Although the main stock market indexes have been in pullback mode the past few days, overall market conditions remain bullish.

As such, the current pullback presents a lower-risk buying opportunity for top stocks and ETFs that have been showing relative strength with tight chart patterns.

Two such swing trade buy setups we are stalking for potential buy entry in The Wagner Daily over the coming days are biotechnology firm Cytokinetics Incorporated (NASDAQ:CYTK) and software development company Rubicon (RUBI).

Let’s take a quick look at why these equities may be excellent stocks to buy in the coming days…

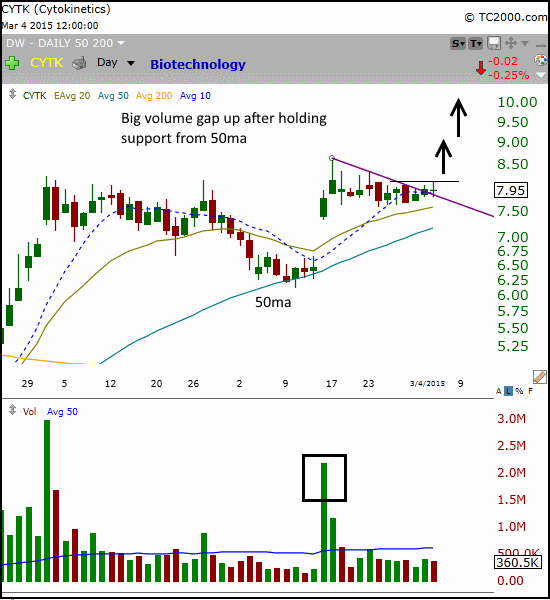

Small-cap poised for big breakout (CYTK)

CYTK is a small-cap biotech stock that is setting up for a base breakout from a first-stage base. Take a look:

CYTK grabbed our attention when it gapped sharply higher about three weeks ago, on volume that was more than 400% greater than the stock’s average daily volume (see black rectangle on the chart).

Since then, CYTK has been trading in a tight, sideways range above its 50-day moving average, with both the 10 and 20-day moving averages sitting above the 50-day moving average.

The combination of the high volume gap, price action above 50-day MA, and the 20-day MA trading above 50-day MA means the stock possesses 3 of the top 5 qualities of the best stock breakouts.

If the price of CYTK rallies above the March 4 high (marked by the horizontal line), the stock could attract enough buying interest to enable it to break out above its tight, three-week range.

If CYTK meets our exact criteria for buy entry, we will buy the stock with reduced share size because it is not an A-rated setup.

Liquidity in this small-cap stock is also a bit on the light side, which we compensate for by lowering our share size.

Crossing The Rubicon Pro (NYSE:RUBI)

To “cross the Rubicon” means to pass a point of no return.

Given the solid, earnings-driven breakout from a first stage base two weeks ago, it indeed appears The Rubicon Project (RUBI) has definitively passed the point of no return (to its prior trading range).

After gently retracing from the February 25 high of its recent breakout and trading in a tight range for more than a week, the 10-day moving average has caught up to the price.

As with the CYTK setup, the stock also shares the key breakout attributes of a high volume gap, trading above the 50-day MA, with the 20-day MA above the 50-day MA:

For this momentum trade setup, we are looking for potential buy entry on a slight pullback from the March 4 move (the price must drop to the exact buy limit order listed in today’s Wagner Daily in order to trigger the trade).

RUBI is not an A-rated stock, but does have strong revenues and two quarters in a row of improving EPS growth.

Although we are primarily technical traders, most leading stocks in the market share these two fundamental traits.

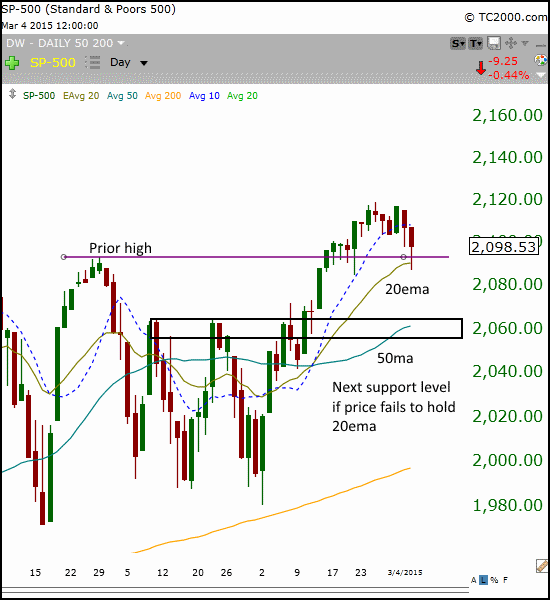

Key Support Levels To Watch (S&P 500)

Our rule-based trading system forces us to focus much more on the performance of leading stocks, rather than the price action of the main stock market indexes.

Nevertheless, because we are trend traders, it is always beneficial to make sure the broad-based indexes remain healthy as well (put the wind at your back).

Despite the substantial pullback of the past few days, the S&P 500 technically remains healthy.

As shown on the chart below, the benchmark index bounced off near-term support of both its 20-day MA and prior highs yesterday (March 4):

Given the bullish intraday price reversal that converged with two near-term support levels, the March 4 low of 2,087 now becomes a key price level to watch.

If the 2,087 support level fails to hold, next support is near the 2,065 level, which represents convergence of the rising 50-day moving average and the 10-week moving average (similar to 50-day moving average).

As long as the S&P 500 remains above that 2,065 level and leading stocks continue to hold up, the current pullback in the market must be viewed as a buying opportunity.

Having an objective, rule-based market timing system (such as this one) is a great way to ensure you remain positioned to take advantage of profitable opportunities when the time is right (and on the sidelines otherwise).