Late last week the Fed announced industrial production decreased 0.6% in March, marking the second straight month of declines. The slide also pushes year over year activity in the industrial sector further into the red. Meanwhile, the ISM manufacturing index, an indicator of sentiment within the industry, has been trending downwards. It was only until the last 2 months that the index began to show signs of life, hopefully signalling a forthcoming turnaround. Until then, earnings in the American industrial and manufacturing sector will continue to suffer. Some of these names adversely affected include General Electric (NYSE:GE) and Caterpillar (NYSE:CAT) which both report first quarter earnings this morning.

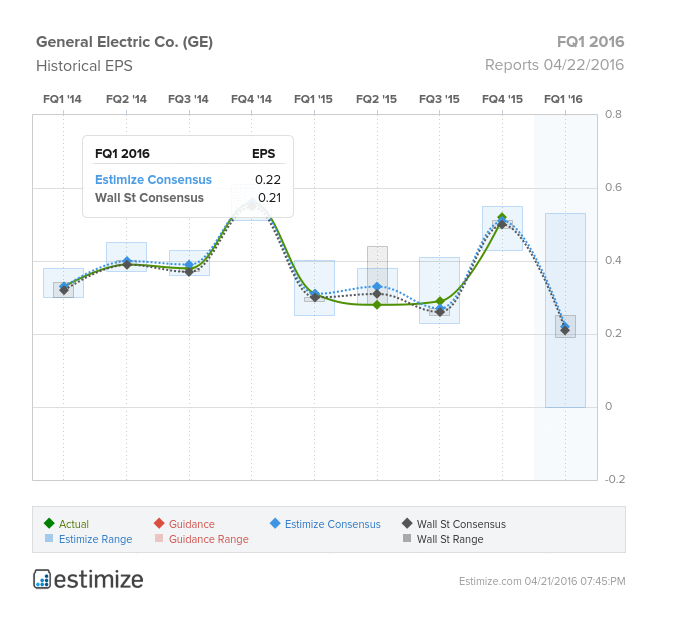

General Electric steps up to the plate this Friday and is expected to strike out for a 9th consecutive quarter. The Estimize consensus is calling for EPS of $0.22 on $28.79 in revenue, 1 cent higher than Wall Street on the bottom line and $180 million below on the top. Since their last report, per share estimates have been cut by 14%, with sales falling 3%. Compared to a year earlier, earnings are predicted to fall by 28% on a 12% decline in revenue.

General Electric is one of the largest, most diversified companies in the world, operating in nine segments from financial services to renewable energy. It is seeing the most weakness from its oil and gas, healthcare, and financial services divisions. The company is actively restructuring its portfolio away from GE capital in order to redefine itself solely as an industrial entity. A recent deal to acquire Alstom’s Energy has been good start and is likely to contribute $0.05 to earnings in 2016.

That said, a mounting order backlog, lower oil prices and significant internal exposure might inhibit its growth potential. Last quarter, GE reported total backlog of equipment and services of $315 billion, up from $261 billion at the end of 2014. Moreover, margins recorded significant declines in the fourth quarter despite stringent cost cutting initiatives. Industrial operating profits declined 8% on a 79% decline in Renewable Energy and 71% decline in Energy Management. Regardless, investors have not been concerned as the stock is now up 14.69% in the last month.

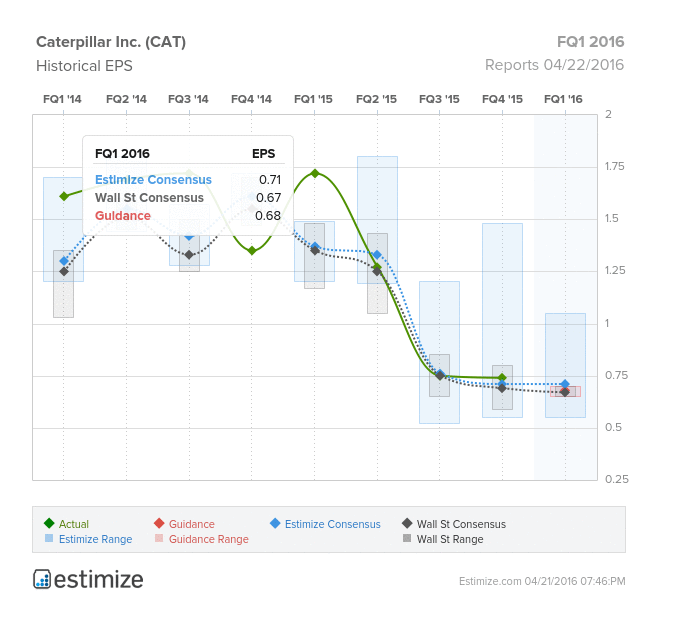

Throughout his campaign, Donald Trump has referenced Caterpillar as the reason America is no longer great. Caterpillar has watched earnings steadily decline over the past year as their core business proceeds to be outsourced to other countries. Conditions in its construction equipment, power systems and mining equipment businesses have been adversely impacted from weak commodity prices and a fragile global economy. The Estimize community has been bearish in regards to Caterpillar’s earnings this quarter. In the past 3 months, expectations have plunged 27% with 22% of that movement coming in the past 30 days. Compared to the first quarter last year, EPS is predicted to fall 57% to $0.71 while sales are expected to fall as much as 24% to $9.47 billion.

How do you think these names will report this week?