By Scott Murdoch and Carolina Mandl

SYDNEY/NEW YORK (Reuters) - U.S. regulators may have stemmed a banking crisis by guaranteeing deposits of collapsed Silicon Valley Bank (SVB), but some experts warn that the move has encouraged bad investor behaviour.

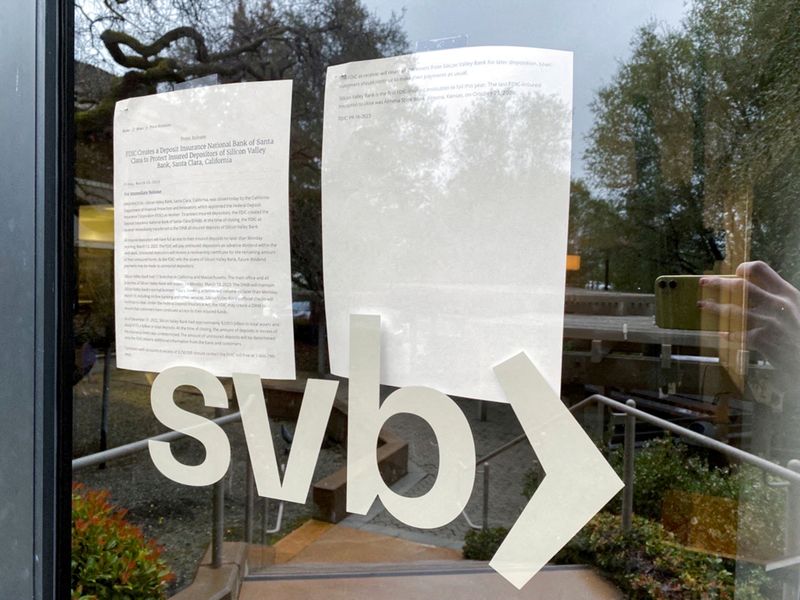

Following a weekend of discussions over the future of SVB owner SVB Financial Group, banking regulators unveiled emergency funding plans for the bank.

Billionaire hedge fund manager Bill Ackman wrote on Twitter that if authorities had not intervened, "we would have had a 1930s bank run continuing first thing Monday causing enormous economic damage and hardship to millions."

"More banks will likely fail despite the intervention, but we now have a clear roadmap for how the gov't will manage them."

Yet by guaranteeing that depositors would lose no money, authorities have again raised the question of moral hazard - removal of people's incentive to guard against financial risk.

"This is a bailout and a major change of the way in which the U.S. system was built and its incentives," said Nicolas Veron, senior fellow at the Peterson Institute for International Economics in Washington. "The cost will be passed on to everyone who uses banking services."

"If all bank deposits are now insured, why do you need banks?"

Separately, officials said depositors of New York's Signature Bank (NASDAQ:SBNY), which the New York state financial regulator closed on Sunday, would also be made whole at no loss to the taxpayer. Also, the Federal Reserve made it easier for banks to borrow from it in emergencies.

"... If the Fed is now backstopping anyone facing asset/rates pain, then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard," Rabobank bank strategists Michael Every and Ben Picton wrote in a note to clients.

DEPOSIT INSURANCE

Because only the first $250,000 of each deposit at a U.S. bank is insured by the Federal Deposit Insurance Corporation (FDIC), last week's collapse of SVB sparked concerns that its small-business clients would be unable to pay employees. Some 89% of around $200 billion in deposits held by SVB at the end of 2022 was uninsured, according to the FDIC.

Regulators have now removed that risk.

But in doing so "they took another step towards demonstrating that they are unwilling to allow free markets to sort themselves out," said Toronto-based independent proprietary trader Kevin Muir.

Some analysts said the U.S. actions were not a bailout, because shareholders and unsecured debtholders of SVB would not be covered.

"It's certainly a stress relief in the short-term, and we can worry about moral hazard and lax regulation later," said Steve Sosnick, chief strategist at Interactive Brokers (NASDAQ:IBKR) in Connecticut, referring to the regulators' actions.

"Stock and bond holders in SVB and Signature are likely wiped out. That's a lot of money that simply evaporated, which has to hurt someone. It won't fully remove the worries about what other banks might be in trouble."

The regulators' moves pushed up U.S. stock futures in Asian trade on Monday, but investors wagered that, amid the financial nervousness, a U.S. interest rate rise this month was no longer a certainty.