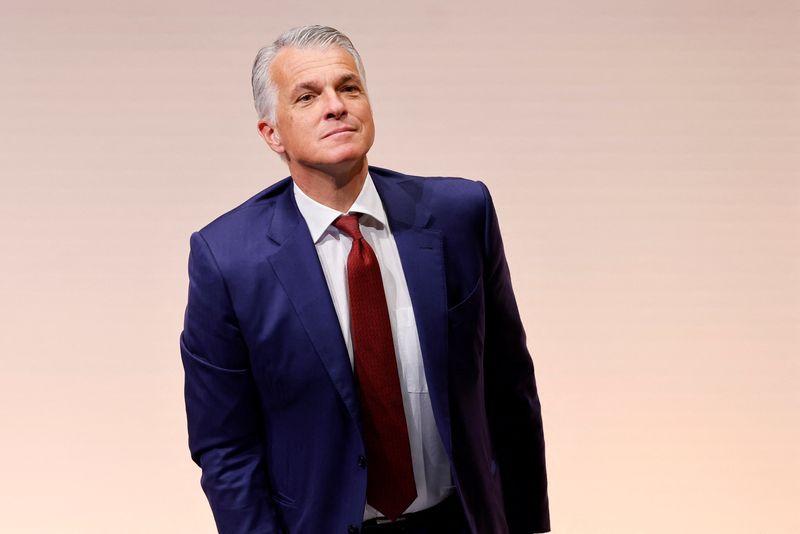

(Reuters) - Incoming UBS Chief Executive Sergio Ermotti has sought to ease worries about the size of the new bank being created by its takeover of Credit Suisse.

Critics have voiced concern about the forced deal, designed to help secure financial stability globally during a period of turmoil, which will create a new Swiss bank with $1.6 trillion in assets and more than 120,000 staff.

"Even putting UBS and Credit Suisse together, we won't be at the top of the classification for international banks in terms of size," Ermotti said in an interview with Italian business daily Il Sole 24 Ore.

"We have a good position thanks to our activities, and our greater critical mass at a global level will certainly give us another advantage. The question of excessive size does not arise," added Ermotti, who is Swiss but an Italian speaker.

Ermotti, who was previously chief executive of UBS from 2011 to 2020 and is now chairman of insurance group Swiss Re (OTC:SSREY), will take the helm at the bank from April 5.

He indicated that the combined bank would stick to the successful UBS strategy.

"I maintain that the model should be that of the current UBS whose core features include a central role for wealth management activity and the containment of investment banking and its related risks," he added.

In Switzerland, the public and politicians have also voiced concerns about the level of state support for the banks, with nearly 260 billion Swiss francs ($284 billion) in liquidity and guarantees offered by the government and Swiss National Bank.

"If you look at the full framework for the acquisition, I think you can say that the guarantees from the National Bank and Confederation are reasonable," Ermotti said.

($1 = 0.9148 Swiss francs)