10-Year Note Non-Commercial Speculator Positions:

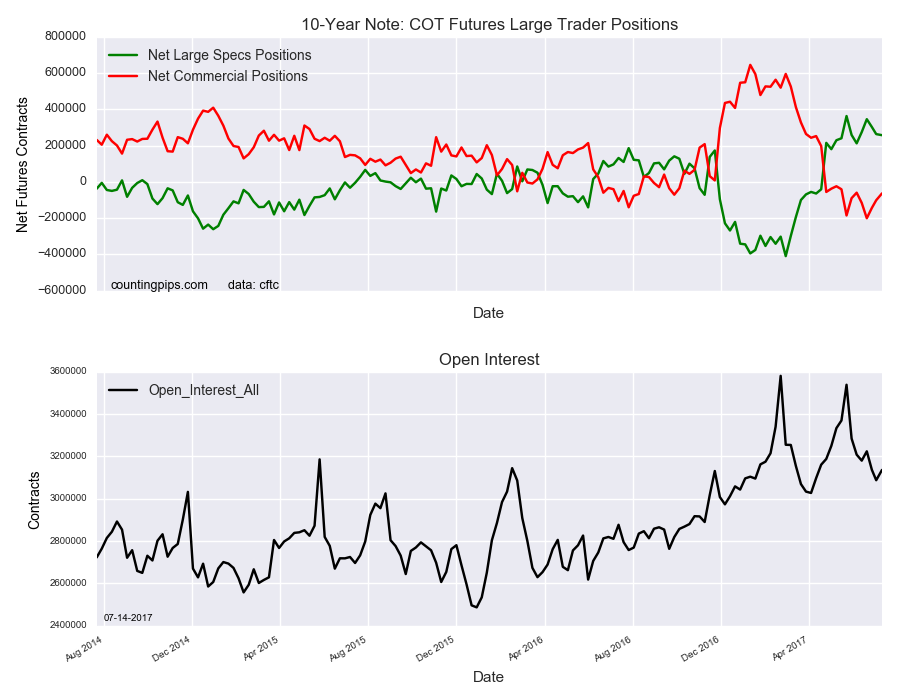

Large speculators decreased their bullish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 257,027 contracts in the data reported through Tuesday July 11th. This was a weekly fall of -5,935 contracts from the previous week which had a total of 262,962 net contracts.

The 10-Year Note speculators have now reduced their positions for a third consecutive week although speculative positions remain very bullish with a total net position above the +250,000 threshold for a fifth straight week.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -63,836 contracts on the week. This was a weekly boost of 37,761 contracts from the total net of -101,597 contracts reported the previous week.

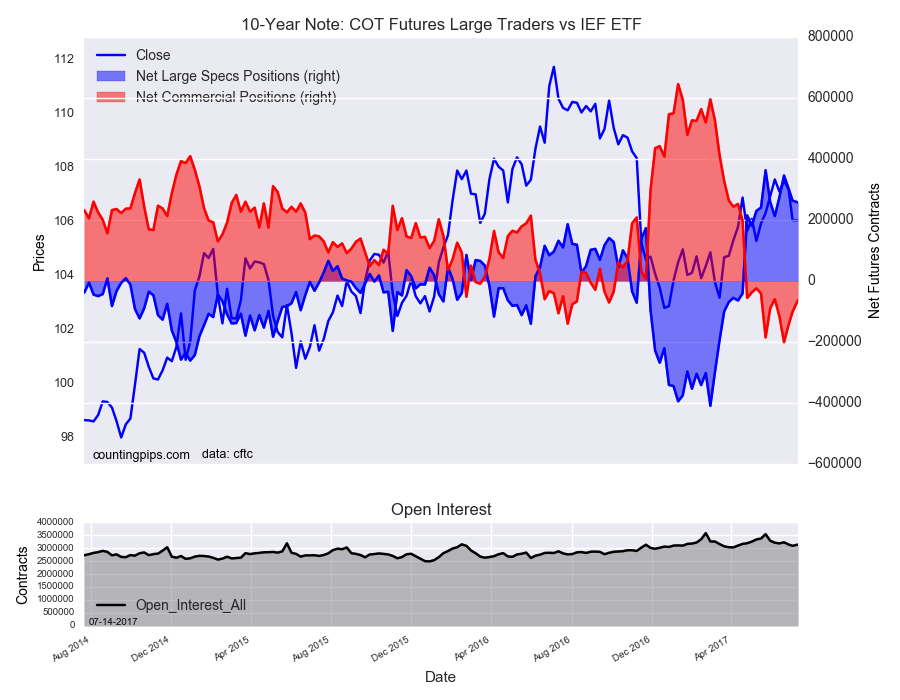

IEF (NYSE:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.05 which was a loss of $-0.01 from the previous close of $106.06, according to unofficial market data.