Gold spot prices as well as the SPDR® Gold Trust ETF (NYSE:GLD) and the Sprott Physical Gold Trust (NYSE:PHYS) came under severe pressure as a multi-week triangle was dissolved downwards on September 21st. However, over the last five days gold was able to recover back above US$1,900 and has thus increased the probability for a larger recovery or bounce over the next few days or maybe even weeks.

Review

Starting from the last major panic low on August 16th, 2018, at US$1,160, gold prices almost doubled over the last two years reaching US$2,075 on August 7th, 2020. This sensational two-year bull run must be seen as one big wave, which can of course be broken down into numerous sub-waves! All intermediate consolidations and pullbacks that happened during those two years ultimately served only the typical mass psychological goal of ending this superordinate wave with a parabolic exaggeration (finale).

Accordingly, the first sharp pullback from US$2,075 back down to US$1,861 had an important signal effect and already delivered the trend change in the second week of August. In the following several weeks and within a large of consolidation triangle, the gold bulls were able to push prices towards US$2,015. But their next attempt failed already at US$1,992 USD and hence below the US$2,000 psychological mark. A series of lower highs was formed. On the downside, the zone around US$1,910 to US$1,920 was defended several times, which repeatedly raised new hopes among the still numerous precious metal bulls.

However, on September 21st, six weeks after gold had reached its new all-time high of US$2,075, the bears were finally able to break down the triangle, thus reversing the week-long consolidation in their favor. Gold prices then quickly sold off towards US$1,849 within just three trading days.

As gold’s first sell-off low at US$1,861 from August 12th was recently undercut by a new low of US$1,849, the correction has been formally confirmed with lower highs and lower lows. For the first time in a very long time, the dissolution of the consolidation triangle had given the battered bears some momentum and, above all, new courage.

However, with a short-term double low at around US$1,850 in place, it now looks more likely that the first corrective wave is already over and gold bulls are now trying to stage a bounce or recovery which could push prices back towards and maybe even above US$2,000.

At the same time, the crucial question about how much or what distance of the 2-year wave up will have to be retraced (at least temporarily) remains unanswered. After all, the rise of US$915 in two years has cost the bulls a lot of energy. The fact that such sharp rises have to be digested is completely normal and healthy. After all market participants first have to get used to this higher price level around US$1,750 to US$2,050!

Technical Analysis: Gold in U.S. Dollars

The large two-year uptrend took place within three increasingly steepening trend channels. By the end of August, gold had already left the steepest of these upward-trend channels in a downward direction. Due to this bearish development alone, a return to the upper edge of the next lower uptrend channel is very likely. Currently, this upper edge runs around US$1,770. The upper edge of the very first and shallowest uptrend channel is currently sitting far away at around US$1,625.

If one connects the new all-time high at US$2,075 with the most recent high at US$ 1,972, the resulting downtrend line currently around US$1,935 represents an important resistance for the bulls. Any recovery is likely to be slowed down or could even stop here for the time being.

Weekly Stochastic Oscillator is on a sell signal

Furthermore, the Stochastic Oscillator on the weekly chart makes it quite clear that the ongoing correction is not over yet. Although the heavily overbought setup has been negated, the momentum still points downwards as a reversal signal is missing so far. In view of the extremely strong two-year uptrend, it would be typical for the pendulum to swing a bit more clearly in the opposite direction, at least temporarily. In this respect, a heavily oversold weekly stochastic would probably be the best means to clear the gold market of its previous exaggerations.

In summary, the weekly chart is bearish. The gold market is in a correction, the end of which is not yet in sight. Realistically, we should assume a correction over time and in price. The minimum Fibonacci retracement (38.2%) of the two-year rally sits at US$1,725. The 61.8% retracement would mean a pullback towards US$1,510! Furthermore, after two years of upward movement, the bears will certainly want to run for a little longer than just two months. We should allow the correction to last at least four to five months. Depending on how the macro situation and geopolitics develop, a longer period would also be conceivable in principle. However, given the intensifying crack-up boom and the increasingly rapid loss of confidence, we are already in the acceleration phase. In this respect, a protracted and extremely complicated correction would be rather unlikely.

While the weekly chart calls for patience and caution, the daily chart was recently more oversold than at the low point of the corona crash in mid-March. A recovery or a somewhat larger countermovement is therefore very likely to occur. A first bouncen towards US$1,917 has already happened. However, as long as all this takes place below US$1,940, the new downtrend is not at risk at all. At US$1,935, the 38.2% retracement of the previous downtrend is waiting. Hence, prices above US$1,935 to 1,945 would probably unleash a much greater recovery in the direction of US$1,985 to 2,000.

At the same time, neither panic nor fear could be detected among market participants at the recent low at US$1,849. As well, at US$1,849, the gold price had not reached any significant support on the downside either. Such a support would wait around US$1,800.

The 200-day moving average (US$1,734) would also be a very realistic target. Currently, this moving average rises by about US$2 per trading day. In other words, by the time of the US election, the 200-day moving average should have risen to around US$1,790 and could considerably strengthen the support zone around US$1,800.

Overall, the daily chart currently raises more questions than it answers. In any case, it is clear that a bounce from the oversold situation has started. Thus, rising prices are more likely in the short-term. However, the weekly chart contradicts the daily chart one timeframe higher. In this respect, a possible recovery is likely to be merely a countertrend movement within the overall downtrend. Once the recovery has run its course another corrective leg down towards US$1,800 should be expected.

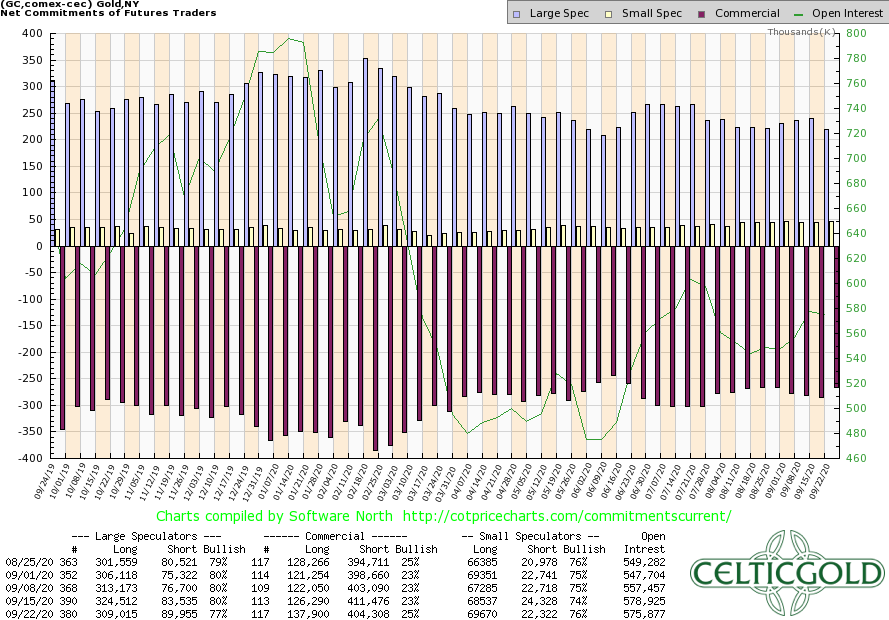

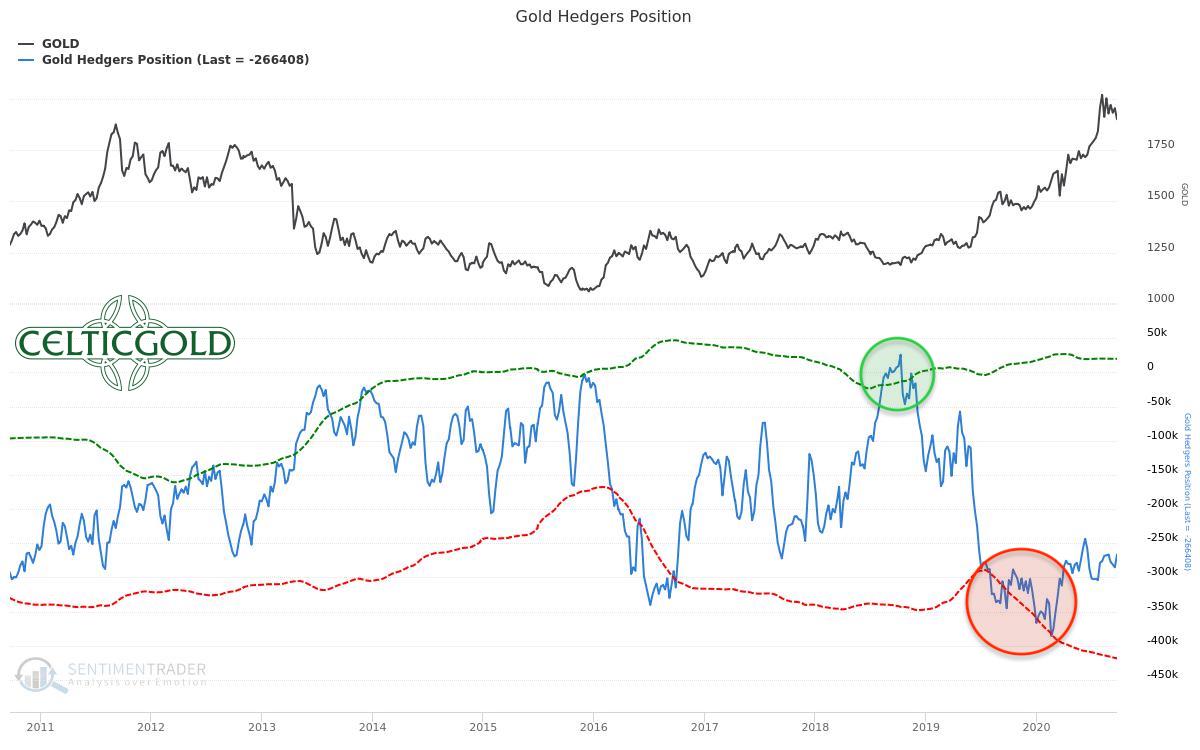

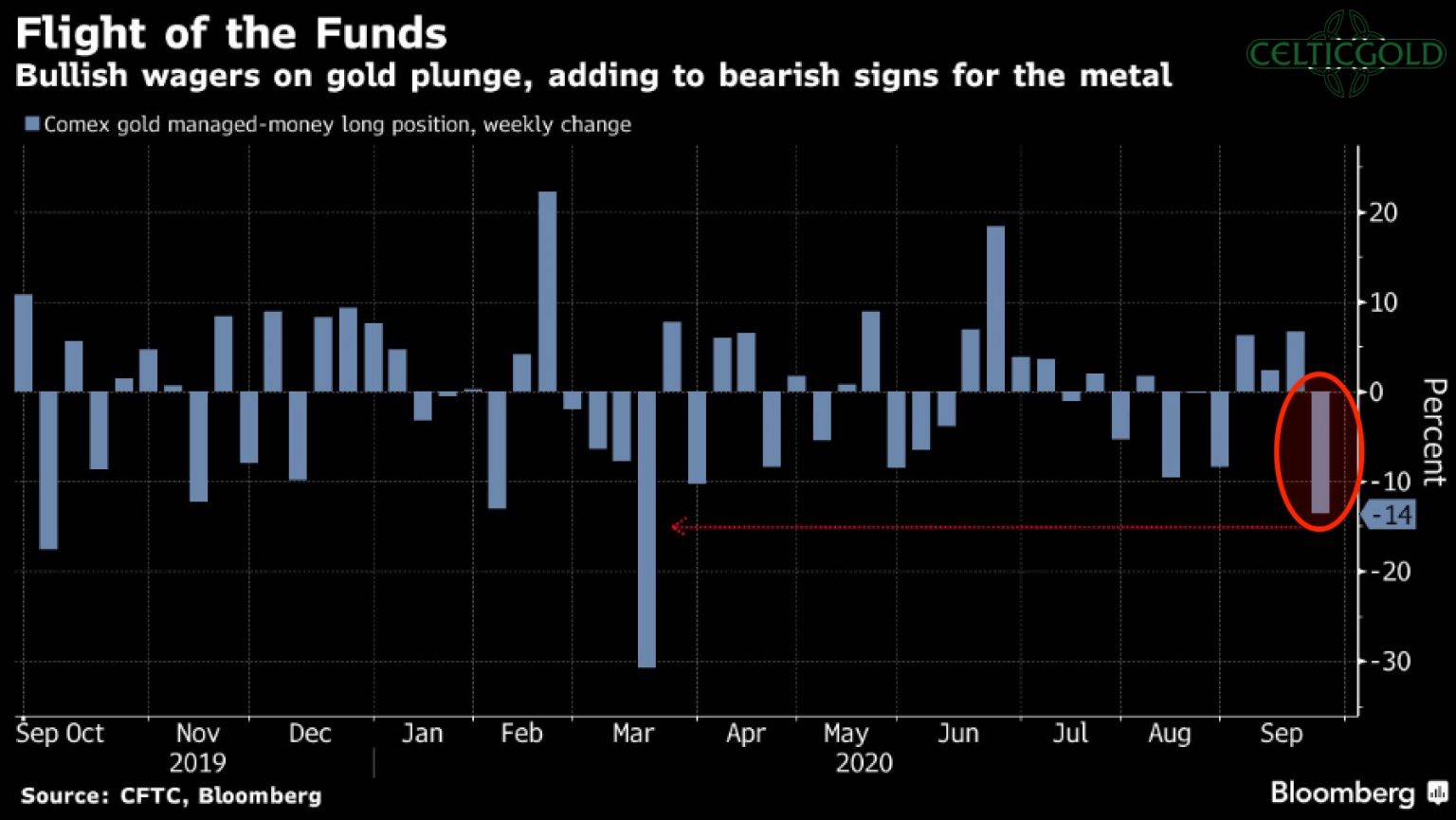

Commitments of Traders

Commercial traders took advantage of last week’s price slide and slightly reduced their accumulated short position. Overall, however, according to the latest CoT Report, this group of traders still holds an extremely high short position of 266,408 short contracts.

Thus, the CoT report is far away from an anti-cyclical buy signal, which usually occurs from a commercial short position of maximum 100,000 short sold contracts.

What makes matters worse is that recently the hedge funds have been fleeing the gold market again and gradually closing their bets on higher prices.

In summary, and only in the isolated perspective of the CoT report, the set up continues to provide a clear sell signal, as it has for over a year already, and continues to signal the need for a larger correction.

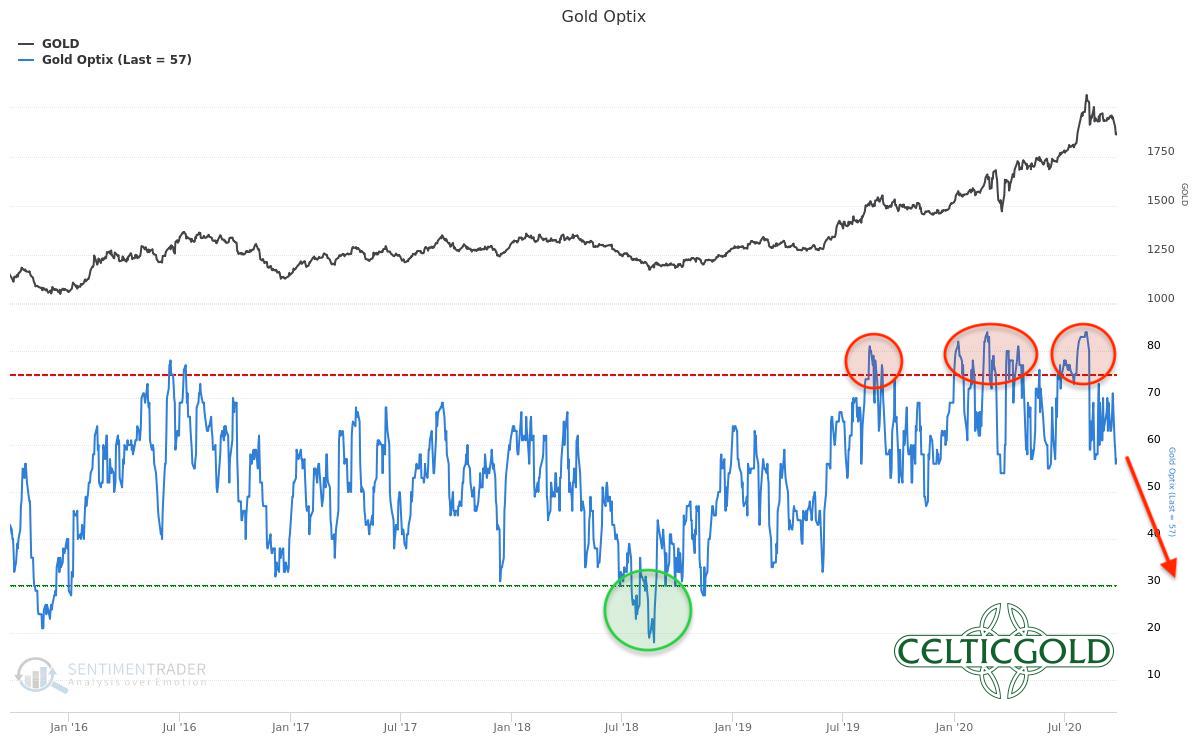

Gold Sentiment

The fact that the mood on the gold market has changed in recent weeks should have got around by now. Nevertheless, there are no signs of surrender fear and panic.

It can therefore be concluded that the gold price will have to fall a good deal more. Only then will fear and panic return to the gold market. And only then will the chances for a sustainable bottom rise steeply.

Seasonality: Gold

The presidential elections in the USA on November 3rd are slowly but surely entering into the hot phase. At the same time, the disputes are heating up every day. The hostile party camps are irreconcilably facing each other. We already feared months ago, the imponderables are constantly increasing. But the financial markets do not like uncertainty at all. Accordingly, both the stock markets and the precious metals have been under increasing pressure for weeks. Most recently, concerns about a renewed corona lockdown and a possible government shutdown in the USA were cited as possible reasons.

Statistically speaking, the weeks leading up to the US election are in any case a difficult time for the gold price. We had already pointed this out in our May analysis. In the past, the gold price was simply never allowed to really rise before the respective US elections. Instead, it was often beaten down, because otherwise the golden thermometer would signal that something was rotten in the system or in the state of the USA. The eternal fight between the Red and Blue Team must continue without the US citizen realizing that the whole thing is basically just a big show and that the outcome of the election will not change much anyway.

It becomes interesting if we take a closer look at what had happened in the gold market win front of the last three US elections.

- 2008 Obama vs. John McCain: From a high of US$990 in mid-July, the price of gold did fall over 30% and reached a low at US$ 681 end of October. The election took place on November 4th, 2008. Only from the 20th of November the gold prices start to rise sustainably again!

- 2012 Obama vs. Mitt Romney: From the high at US$1,790, within 4 weeks gold prices fell like a stone down to US$1,672 USD on November 5th. On November 6th, 2012 Obama won the election.

- 2016 Donald Trump vs. Hilary Clinton: On July 11th gold price topped at US$1,375 and fell back to US$1,241 USD on October 7th 2016. Until the election on November 8th, the gold market did not get back on its feet sustainably. After the election of Donald Trump, gold price collapsed completely and did not reach the final low at US$1,123 until December 15th!

Until at least the end of October, the seasonal component in US election years is therefore negative for the gold price. In addition, in recent years, the gold market has often seen a trend reversal to the upside in mid-December. In this respect, seasonality is a reminder of patience and restraint. Only when the US election is over and the stock markets rise again (usually about a week after the election) will it become clearer whether gold has also ended its correction or whether it might need a few more weeks until the trend reversal.

Bitcoin/Gold Ratio

At current prices of US$10,550 for one Bitcoin and USD 1,902 for one troy ounce of gold, the Bitcoin/Gold ratio is currently 5.55, meaning that you have to pay almost 6 ounces of gold for one Bitcoin. In other words, a troy ounce of gold currently costs 0.18 Bitcoin. This means that the Bitcoin/Gold ratio is moving clearly upwards again after the successful breakout from the two-and-a-half-year consolidation triangle. Therefore, Bitcoin is again outperforming the gold price! This trend should continue and accelerate in the coming months and especially presumably also in the coming years.

Generally, buying and selling Bitcoin against gold only makes sense to the extent that one balances the allocation in the two asset classes! At least 10% but better 25% of one’s total assets should be invested in precious metals (preferably physically), while in cryptos and especially in Bitcoin, one should hold at least 1% but not. more than 5%. Paul Tudor Jones holds a little less than 2% of his assets in Bitcoin. If you are very familiar with cryptocurrencies and Bitcoin, you can certainly allocate higher percentages to Bitcoin and maybe other Alt-coins on an individual basis. For the average investor, who usually is primarily invested in equities and real estate, 5% in the highly speculative and highly volatile bitcoin is already a lot!

“Opposites compliment. In our dualistic world of Yin and Yang, body and mind, up and down, warm and cold, we are bound by the necessary attraction of opposites. In this sense you can view gold and bitcoin as such a pair of strength. With the physical component of gold and the digital aspect of bitcoin (BTC-USD) you have a complimentary unit of a true safe haven in the 21st century. You want to own both!”– Florian Grummes

Conclusion and Recommendation

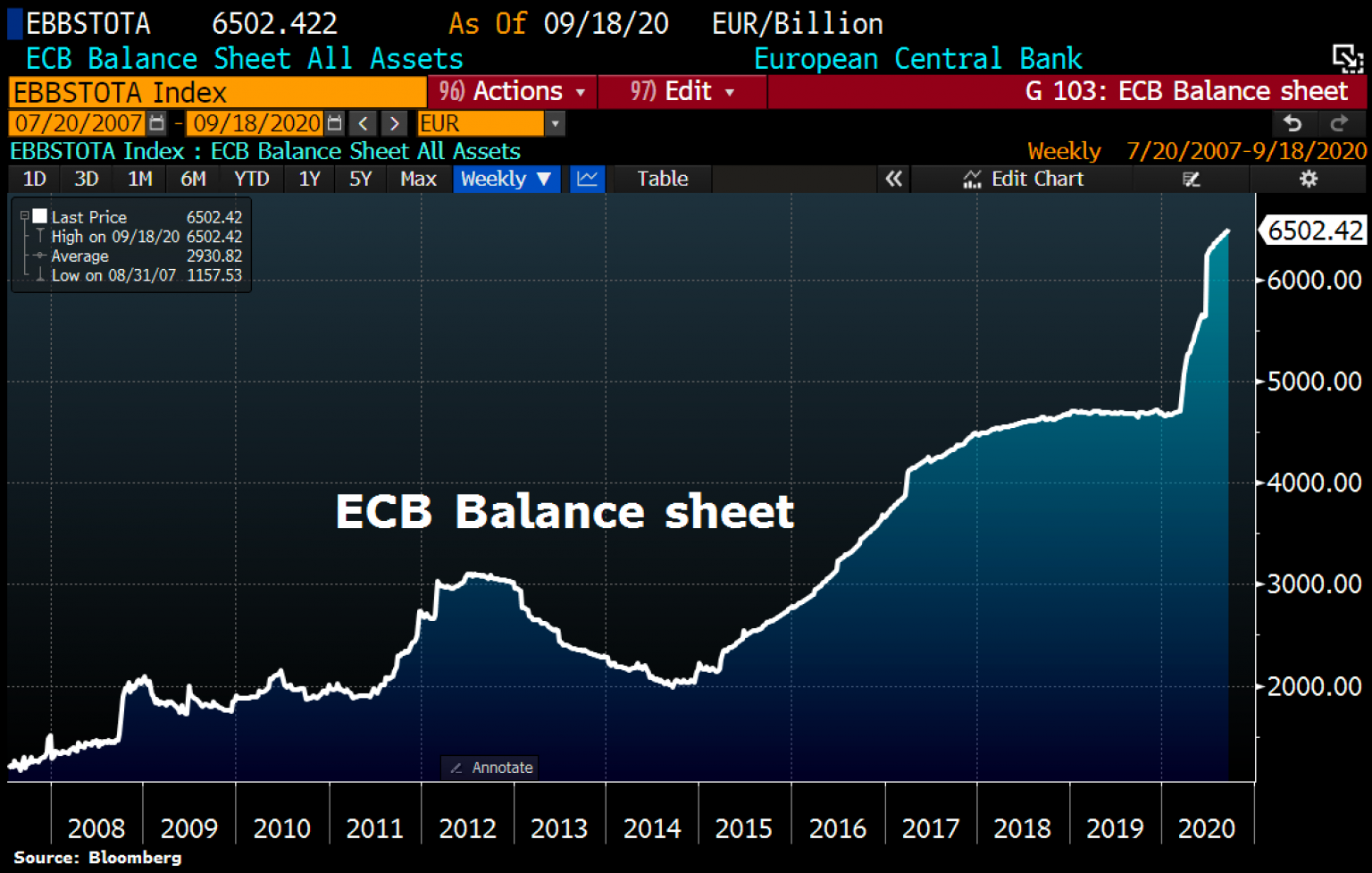

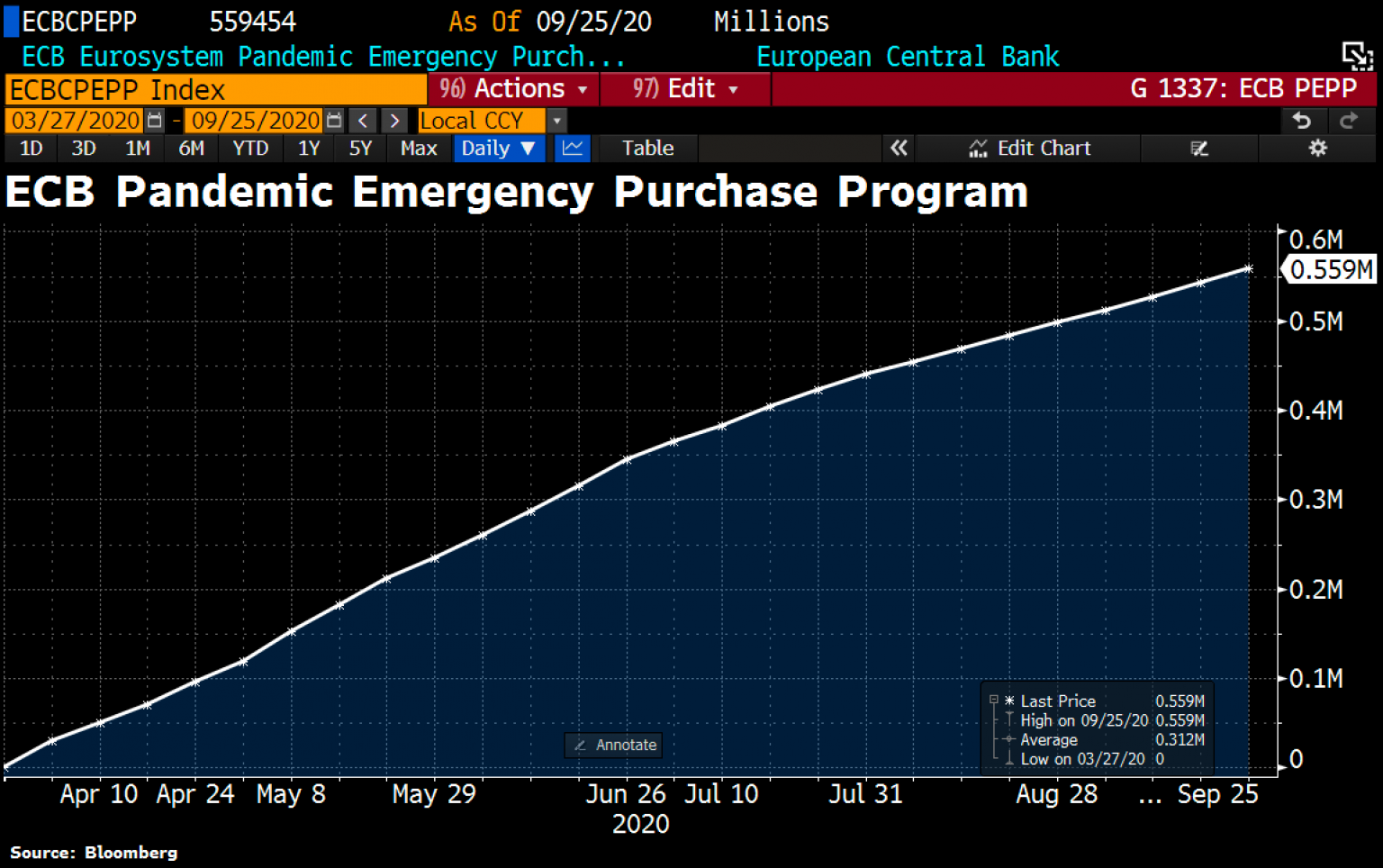

In the last six weeks, the ECB’s balance sheet total has continued to swell by almost EUR 160 billion. Madame Lagarde is thus maintaining her rhythm of currency creation at EUR 10 to 30 billion per week!

Incidentally, the European Central Bank had already set up the “Pandemic Emergency Buying Program” (PEPP) in spring to cushion the consequences of the Corona crisis. Most recently, due to the increase in the number of shares purchased to EUR 1.35 trillion, the well-known political divisions within the ECB have recently been clearly and publicly broken up again. Since the ECB bought up Italian bonds to a greater extent than those of other countries during spring, the justified accusation of a debt union is once again in the air. After all, financing the EU budget through debt should remain a clearly limited crisis measure and not open the door to continuous borrowing by the EU. Now the hawks in the ECB also wanted to tacitly reduce the pace of PEPP purchases.

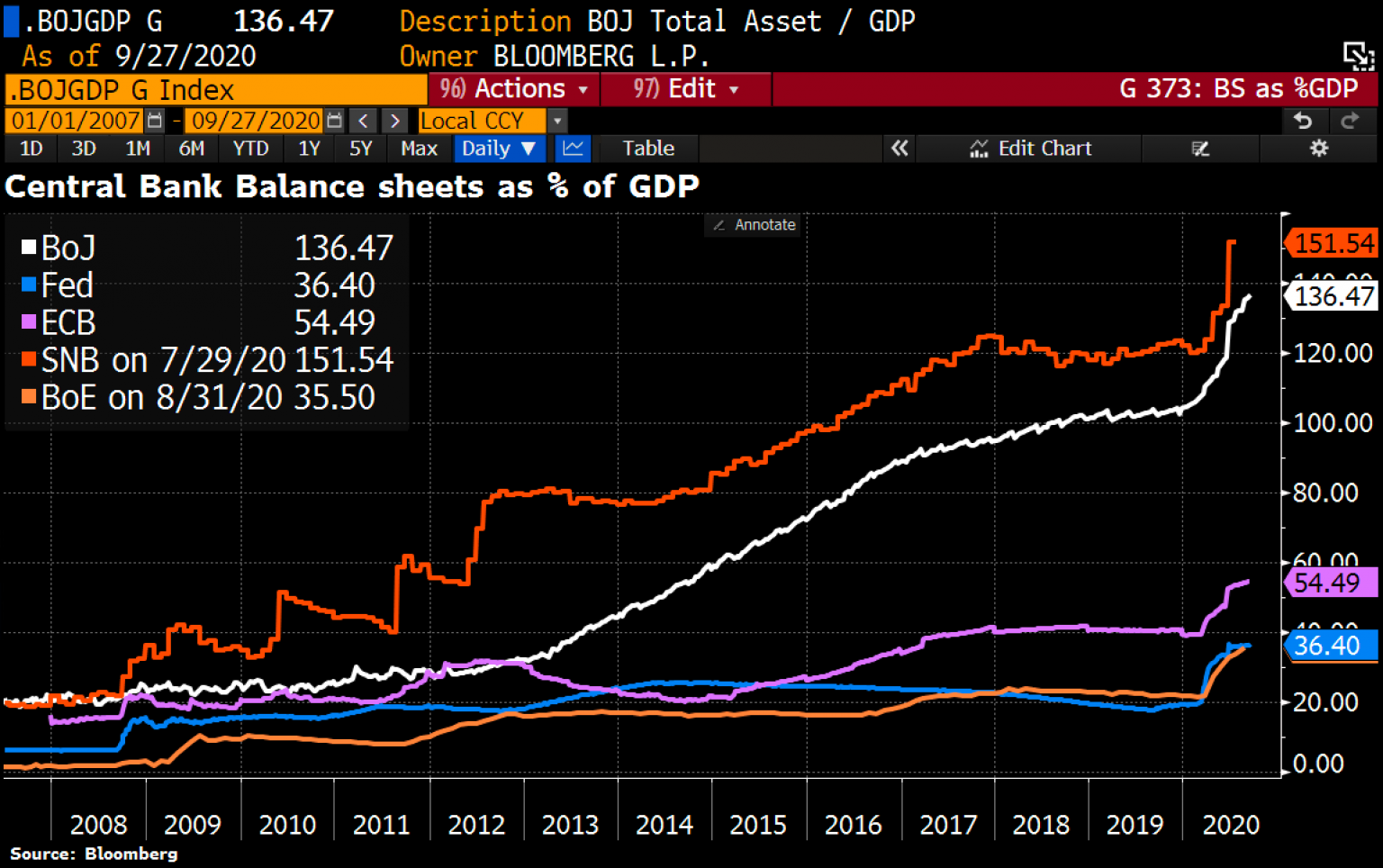

Meanwhile, however, the biggest money experiment in history continues unhindered and uninhibited worldwide. When will we reach the point where confidence in central banks collapses because too much currency was created out of nothing? Currently, the Swiss National Bank is leading the race with a balance sheet total of 150% of gross domestic product, just ahead of the Bank of Japan (140%). In contrast, the ECB balance sheet at 54.5% and the Fed balance sheet at 36.4% are still relatively manageable and give reason to fear that further huge balance sheet expansions are yet to come in these two currency zones!

Since all central banks worldwide are constantly pursuing an excessively expansive monetary policy, while at the same time all economic areas are being hit hard by a recession in the respective real economy, the loss of confidence in the respective central bank money continues to progress daily. All this leads slowly but surely to rising and at some point uncontrolled inflation expectations.

For the gold price, these ongoing monetary expansions are of course the ideal breeding ground. In this respect, it can already be assumed with extremely high certainty that the ongoing correction will only be a correction in a much larger bull market. Price forecasts of US$1,000 and lower are therefore completely frivolous and can only be imagined in the event of a complete deflationary collapse of the global financial markets.

Best- and Worst-case scenario

At the same time, however, we have to realize honestly and soberly that the gold price currently has to digest and correct a US$915 rise within two years, both over price and over time. Even if the bears in the gold market could only temporarily recover a third of the distance lost, this would already mean a price drop towards US$1,770. In terms of time, a minimal correction would take about five to seven months. If we combine this to form a “best case”, prices can be expected to drop slightly below US$1,800 into December.

The “worst case” scenario, on the other hand, would even include at least a “two-thirds discount”, which would mean that the corona low (US$1,451) would be seen again in the range around. In terms of time, we would probably have to prepare ourselves for a correction of one to one and a half years in this scenario.

From a technical perspective, at least a return to the rising 200-day moving average (US$1,726) is extremely likely. The faster this is expected to happen, the lower the gold price will have to fall currently. However, if the correction is protracted due to countertrend movements and recoveries (like right now), the moving average should have risen to higher levels in the meantime. The only thing that seems certain is that only prices around and especially below US$1,800 should cause fear and panic in the gold market. As soon as this happens, the sentiment would be cleared up again and contrarian entry opportunity would present itself.

Expect a rather difficult environment for precious metals until December

In summary, over the next five weeks, and probably into December as well, we can expect a rather difficult environment for precious metals. After this summer’s epic rally, all weak hands must first be washed off board. At the same time, however, a lot of impatient money is waiting on the sidelines, pushing into the gold market at lower prices not wanting to miss the presumably “last deep buying opportunity”.

From mid-November onwards, however, tax loss selling could temporarily create additional pressure in the sector, because despite the huge increases for the year as a whole, almost all purchases of precious metal stocks in the last two to three months are likely under water. If gold corrects one or two levels lower, small investors will close out these positions with a loss.

In the big picture, the crack-up boom will of course continue and the loss of confidence in the respective currency will accelerate worldwide. Already next year, new all-time highs for gold and silver are conceivable and realistic!