- The stock market keeps on pushing higher despite.

- Against this backdrop, investors should exercise caution due to high valuations and market cyclicality.

- Bonds offer attractive returns and can reduce equity exposure, providing a safer alternative in current market conditions.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

- No one talks about bonds anymore

- Bonds are considered second-class assets

- Stocks and cryptocurrencies are the only options in portfolios

The stock market has continued to rise fueled by better-than-expected earnings reports. October 2022 was actually not only the low of the bear market, but also the beginning of a new bull market that has lasted to date.

As always, markets have their own cyclicality, and there are times like 2022 where the bravest can gain several satisfactions by going against the current. If you look back at my analyses, both in 2023 (in that case I received several criticisms, but that's part of the game) and in 2024 (here less so because the trend was already more established), I talked about positive vintages, this one in particular being the last year of the presidential cycle.

All this, of course, passing through natural and physiological corrections (in the range of 5-10%, which happen once a year).

The successeful investor, however, must also be able to manage not only the returns part, but especially the risk part. And as always, the risk is that this equity rally, given also the historically high valuations especially in the U.S. area, may sooner or later come to an end, causing several damages in investors' portfolios.

There is indeed a lot of euphoria around, after the AI phenomenon, the rise (again) of meme stocks (due to a Roaring Kitty comeback), see GameStop Corp (NYSE:GME) case.

So, the market, between now and the next few months, should certainly be ridden (as it always is), but it also requires a sharp increase in caution.

Here then, for the first time in many years, the bond market can come to our aid.

The short end of the curve, in particular, offers decidedly interesting alternatives. Indeed, it is possible today to invest in 1-3 year durations with returns to maturity that are not only positive but in many cases higher than what the stock market can offer going forward.

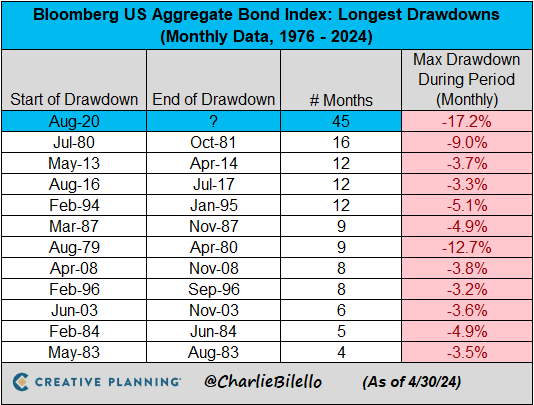

This, of course, is possible after the bond market suffered the deepest bear market in its history.

So here are three very compelling reasons to add bond exposure to your portfolio:

Here, in these cases, is usually the best time to enter an asset class.

In fact, today, taking only government bonds, we can easily find yields (gross) above 5 percent in both the U.S. and European zones, on durations precisely from 1 to 3 years.

This, in tactical terms, would allow us to reduce equity exposure without giving up a positive and optimal return (also in real terms).

And perhaps, 3 years from now, if the market (cyclically) were to return to a bear market or a substantial correction again, we would be ready, once we reach maturity, to return with the cash received from bond sales.

Of course, the stock market could run again, so there is (for the part of the portfolio where we are going to make this choice) an opportunity cost, but in these times and with these valuations, perhaps it is worth taking.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.