By Sagarika Jaisinghani

(Reuters) - European shares retreated after an initial bounce on Tuesday as damage being heaped on companies and economies across the globe from the coronavirus grew and kept financial markets on edge.

Sharp restrictions on large gatherings, shutdowns of major cities and disruptions to business supply chains are taking a toll on corporate Europe. The world's biggest catering firm Compass Group (L:CPG) and automaker Volkswagen Group (DE:VOWG_p) were the latest to warn of a hit from the pandemic.

Compass tumbled 22.2% and Volkswagen dropped 3%.

The pan-European STOXX 600 index (STOXX) was down 1.1% after rising as much as 3.7% in early trading, following a dramatic sell-off on Monday that dragged it to levels last seen in 2012.

"With the news flow evolving quite rapidly and liquidity tight, we're likely to see continued bouts of volatility, which suggests that it's not a particularly sensible time to be trying to do anything too aggressive from a trading perspective," said Toby Gibb, head of investment directing at Fidelity International in London.

"It is absolutely going to create a lot of (buying) opportunities, but it doesn't feel like a good time to be locking in losses."

All of the 19 European sub-indexes were trading in red, with travel and leisure stocks (SXTP) plummeting 10% as drastic containment measures forced airlines to make unprecedented cuts to flights, costs and staffing.

British Airways parent IAG (L:ICAG), EasyJet (L:EZJ), Ryanair (I:RYA) and Air France-KLM (PA:AIRF) were again among the biggest decliners on the STOXX 600, bringing the wider travel sub-index's total declines in the first quarter to over 50%.

Wall Street had recorded its worst decline on Monday since the 1987 "Black Monday" crash as the unchecked spread of the virus wiped out liquidity from financial markets and sent volatility to record highs.

A coordinated effort by global central banks to flush more cash into the system only added to the alarm around a looming global recession.

Airbus (PA:AIR) tumbled 6.7% after saying it would stop production and assembly activities at its plants in France and Spain for the next four days in order to comply with the government's containment measures.

The wider French bourse (FCHI) fell 1%, but was off 2013 lows hit on Monday as President Emmanuel Macron sought to reassure businesses by offering more fiscal aid.

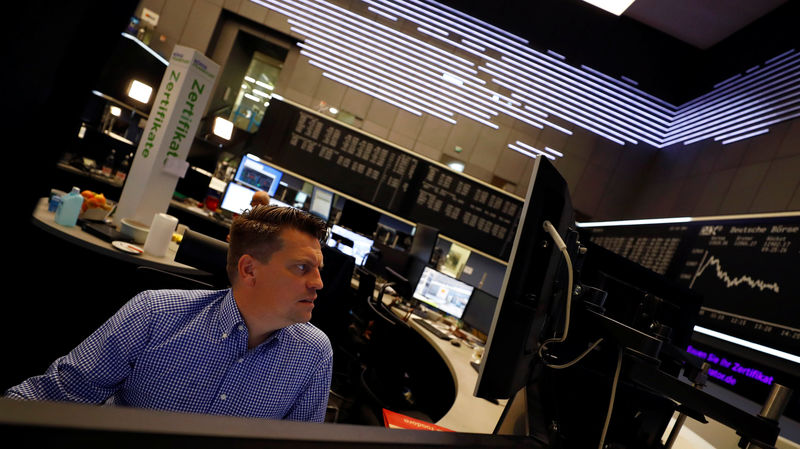

Frankfurt shares (GDAXI), which have declined in seven of the past eight sessions, also shed 0.9% ahead of a reading of German economic sentiment for March, which is expected to plunge to -26.4 from +8.7 a month earlier, according to Refinitiv Eikon data.