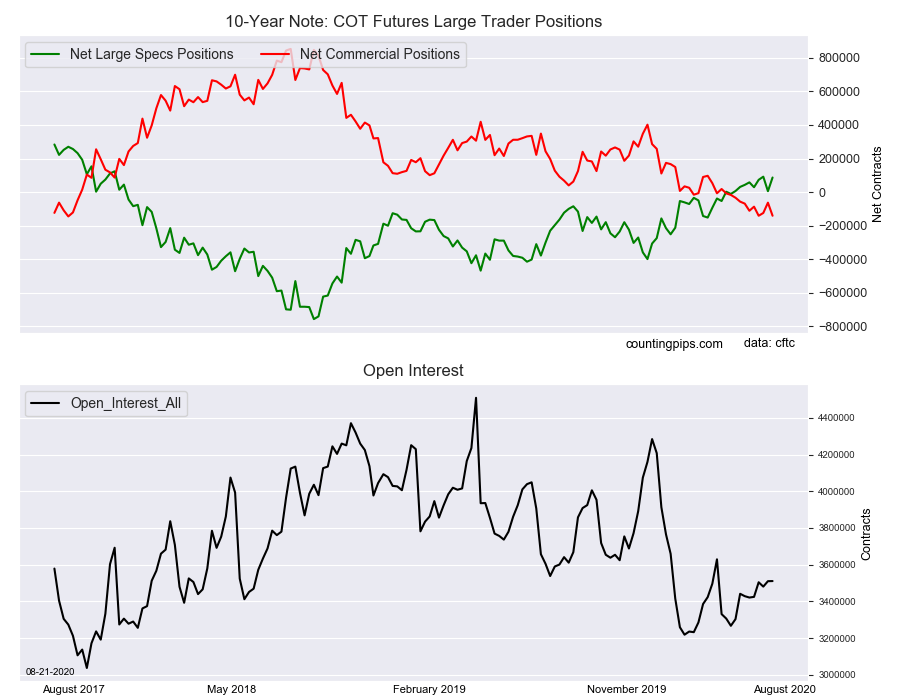

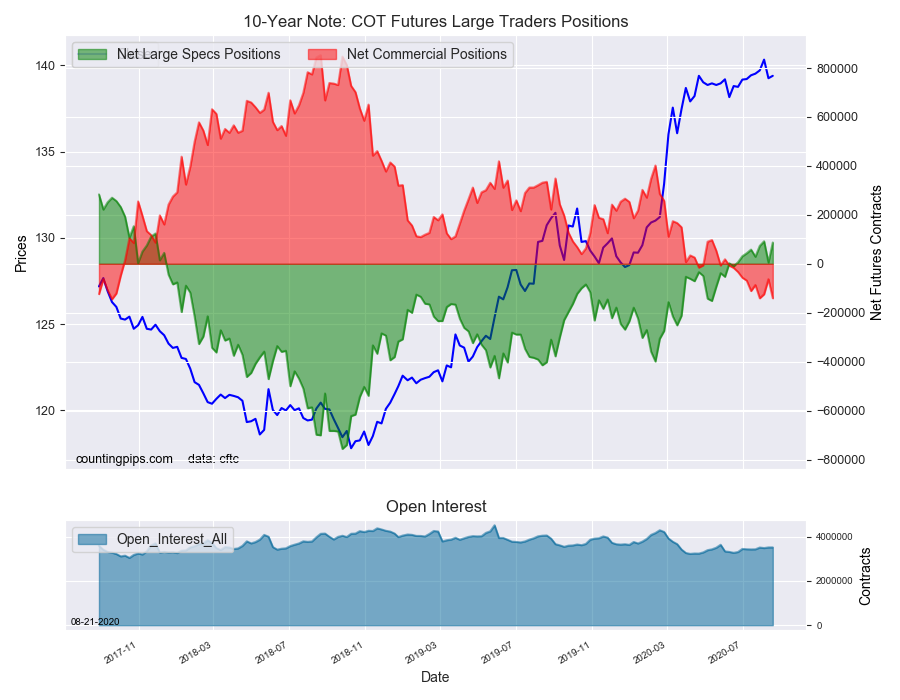

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bullish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 87,004 contracts in the data reported through Tuesday August 18th. This was a weekly gain of 81,504 net contracts from the previous week which had a total of 5,500 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -24,791 contracts (to a weekly total of 720,076 contracts) while the gross bearish position (shorts) fall by a greater amount of -106,295 contracts for the week (to a total of 633,072 contracts).

10-Year Note speculators rebooted their bullish net positions this week following a sharp draw-down in bets last week. The +81,504 net contract gain this week almost wipes out last week’s -86,565 net contract shortfall and brings the current standing back to a small bullish level at +87,004 contracts. Overall, speculators have now increased their bullish bets in seven out of the past nine weeks which has kept the 10-Year sentiment in positive territory since June.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -140,654 contracts on the week. This was a weekly decrease of -77,807 contracts from the total net of -62,847 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $139.39 which was an advance of $0.14 from the previous close of $139.25, according to unofficial market data.