By Brendan Pierson

NEW YORK (Reuters) - Two former Deutsche Bank AG (DE:DBKGn) traders will serve no prison time for conspiring to manipulate the Libor benchmark interest rate between 2005 and 2011, a federal judge ruled on Thursday, sharply criticizing U.S. prosecutors for treating the two men as "proxy wrongdoers" for a much larger scheme.

Matthew Connolly, who once led Deutsche Bank's pool trading desk in New York, was sentenced by U.S. District Judge Colleen McMahon in Manhattan to six months' home confinement, while Gavin Campbell Black, who worked on the bank's London desk, was sentenced to nine months' home confinement, which he will be allowed to serve in England.

McMahon also ordered Connolly to pay a $100,000 fine, and Black to pay a $300,000 fine.

The sentence is a setback for U.S. prosecutors in one of the few criminal cases to emerge from a sweeping probe of Libor rigging. The prosecutors had asked the judge to order "substantial" prison time for both men, saying federal guidelines called for close to 10 years, along with a $3 million fine for Connolly and a $2 million fine for Black.

McMahon, however, said the prosecutors were trying to hold Connolly and Black responsible for behavior throughout the financial industry.

"I do think it is fair to say that the government has used Mr. Connolly and Mr. Black ... as proxy wrongdoers," she said.

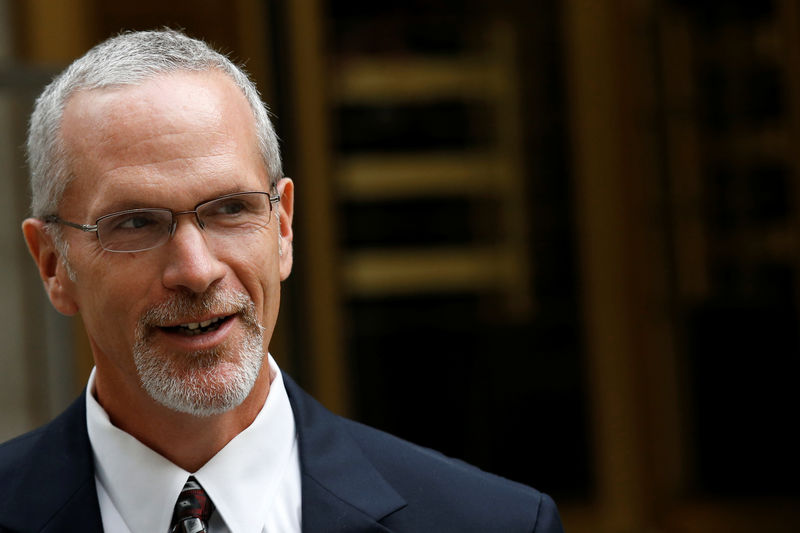

"We're pleased with the court's ruling," Kenneth Breen, Connolly's lawyer, said after the sentencing. Black's lawyer, Seth Levine, had no immediate comment.

A spokesman for the U.S. Department of Justice declined to comment.

Libor, or the London interbank offered rate, underpins trillions of dollars of financial products and is based on what banks say they believe they would pay if they borrowed from other banks. It is to be phased out by 2021.

Investigations into whether banks manipulated Libor have led to billions of dollars in global settlements with financial institutions and U.S. and UK cases against several people.

Two former Rabobank traders were sentenced to prison in the United States, but their convictions were thrown out on appeal.

Connolly was the first U.S. citizen charged with Libor rigging. In a 2016 indictment, prosecutors said that from 2005 to about 2011, he, Black and others conspired to submit false estimates for U.S. dollar Libor rates to manipulate the rate for their own gain.

Deutsche Bank agreed in April 2015 to pay $2.5 billion to resolve U.S. and UK investigations of Libor rigging.