- Home Depot provided a better-than-feared Q1 report but gave no reason for the market to rally.

- Growth will be hard to achieve this year, but cash flow and capital return will remain solid.

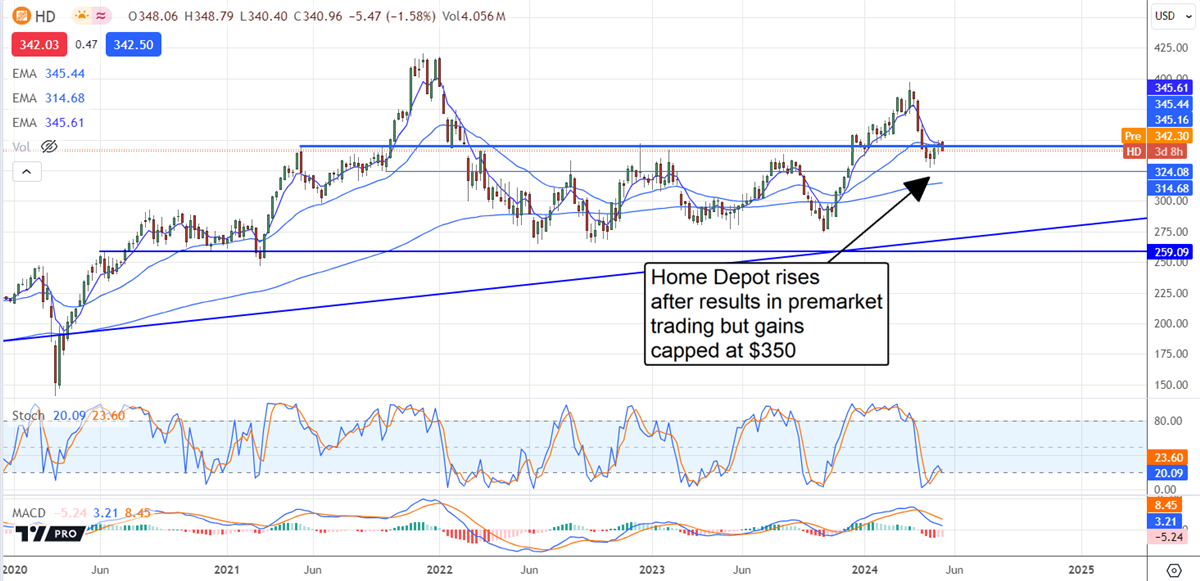

- Analysts capped the upside ahead of the release and may lower their price targets now.

Home Depot (NYSE:HD) issued a mixed Q1 report offering little reason to buy or sell the stock. On the one hand, weaker-than-expected revenue and tepid guidance suggest growth will be hard to come by this year. Conversely, better-than-expected profitability and an outlook for normalized operations suggest that capital returns will continue to flow.

Because HD analysts cap gains, upward movement will be limited for the foreseeable future. Because the stock yields a healthy 2.65% while trading at fair value relative to the S&P 500, support should be solid at the bottom of the range. The takeaway for investors is that Home Depot is a solid discretionary stock to hold while it trades within a long-term consolidation range and one to target for buying on the dips.

Home Depot has Mixed Quarter, Reaffirms Guidance

Home Depot had a mixed quarter, with top and bottom line results diverging from consensus. The company reported $36.4 billion in net revenue, a decline of 2.4% compared to last year. The top line missed consensus by a slim 70 basis points, but a better-than-expected bottom line offsets the weakness. As a point of reference, Home Depot’s Q1 revenue is up 28% compared to Q1 2020, when sales were up 7% on budding pandemic-driven demand.

Revenue weakness is due to poor comps; comparable store sales are down 2.8% and compounded by weakness across the network. Customer transactions are down 1% YOY despite an increased store count; the ticket average is down 1.3%, with sales per square foot falling 3.4%. Management attributes the weakness to a slower start to the spring season than anticipated and cautious consumers. In their view, consumers can spend but aren’t because of high interest rates.

The margin news is mixed. The company’s margins contracted compared to last year but less than expected. The gross profit fell by 1%, while operating income fell by 8.5%. Operating income was impacted by deleveraging sales per square foot and increased costs. The net result is $3.63 in diluted GAAP earnings, down 5% compared to last year but a nickel above the Marketbeat.com analysts’ consensus forecast.

Guidance is another mixed bag. The company reaffirmed its full-year outlook despite the mixed Q1 results. The company expects growth to return by year’s end and drive a 1% increase versus last year. The caveat is that 2024 results include an extra week, and 1% aligns with the consensus outlook; no catalyst for a rally.

However, the guidance expects margins to improve, aiding the capital return outlook. The guidance doesn’t include the impact of a recent acquisition expected to close this quarter. The company is leaning into its Professional services segment with the acquisition of SRS Distribution Inc. The purchase will impact the balance sheet but also increase sales and earnings and potentially widen margins.

Home Depot has Solid Cash Flow, Capital Returns to Continue

Home Depot has solid cash flow and was able to build its cash balance sequentially and compared to last year. Leverage is still high, with long-term debt at 23X equity, but equity is rising, and capital returns are reliable. The dividend payout is about 60% of earnings, allowing for distribution growth in the coming years, although the pace of growth may slow. The dividend is compounded by share repurchases, which reduced the count by 2.1% on average in Q1.

Analysts are unlikely to raise their ratings or targets on this news. The more likely scenario is that recent price target reductions will turn into a trend that weighs on the market over the summer and into Q4.

As it is, the consensus price target implies about 10% upside from the pre-release price points, down on a month-to-month basis, and insufficient for a new high. Assuming the price targets continue to fall, investors should expect solid resistance at $375, if not lower. Shares of HD stock are up in premarket trading but show evidence of resistance at $350. If the market can’t get above that level soon, a move to the bottom of the long-term range, near $280, is likely. A move to that level would align with the long-term trend and present an attractive entry for income investors.