By Stephen Nellis and Chavi Mehta

(Reuters) -Chipmaker Intel Corp (NASDAQ:INTC) said on Thursday it still faces supply chain constraints and gave an annual sales forecast that implied a weak end of the year.

The 2021 forecast of $73.5 billion in adjusted sales was higher than Wall Street expectations, appeared driven by a strong second quarter ended June 26 and a modestly better-than-expected third-quarter, implying a weak fourth quarter. The results sent shares down 2.8% in after-hours trading after the results.

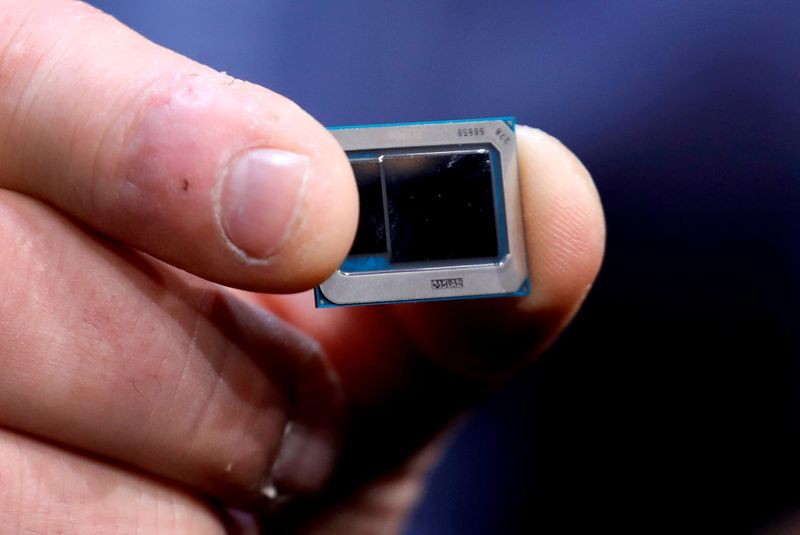

Intel, one of the few remaining companies in the processor chip industry that both designs and manufactures its own chips, has been able to weather the supply chain woes better than some rivals and is also working to build a business of making chips for others, called a "foundry" business.

Intel Chief Executive Officer Pat Gelsinger declined to comment on a recent report that Intel is looking to buy GlobalFoundries for $30 billion to bolster its foundry efforts but told Reuters that he expects industry consolidation to continue and that "M&A will remain a part of our strategy" for building the company's foundry business.

Intel raised its previous annual forecast $1 billion from its earlier $72.5 billion and beat expectations of $72.80 billion, according to Refinitiv IBES data. Intel expects adjusted third-quarter revenue of about $18.2 billion, only modestly above estimates of $18.09 billion, according to Refinitiv data.

"I think investors simply expect more from semiconductor companies in this environment," said Logan Purk, an analyst at Edward Jones "Even though they did increase revenue guidance, it was only about a 1% increase. A bulk of the change in earnings guidance was due to a lower tax rate."

Gelsinger said Intel could sell more chips if it could make more chips. Even though the company runs its own factories, it still faces supply constraints from its own suppliers of materials and equipment.

"We are helping them build factories as fast as they can," Gelsinger told Reuters. "But it will be one of those things that just takes a couple years to fully catch up to this explosive demand we’re seeing, and we have better tools to address it than others."

But some analysts do not agree with Intel's rosy view of end demand. Citing a tame forecast this week from Texas Instruments (NASDAQ:TXN) Inc, Kinngai Chan, analyst at Summit Insights Group, disputed Gelsinger's view of the market and said Intel was likely to keep "playing defense" against rivals like AMD with better chips.

"We think the entire semiconductor supply chain will be caught up by 4Q21 as we believe there's rampant double ordering in the supply chain coupled with a moderating end-market demand," Chan said.

For the just-ended second quarter, Intel reported $18.5 billion in adjusted sales, well above analyst estimates of $17.80 billion, according to Refinitiv data.

Taking the second and third quarter into account, Angelo Zino, analyst at CFRA Research, said that Intel's slightly higher full-year forecast implied a shortfall in fourth-quarter sales versus previous forecasts - despite the fourth-quarter usually being one of the company's best quarters as consumers snap up laptops and PCs as holiday gifts. Intel did disclose that a one-time charge of $300 million will hit the fourth quarter, saying it was related to its business of selling supercomputers to the federal government.

Gelsinger, however, told investors on a conference call that he expects the PC market to keep growing into 2022, contradicting the predictions of some analysts.

Revenue from the company's higher-margin data center business fell 9% to $6.5 billion in the second quarter, while its personal computing business revenue rose 6%, both beating Refinitiv estimates.

On an adjusted basis, the company earned $1.28 per share in the second quarter, compared with estimates of $1.06, according to Refinitiv data.