By Peter Nurse

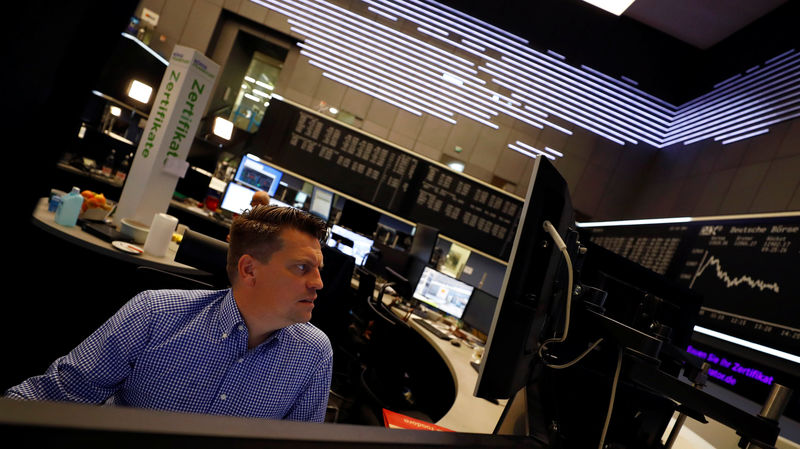

Investing.com - European stock markets are set to edge higher Thursday, after Wednesday’s sharp losses to start the month, but the tone remained cautious as investors awaited key U.S. unemployment data.

At 2:15 AM ET (0615 GMT), the DAX futures contract in Germany traded 1.7% higher. France's CAC 40 futures were up 0.4%, while the FTSE 100 futures contract in the U.K. rose 0.5%.

The three cash indices all posted losses of around 4% Wednesday as the damage done by the virus outbreak continued to weigh on investor sentiment.

The Covid-19 pandemic has shown few signs of abating Thursday, with global cases on track to hit one million within a day or two, stretching across more than 200 countries.

It’s Europe where the most deaths have been recorded, with Italy leading the way with over 13,000 and Spain just behind with over 9,000 fatalities.

That said, the attention is now shifting to the U.S., after President Donald Trump's recent grim press briefing, in which he warned Americans of a "painful" two weeks ahead.

The starkest evidence of the economic damage caused came last week when weekly U.S. initial jobless claims, one of the earliest gauges of economic trends, jumped to 3.28 million, blowing past the previous record of 695,000 set in 1982.

This week, the numbers could well be worse.

Economists expect claims for first-time unemployment benefits to have jumped by 3.5 million last week, when the figures are released at 8:30 AM ET (1230 GMT).

The forecasts in a Reuters poll range from 1.5 million to 5.25 million.

In corporate news, Delivery Hero (DE:DHER), one of the world's top online food delivery marketplaces, announced measures Thursday to support restaurants that are trying to survive coronavirus lockdowns by ramping up deliveries to consumers stuck at home.

French food services and catering company Sodexo (PA:EXHO) could be in the spotlight after senior managers agreed to pay cuts, which it said would help fund a 30-million-euro ($33-million) program to aid staff facing lay-offs as a result of the crisis.

Credit Agricole (PA:CAGR) has decided to cancel the 2019 dividend following a recommendation from the European Central Bank. This follows similar steps taken by many of its European peers.

Oil markets bounced strongly Thursday after President Trump stated late Wednesday that Russia and Saudi Arabia would make a deal to end their price war within a "few days".

Global oil prices have fallen by roughly two-thirds this year as the coronavirus has slammed global economies at the same time major producers Saudi Arabia and Russia have started to flood the market with oil.

At 2:15 AM ET, U.S. crude futures traded 7.9% higher at $21.91 a barrel. The international benchmark Brent contract rose 10% to $27.33.

Elsewhere, gold futures fell 0.4% to $1,597.40/oz, while EUR/USD traded at 1.0947, down 0.1% on the day.