make when using them. We’ll get to that—and dive into two ignored CEF deals to grab now (plus another loser that’s cheap for a reason) in a moment.

First, we need to talk more about what’s providing our CEF-buying opportunity.

One Investor’s Trash …

The key to spotting the best deals in CEFs—from tax-loss selling or anything else—comes back to the discount to NAV. Specifically, we need to zero in on funds whose discounts are unusually wide right now, compared to where they were a few weeks or months ago—then ride along as those discounts return to normal, propelling our funds’ prices higher.

CEF Discounts: Close the Window

Note that I said “unusually wide”—as with dividend yields, we can’t simply pick the fund with the biggest headline number and buy. It’s the discount’s relationship to its historical level that’s critical. If you only go by the current discount, you run the risk of being tied down by CEFs like the laggard we’ll discuss next.

This 'Lazy' CEF Is Always Cheap

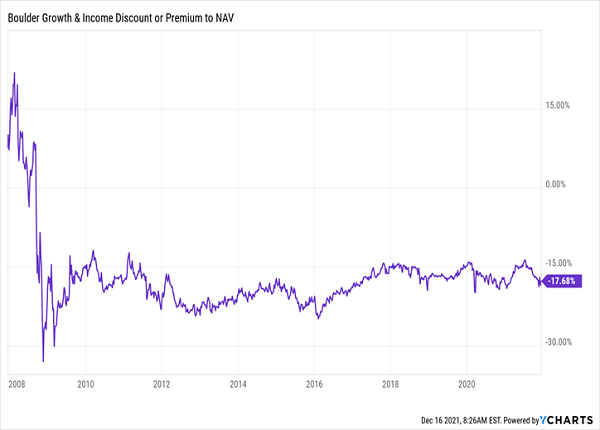

On the surface, the Boulder Growth & Income Fund (NYSE:BIF) looks like a great deal today, with its 17.7% discount to net asset value (NAV). That basically means we’re getting BIF’s portfolio of blue-chip stocks for just over 82 cents on the dollar!

BIF goes after stocks its managers consider bargains, essentially offering us a double discount: one on the CEF itself and one on the stocks it holds.

The portfolio reads like a greatest hits of Warren Buffett favorites, including JPMorgan (NYSE:JPM) and Wells Fargo (NYSE:WFC), as well as a whopping 36% of the portfolio devoted to Berkshire Hathaway (NYSE:BRKa) itself! That may sound good, but BIF’s big discount is like the annoying party guest who just won’t leave—it’s been hanging around since the last financial crisis.

BIF Is Getting the Discount It Deserves

There are good reasons for that, and it only takes us savvy second-level investors a bit of digging to find them.

First, BIF’s managers don’t add much value for the 1% fees they charge (as the massive lean toward Berkshire Hathaway shows). Moreover, the fund’s dividend yield, at 3.5%, is roughly half of what the CEF market yields on average.

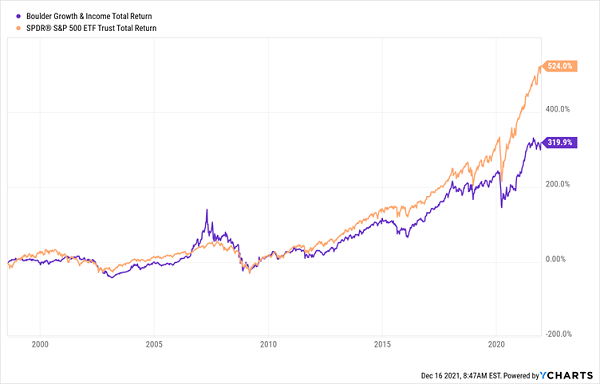

The ever-present discount simply reflects these realities. And that persistent discount has been a weight on BIF’s return, causing it to badly lag the S&P 500 over just about any timeframe, including from inception:

BIF’s Underpowered Share Price

Let’s skip BIF and look at two other funds offering up some sweet temporary deals:

1. A 7.6% Payer That’s Perfect for 2022

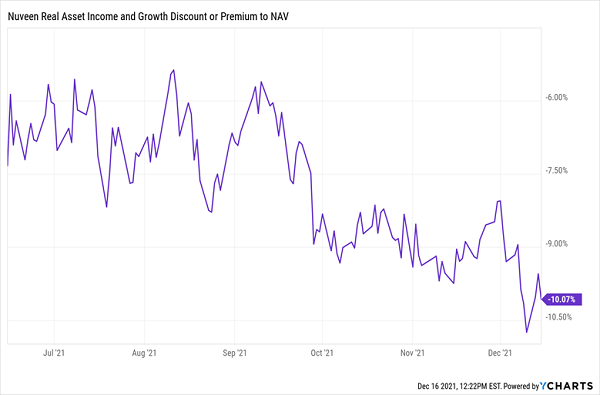

First up is the Nuveen Real Asset Income And Growth Closed Fund (NYSE:JRI), a CEF that members of our sister CEF Insider service know well. It throws off a 7.6% dividend that comes your way every month, instead of quarterly.

The fund powers that payout with infrastructure stocks whose cash flows are as steady as they come. Pipeline operators such as Enbridge (NYSE:ENB) and Enterprise Products Partners (NYSE:EPD) populate its portfolio, as do utilities like NextEra Energy (NYSE:NEE) and Southern Co (NYSE:SO).

Those smooth and steady holdings sound like smart buys in the time of Omicron, right? Yet inexplicably, JRI trades at a 10% discount to NAV as I write this. And while the CEF rarely trades at a premium, it regularly trades at discounts narrower than this: as recently as August, its discount was just 5.5%, or just under half of today’s level.

JRI’s Discount Is Due for a Bounce

With the virus taking off and investors nervous about a pivoting Fed, this fund, with its deeper-than-usual discount and high, steady—and monthly!—dividend, is well worth a look.

2. A 10% Payer With a Discount in Disguise

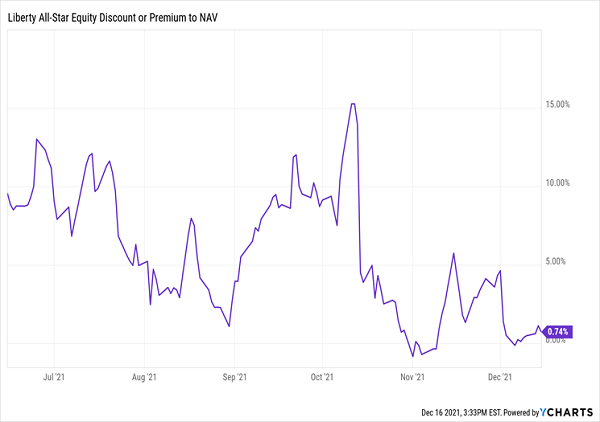

Here’s a funny thing with CEFs: sometimes a fund that trades at a premium is still cheap! That’s the case with the Liberty All-Star Equity Fund (NYSE:USA) it yields north of 10% and trades at a 0.74% premium to NAV.

That might cause first-level investors to pass. But that’s a mistake, because that 0.74% premium is cheap for USA, which has traded at premiums much larger than that in the last six months:

An Expensive CEF? Nope

USA is a great index-fund proxy because it has a broad mandate and taps a lot of high-level talent, with a committee of five different firms, two focused on growth and three focused on value, running the portfolio.

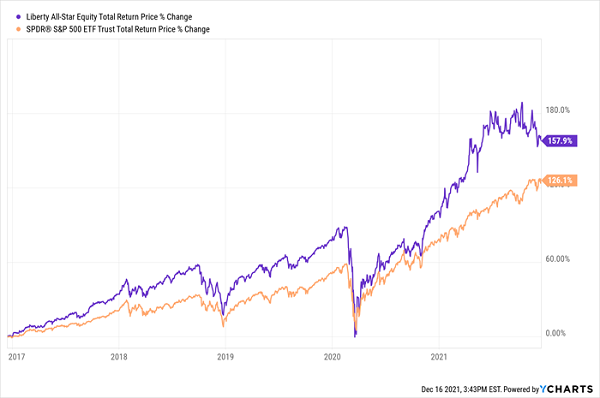

I know that sounds like a few too many cooks in the kitchen, but it’s paid off: USA’s total return has beaten the S&P 500 over the last one-year, three-year, five-year and 10-year time periods. And thanks to its high dividend, most of its gains were in cash:

Human Managers Crush the Market

That mammoth 10% yield certainly stands out, but the only hitch is that it may not quite work for you if you need consistent income from your portfolio. That’s because USA’s policy is to pay out 10% of its NAV as dividends every year, so the payout can fluctuate with the fund’s returns.

But if you’re not leaning on your portfolio for a consistent income stream, you can rest assured knowing you’re getting 10% of the return on USA’s portfolio as cash annually. That’s a nice buffer in a market like today’s, and you can use that cash to pay your bills or reinvest as you like.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."