Just for the fun of it and since we did not include it in our Outlook 2024, I decided to have a look at what experts are saying concerning mushrooms, cannabis, and hemp.

After all, recreational and medical alternatives as investments, have been huge underperformers and a bit of a legend in their own minds.

As I looked around, I saw predictions for increasing sales of pre-rolls, reduction of THC percentages in products to encourage more sales, improving medical benefits and the continuing rise of mushrooms as contenders.

What caught my eye though was this:

“In 2024, hemp beverages will do more to normalize cannabis in the minds of the consumer than any other form factor.”

Kenny Morrison

Founder

CQ is a beverage company that makes hemp-infused juices and sodas.

The cans are fun. The message is “Crafted from the highest quality ingredients, expect a refreshing infusion of real fruit and terpene-rich cannabis for a deliciously juicy buzz.”

They are not though, publicly traded.

Hemp, I mean hence, I looked up four stocks I found surprising technically and perhaps great for the new year to add to your portfolio.

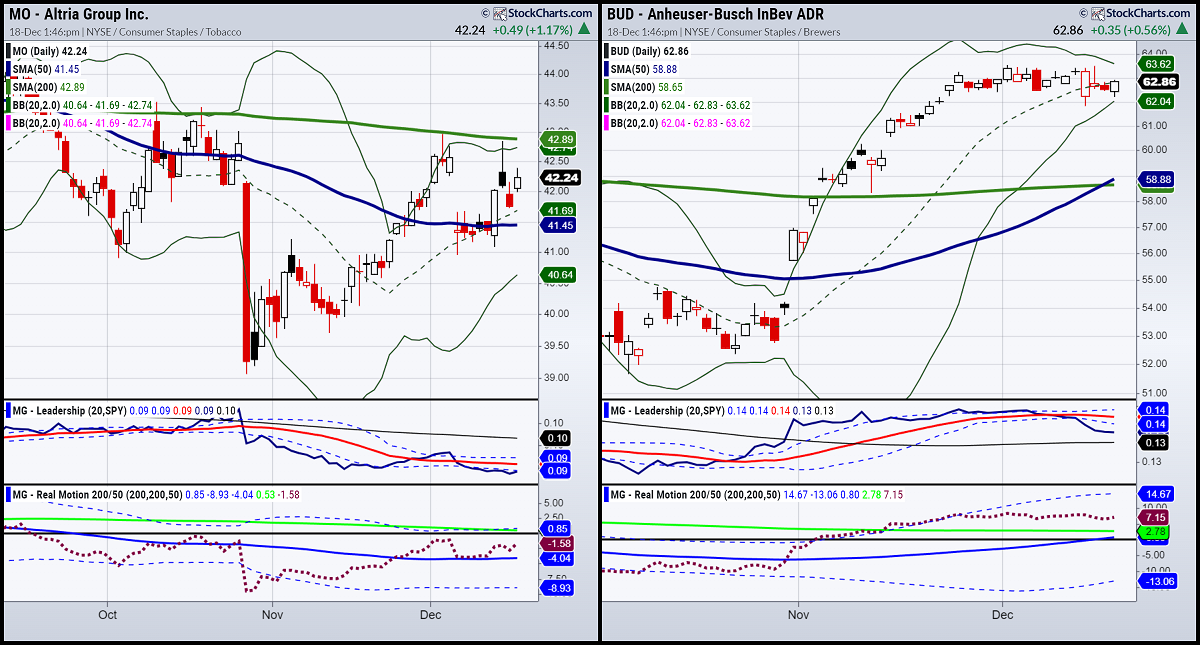

Altria (NYSE:MO) came up in my search for companies that sell hemp and other infused companies.

Underperforming SPY and yet an improved phase change to recovery tells me this is one to watch.

MO spent all of 2023 under the 23-month moving average. Watch for a move over 46.00.

Anheuser-Busch InBev (NYSE:BUD) looks better.

Also, underperforming SPY, check out that golden cross.

Momentum is interesting as well, watch this one on a weekly close over 65.00.

Molson Coors Beverage (NYSE:TAP) had a huge drop from the highs last week. However, the longer-term charts look fine.

Some volume and a shove back over 64.00 looks interesting.

AbbVie Inc (NYSE:ABBV) looks the best right now. This is outperforming SPY and momentum is super strong.

Why ABBV? Marinol, a compound known as dronabinol, is a synthetic form of THC that shows the promise of cannabis as a treatment.

More importantly, is it a direct sign of traditional pharma navigating the alt treatment space.

Over 155 could easily take this to 175 or beyond.

For educational purposes, only-all trading comes with risk.

ETF Summary

- S&P 500 (SPY) 475 resistance 465 underlying support

- Russell 2000 (IWM) 200 resistance and 194 support

- Dow (DIA) Strongest index and needs to hold 370

- Nasdaq (QQQ) 410 resistance with support at 395

- Regional banks (KRE) 47 support 55 resistance

- Semiconductors (SMH) 174 pivotal support to hold this month

- Transportation (IYT) Needs to clear these highs and hold 250

- Biotechnology (IBB) 130 pivotal support

- Retail (XRT) Huge gap up last 2 days of the week that now needs to hold.