Gold may be in a bubble set to burst, economist warns

Consolidated Edison (NYSE:ED) reported Q3 earnings on Nov. 4, with EPS below consensus expectations. The recent results are not the primary concern for the New York City-based electricity, gas and steam utility service provider, however. ED shares are currently trading at $80.25, 15% below the 2020 pre-COVID high close of $94.44 on Jan. 29, 2020.

Its 3-year annualized total return of 3.95% per year is less than half that of the Utilities Select Sector SPDR® Fund (NYSE:XLU) or the iShares US Utilities ETF (NYSE:IDU) which are 10.59% and 9.46% respectively.

Over a 5- and 10-year period, ED’s total returns are around 4% per year less than the industry average.

Source: Investing.com

However, as a dividend aristocrat, with 47 consecutive years of dividend growth, ED appeals to income investors. The 3.9% dividend yield is quite high even among utilities. XLU and IDU have yields of 2.9% and 2.6% respectively.

And ED’s dividend growth rate has been consistent, albeit quite low, over the past 10 years. The trailing 3-, 5-, and 10-year annualized dividend growth rates are 2.72%, 2.95%, and 2.59%, respectively.

From the perspective of the Gordon Growth Model, we might expect annualized total returns of around 6.6%. This value is close to ED’s trailing 10- and 15-year annualized returns (6.4% and 6.2%, respectively). The appeal of steady and predictable income growth must be considered relative to the stock’s substantial long-term underperformance. XLU’s trailing 10- and 15-year annualized total returns are 11.0% and 8.0%, respectively.

I last published an analysis of ED on Feb. 10, 2021 when I assigned a neutral rating. In the 9.6 months since that article, ED has returned 15.9% (including dividends), as compared to 20.6% for the S&P 500.

My neutral outlook was due to concerns about the company’s growth trajectory. In forming my opinion, I relied on two forms of consensus outlooks. The first was the well-known Wall Street analyst consensus rating and price target. The second was the market-implied outlook, a probabilistic price return forecast that reflects the consensus expectations of the options market.

In February, the Wall Street consensus outlook for ED was neutral or bearish (depending on the details of the consensus assessment), with a 12-month price target that was about 5% above the share price at that time. The market-implied outlook in February, looking out to January of 2022, was slightly bearish.

With 9.6 months since my last analysis, I have updated the market-implied outlook and revisited my rating on ED, considering the Wall Street analyst consensus and other factors.

Wall Street Analyst Consensus Outlook for ED

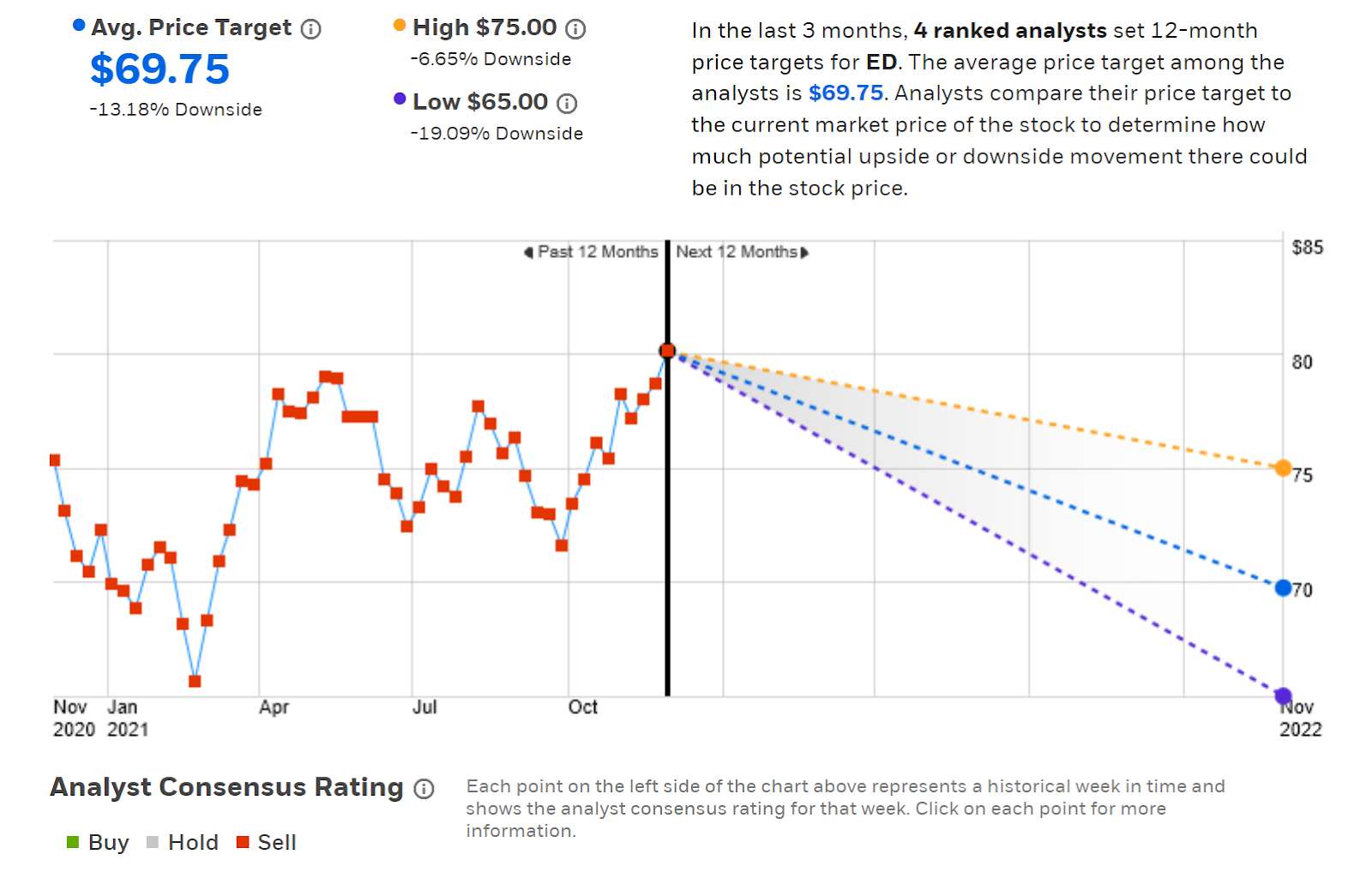

E-Trade calculates the consensus outlook for ED by combining the views of 4 ranked analysts who have published ratings and price targets over the past 90 days. The small number of analysts included in this consensus is worth noting. The consensus rating is bearish and the consensus 12-month price target is 13.2% below the current share price. While E-Trade’s Wall Street consensus rating was bearish in February, the price outlook has deteriorated substantially since then.

Source: E-Trade

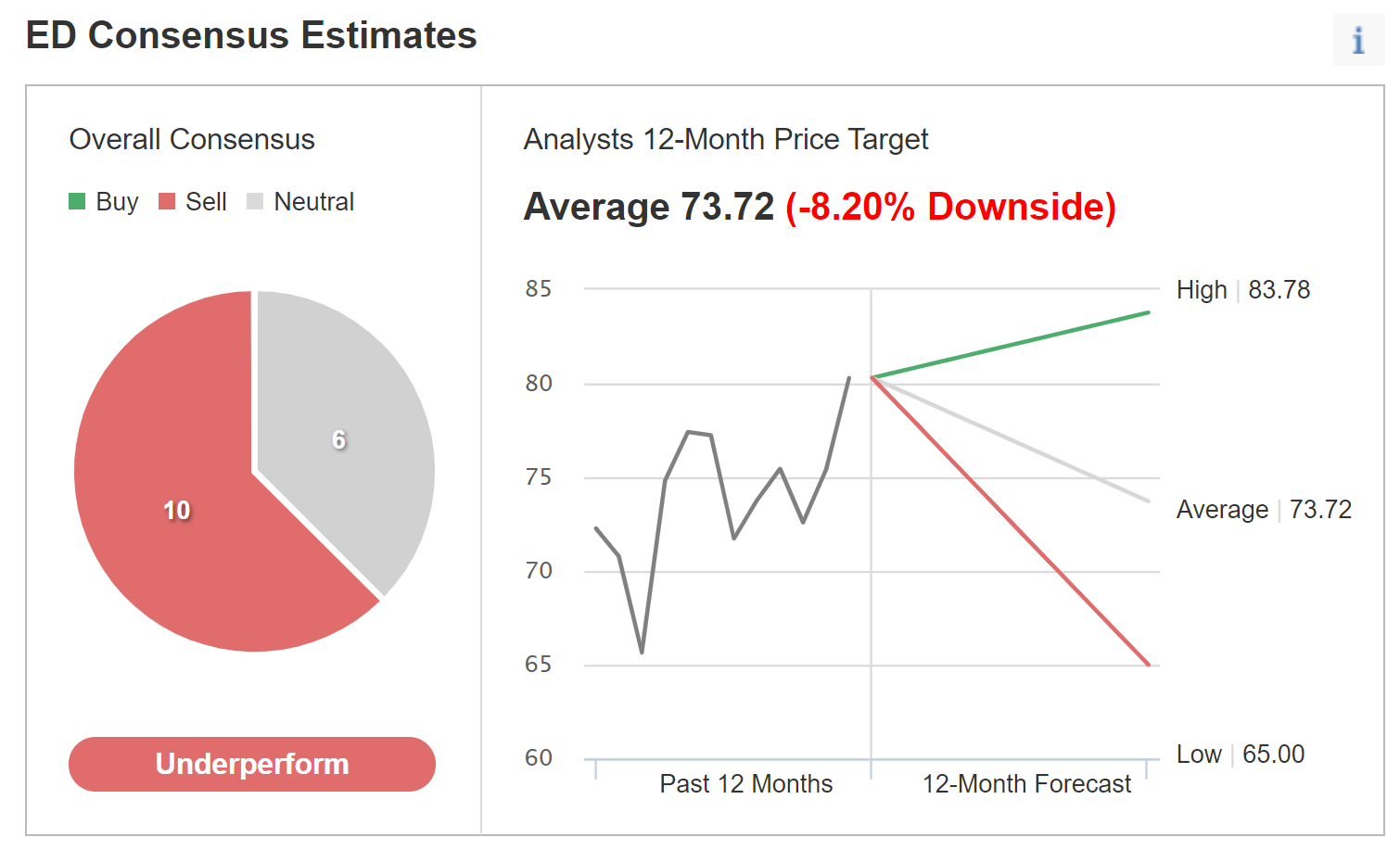

Investing.com’s version of the Wall Street consensus outlook combines the views of 16 analysts. The consensus rating is bearish and the consensus 12-month price target is 8.2% below the current share price.

Source: Investing.com

The two versions of Wall Street consensus outlooks agree on a bearish outlook, with an expected 12-month price target that is about 10% below the current share price. The analyst consensus has been bearish over the last year (the E-Trade rating chart shows the consensus rating over time), and ED has provided almost zero price appreciation over this period.

Market-Implied Outlook for ED

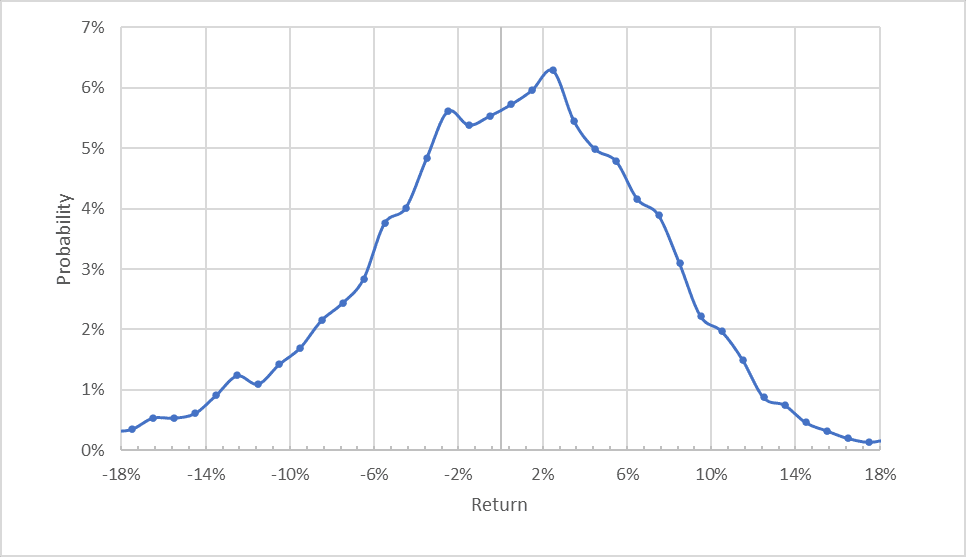

I have calculated the market-implied outlooks for ED to January 2022 (using prices of options that expire on Jan. 21, 2022) and to January 2023 (using prices of options that expire on Jan. 20, 2023). The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal axis.

Source: Author’s calculations using options quotes from E-Trade

The outlook for the 1.7 months to Jan. 21, 2022 is generally symmetric, but the maximum probabilities are tilted to favor positive returns. The peak probability corresponds to a price return of 2.5% over this period. The annualized volatility calculated from this distribution is 19.7%, which is low for an individual stock but not unusually low for a utility.

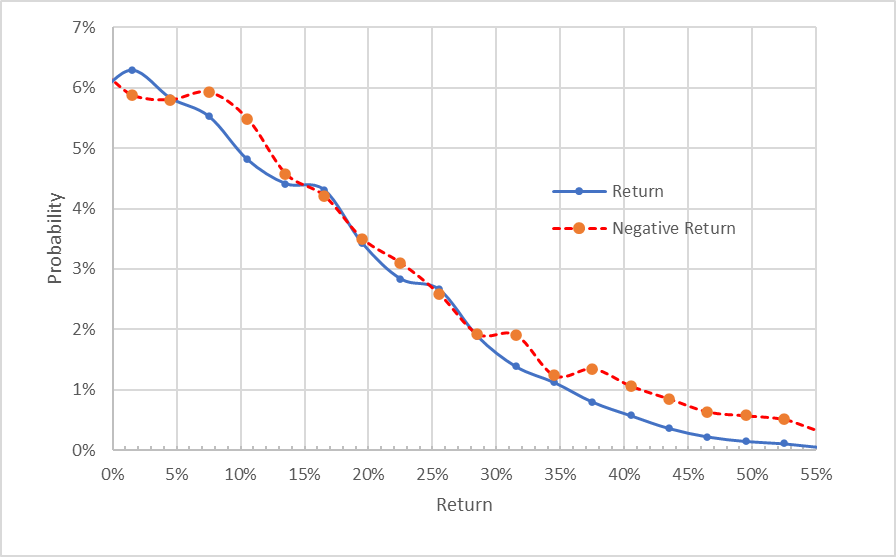

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

With this view, the degree to which the outlook favors positive price returns over the next couple of months is even clearer. The probabilities of positive returns are consistently higher than for negative returns of the same magnitude for a wide range of the most-probable outcomes (the solid blue line is above the dashed red line over the left ⅔ of the chart). This is a bullish outlook to the middle of January 2022.

Theory suggests that the market-implied outlook will tend to have a bearish bias because investors, in aggregate, are risk averse and tend to pay more than fair value for downside protection (put options). With this tendency in mind, the clear bullish tilt in the 1.7-month outlook is even more notable.

The market-implied outlook to January 2023 is predominantly neutral, with a slight bullish tilt. The probabilities of positive and negative returns are very close to one another over the next 13.7 months. The probabilities of extreme negative returns are higher than for positive returns for large-magnitude price moves (the dashed red line is consistently above the solid blue line on the right ⅓ of this chart). This is a standard feature of dividend-paying stocks. Dividend payments reduce the upside price potential of stocks relative to downside. The annualized volatility calculated from this distribution is 20.5%.This would be a neutral outlook if investors were risk neutral, but because of the assumed negative bias, this outlook is interpreted as neutral with a slight bullish tilt.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

The near-term market-implied outlook for ED is bullish. The outlook through 2022 is neutral with a mildly favorable tilt. The expected volatility over the next year is 20.5% but is slightly lower over the next couple of months.

Summary

Consolidated Edison has substantially lagged the utility sector over the past decade and has experienced almost zero price gain over the past 12 months. Wall Street analysts have a bearish consensus on ED with a 12-month price target around 10% below the current share price.

The market-implied outlook for ED over the next couple of months is bullish, becoming neutral (with a slight bullish tilt) through 2022 and expected annualized volatility is 20.5%.

With ED’s 3.9% dividend yield and a dividend growth rate of about 2.7% per year, it is not unreasonable to expect a long-term annualized total return of around 6.6%, assuming that ED maintains this dividend growth rate. However, this is not an especially attractive rate of return, given the expected volatility.

Considering the Wall Street consensus outlook, the market-implied outlook, and the fundamentals, I am maintaining my neutral rating on ED.