CFTC Weekly Commitment of Traders Report

10 Year Treasury Note Non-Commercial Positions:

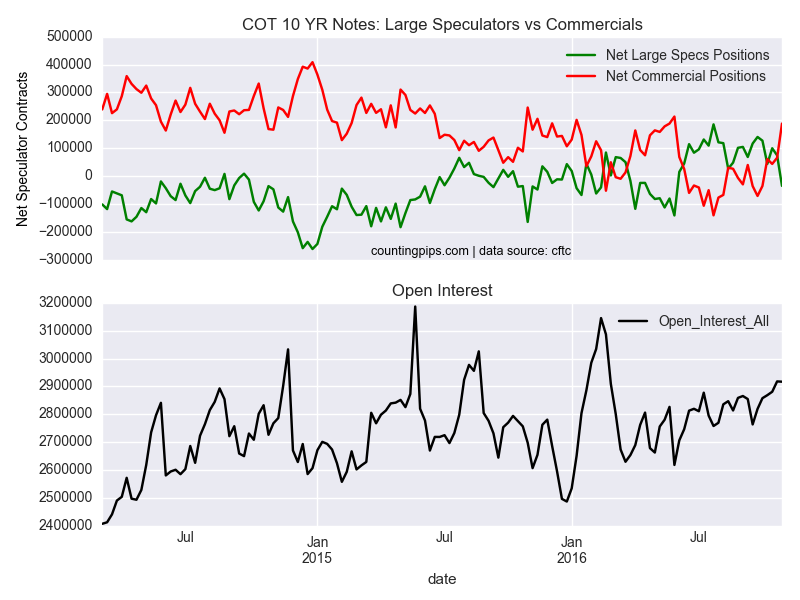

Large speculators and traders sharply decreased their net positions in the 10-year treasury note futures markets last week and totaled a new net bearish position for the first time since May, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -35,057 contracts in the data reported through November 1st. This was a weekly drop of -109,563 contracts from the previous week which had a total of 74,506 net contracts.

The sharp fall in speculative treasury bets last week brought the net position to its first negative level since May 31st when positions totaled -140,962 contracts.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 188,491 contracts last week. This is a weekly boost of 122,744 contracts from the total net of 65,747 contracts reported the previous week.

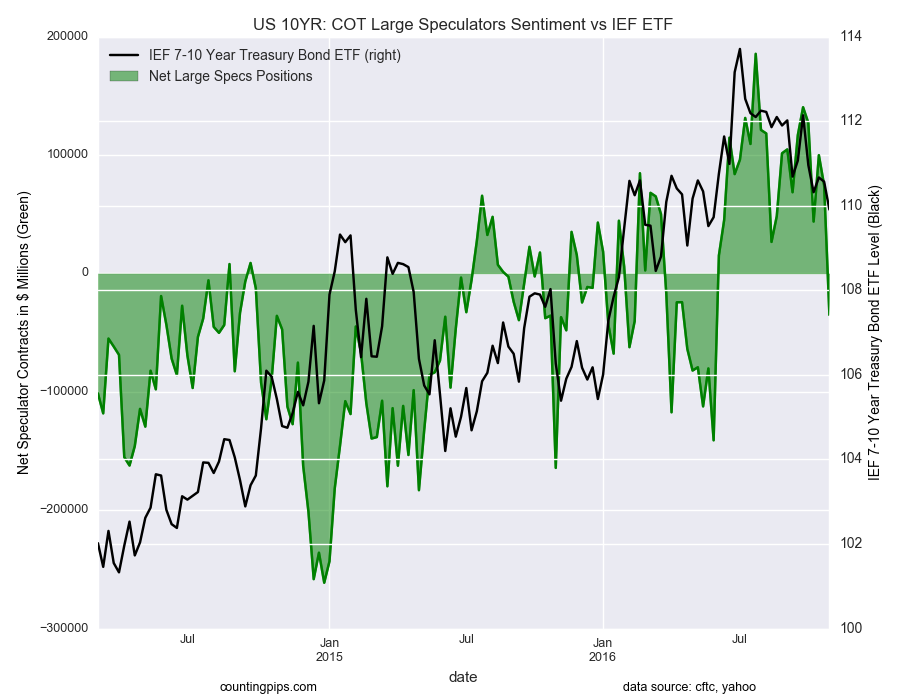

IEF 7-10 Year Bond ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the iShares 7-10 Year Treasury Bond (NYSE:IEF) closed at approximately $109.91 which was a decline of $-0.66 from the previous close of $110.57, according to market data from Yahoo Finance.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the previous Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers and traders for business purposes) were positioned in the futures markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).