Russia Could Determine The Next Big Move

The U.S. stock market remains in a vulnerable position, especially given the possibility Russia could send troops across Ukraine’s border. From Reuters:

NATO said on Wednesday Russia had massed around 20,000 combat-ready troops on Ukraine’s border and could use the pretext of a humanitarian mission to invade. It was the starkest warning yet from the Western alliance that Moscow could mount a ground assault on its neighbor. As rebels have lost ground to Ukrainian government troops, Russia announced military exercises this week near the border. “We’re not going to guess what’s on Russia’s mind, but we can see what Russia is doing on the ground – and that is of great concern. Russia has amassed around 20,000 combat-ready troops on Ukraine’s eastern border,” NATO spokeswoman Oana Lungescu said in an emailed statement.

Russia: Bullish Scenario

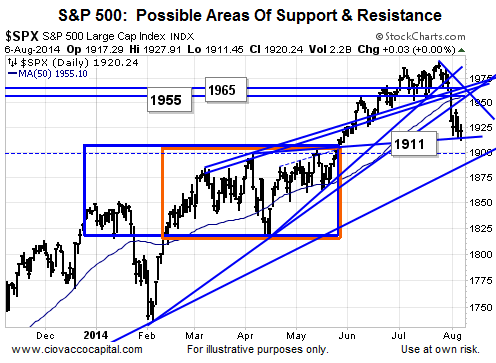

We have already reduced our exposure to stocks significantly since July 24. However, we still need to have contingency plans in place for bullish and bearish scenarios. Let’s assume Russia decides to pull back their troops on Thursday or Friday. Under that scenario, stocks could stage a fairly significant rally. While the chart below is noisy, the concepts are easy to understand. We will review any Russia-relief rally that cannot take the S&P 500 back above 1965 with a grain of salt. If the S&P 500 can close above 1965, we would be much more open to redeploying some of our cash.

Russia: Bearish Scenario

U.S. stock investors are already concerned about the possibility of a sooner than anticipated interest rate hike from the Fed. If we add in the current vulnerabilities from a technical perspective, it is easy to understand that ongoing uncertainty related to Russia’s next move could result in more red days for stock investors. Obviously, any news of Russian troop movements into Ukraine could push an already vulnerable stock market into a waterfall-like decline. We prefer to hold our equity-related ground as long as the S&P 500 can remain above the August 6 low of 1911. Any sustained break of 1911 would most likely call for additional defensive measures based on our market model’s risk management rules.

Spillover Into European Economy?

Russia has one of the largest economies in the world. Tension has been carrying on regarding Ukraine for some time now, which has negative consequences from an economic perspective. Investors have been concerned about low inflation in Europe. We can now add “recession” to the list of worries. From The New York Times:

The Italian economy shrank in the second quarter, according to an official estimate on Wednesday, taking economists by surprise and provoking concern that violence in Ukraine and tension with Russia could be pushing the broader eurozone back into recession.

Silver Lining

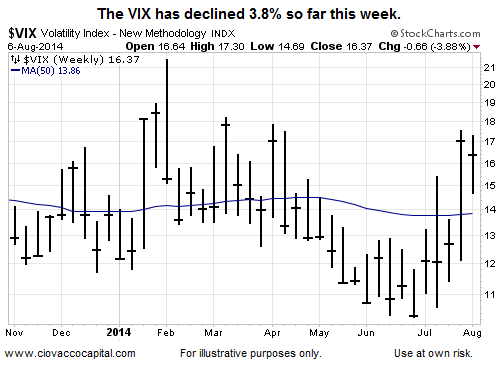

Is it all gloom and doom for stocks? No, as noted on August 5, the longer-term outlook for U.S. stocks has not taken a significant hit in the last two weeks. Despite the S&P 500’s 5-point decline this week, some pockets of hope remain. Small caps (iShares Russell 2000 Index (ARCA:IWM)) are up almost one percent over the last three trading sessions. The VIX Fear Index has dropped almost 4% this week.

Investment Implications – The Weight Of The Evidence

Stocks cannot rocket 20% higher without the S&P 500 closing above 1965. Conversely, a 20% free fall in equities cannot take place unless the S&P 500 closes below 1911. Therefore, between those levels we will exercise some patience within the context of our portfolio management rules. The bigger picture continues to align with “vulnerable to more pain”, which is why we have raised and are maintaining a large position in cash to offset the ongoing uncertainties related to our stocks (SPDR S&P 500 (ARCA:SPY)) and bonds (iShares Barclays 20+ Year Treasury (ARCA:TLT)).