Gold and mining stocks are overbought on a myriad of charts and “the world’s most predictable pause and pullback” is underway.

Chinese futures market traders are now as much price makers as a taker and their margins have been hiked. That’s the primary reason for the pause in the action.

There are also concerns that today’s Fed meet could be a hawkish event.

Those concerns are exacerbated by the fade of inflation (at least in official numbers) in Europe. That could theoretically put pressure on the euro and boost the dollar.

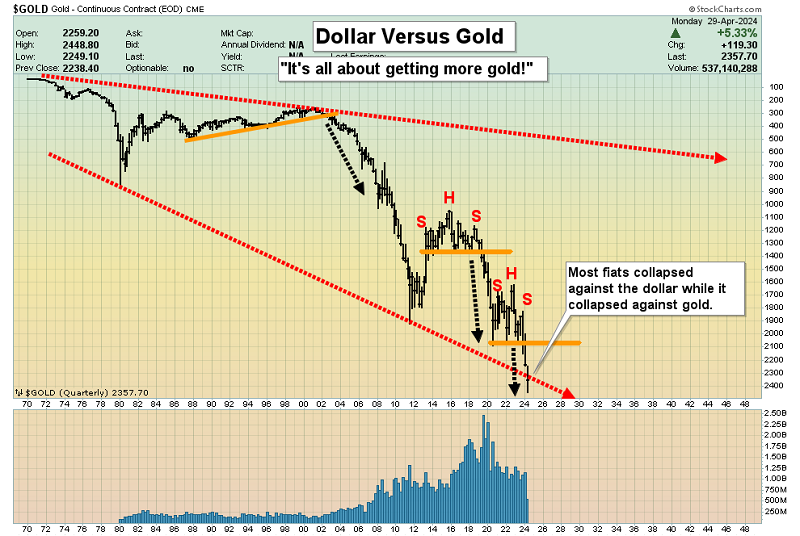

In the big picture, the intermediate term zigs and zags aren’t that important.

All fiat is clearly on a long-term road to a place best described as financial Hades versus gold.

That fact means that when it comes to currency, all investors need to make it their prime directive

To get more gold.

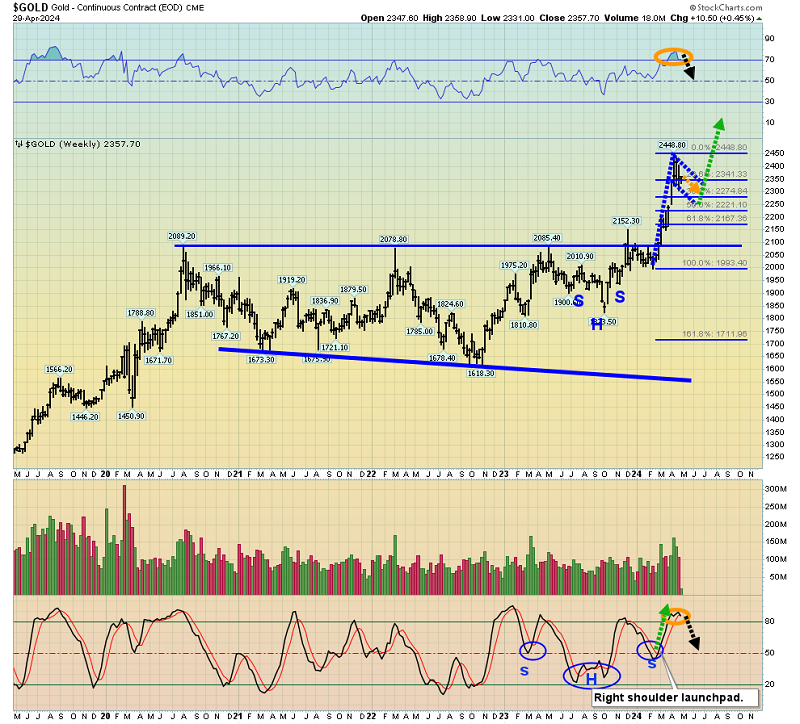

On this weekly chart, I highlighted the right shoulder action on Stochastics that was both the technical launchpad for the breakout over $2100 and rocket fuel for the surge to the $2400 target zone.

This type of technical action often produces a bull flag pattern, and that's likely what is happening now.

While there’s no guarantee that it plays out as indicated, investors should be open to a “sell in May and go away” event for the US stock market, and a gentle drift sideways or down for gold.

Here’s another look at the flagpole and potential flag pattern, via the weekly close chart. Simply put, the price action is magnificent!

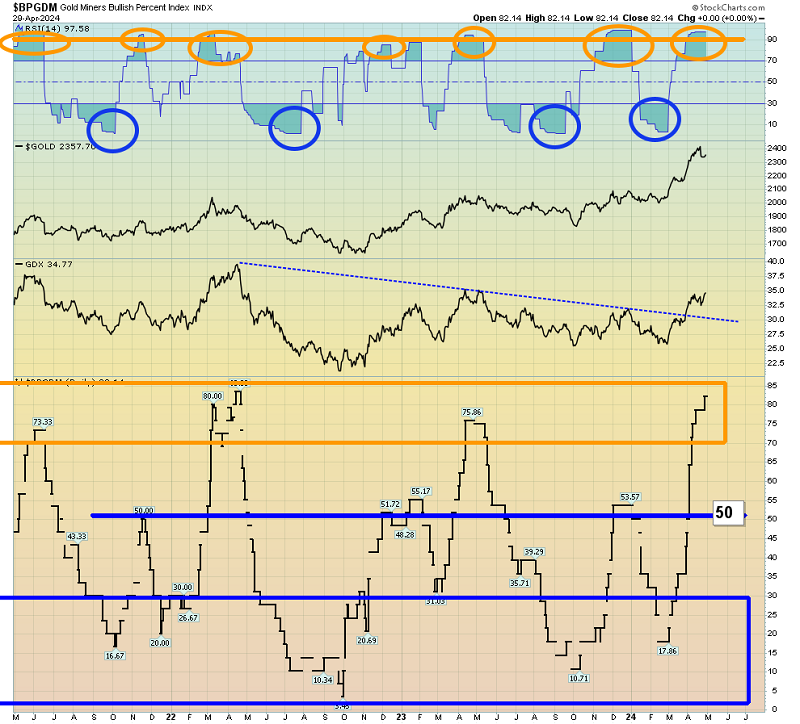

With the BPGDM sentiment index above 80 and its RSI at 97, what’s the next move for investors?

I suggest waiting for a return to the 50 zone for the index and 30 or lower for RSI. If that happens as gold arrives at my buy zone of $2220, buyers of gold, silver, and miners should fare quite well.

I’m a buyer of the “fizz” (physical gold bullion) at $2270 regardless of how overbought the market may still be. That’s because a dip from $2440 to $2270 is roughly a 7% price sale.

That’s enough for all physical gold enthusiasts to take bold action and get more of the world’s greatest metal.

The Fed meet today is important, but the Indian election is likely even more so. The winner is now scheduled to be announced June 4, and the nation’s citizens are likely to return to the gold market then.

The next four weeks could see gold complete its bull flag pattern around that June 4 date. Long ago, I dubbed the citizens of India as the world’s “titans of ton” because of their obsession with getting ever-more gold

But only buying with size when it goes on sale.

What about silver? Silver hasn’t done as well as gold, but the monthly chart is fantastic.

A very bullish drifting rectangle (almost a bull flag) looks to be next for gold’s “little brother”. If gold trades at $2220, silver bugs should consider buying more silver.

The GDX (NYSE:GDX) daily chart suggests that even if a bull flag forms for gold, the miners could go higher while that happens.

The buy zone for GDX and associated senior miners is a price of about $2220 for gold but “times are changing”, and instead of collapsing as has happened in the past, gold stocks are pausing and correcting with grace!