10-Year Note Non-Commercial Speculator Positions:

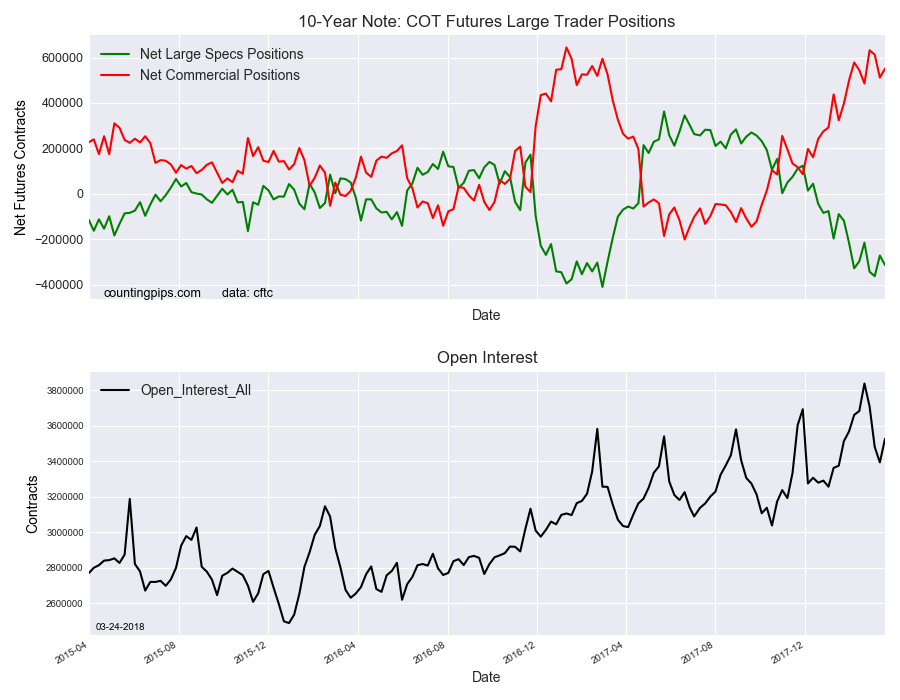

Large treasury speculators increased their bearish net positions in the 10-Year Note futures markets this week following a cut in bearish bets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -313,304 contracts in the data reported through Tuesday March 20th. This was a weekly fall of -41,935 contracts from the previous week which had a total of -271,369 net contracts.

Speculative positions fell back below the -300,000 bearish bet threshold this week after ascending above this threshold in last week’s data. The 10YR specs have now raised bearish positions for three out of the past four weeks and remain strongly in bearish territory.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 551,119 contracts on the week. This was a weekly boost of 39,460 contracts from the total net of 511,659 contracts reported the previous week.

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

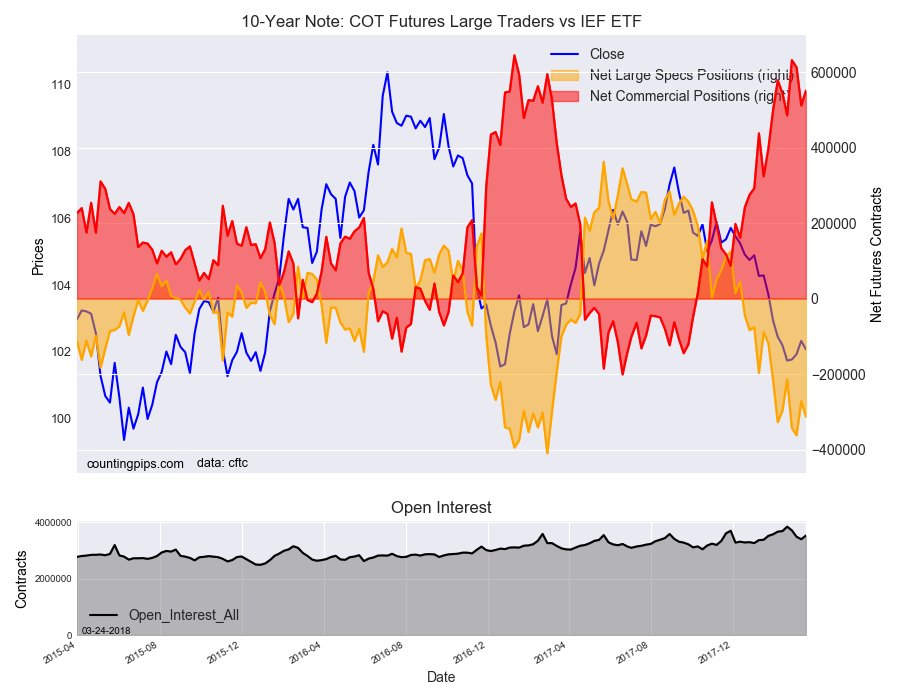

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $102.07 which was a decline of $-0.26 from the previous close of $102.33, according to unofficial market data.